- Meta Platforms (META, Financial) challenges a $1.03 billion VAT claim in Italy, potentially influencing tech regulations across Europe.

- Analyst forecasts suggest a modest upside for META stock, with an average price target of $739.10.

- GuruFocus estimates indicate META could be overvalued, highlighting a potential downside risk.

Meta Platforms Inc. (META), alongside other tech giants like X and LinkedIn, finds itself embroiled in a significant legal battle. The company is contesting a $1.03 billion VAT claim imposed by Italian tax authorities. At the heart of the dispute is the argument that free user registrations should incur taxes due to the exchange of data. This ongoing case could set a critical precedent, potentially reshaping the landscape for tech businesses operating across Europe.

Wall Street Analysts' Forecast for Meta Platforms

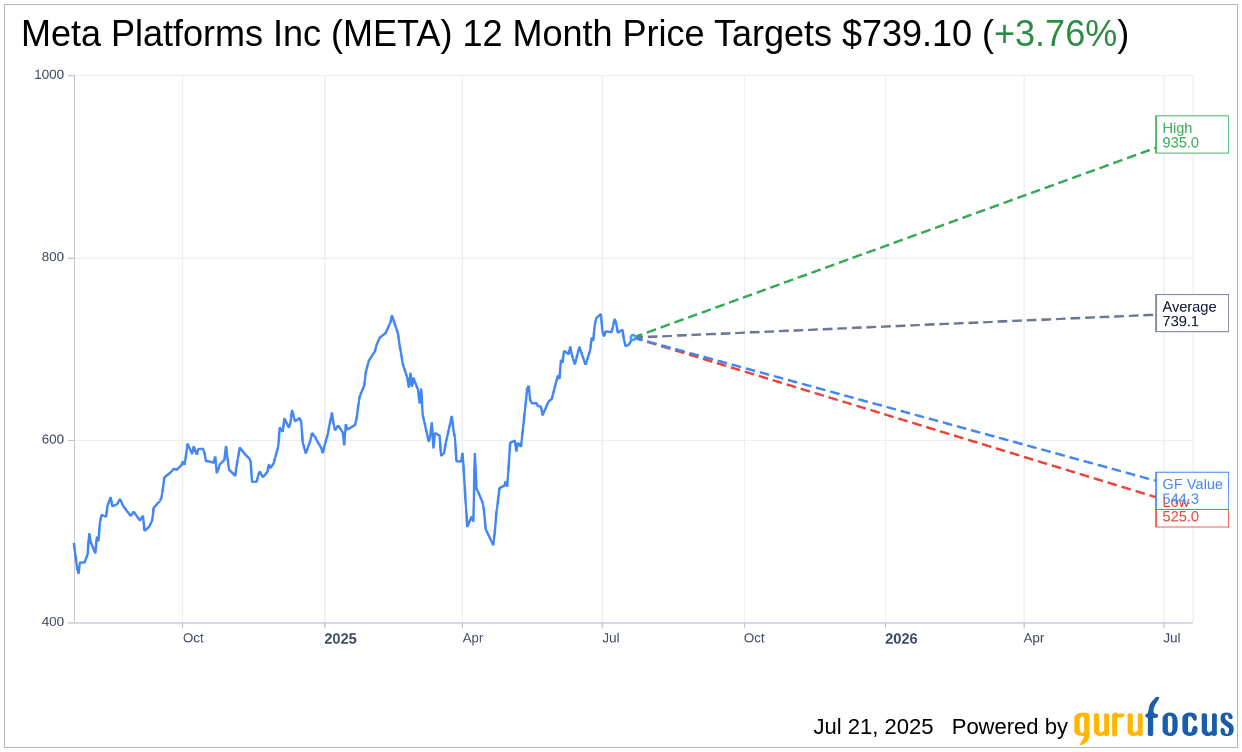

Meta Platforms Inc. (META, Financial) remains a focal point for analysts, with 61 professionals offering one-year price targets. The average anticipated price for META stands at $739.10, flanked by a high estimate of $935.00 and a low estimate of $525.00. This average target suggests a modest upside of 3.76% from its current trading price of $712.34. For more comprehensive data, visit the Meta Platforms Inc (META) Forecast page.

Moreover, the consensus recommendation from 71 brokerage firms rates Meta Platforms Inc. (META, Financial) at an average of 1.8 on a 1 to 5 scale. This places META firmly in the "Outperform" category, where 1 represents a Strong Buy and 5 a Sell. Such a rating underscores the confidence many have in Meta's market potential.

However, investors should note GuruFocus' proprietary estimates, which present a different perspective. The GF Value for Meta Platforms Inc. (META, Financial) suggests a one-year projection of $544.27. This forecast implies a significant downside of 23.59% from the present price of $712.34. The GF Value, calculated from historical multiples and anticipated business performance, provides a sobering reminder of potential risks. For in-depth analysis, refer to the Meta Platforms Inc (META) Summary page.