Summary:

- Costco (COST, Financial) launches a Global Capability Center in Hyderabad, India, to enhance global operations.

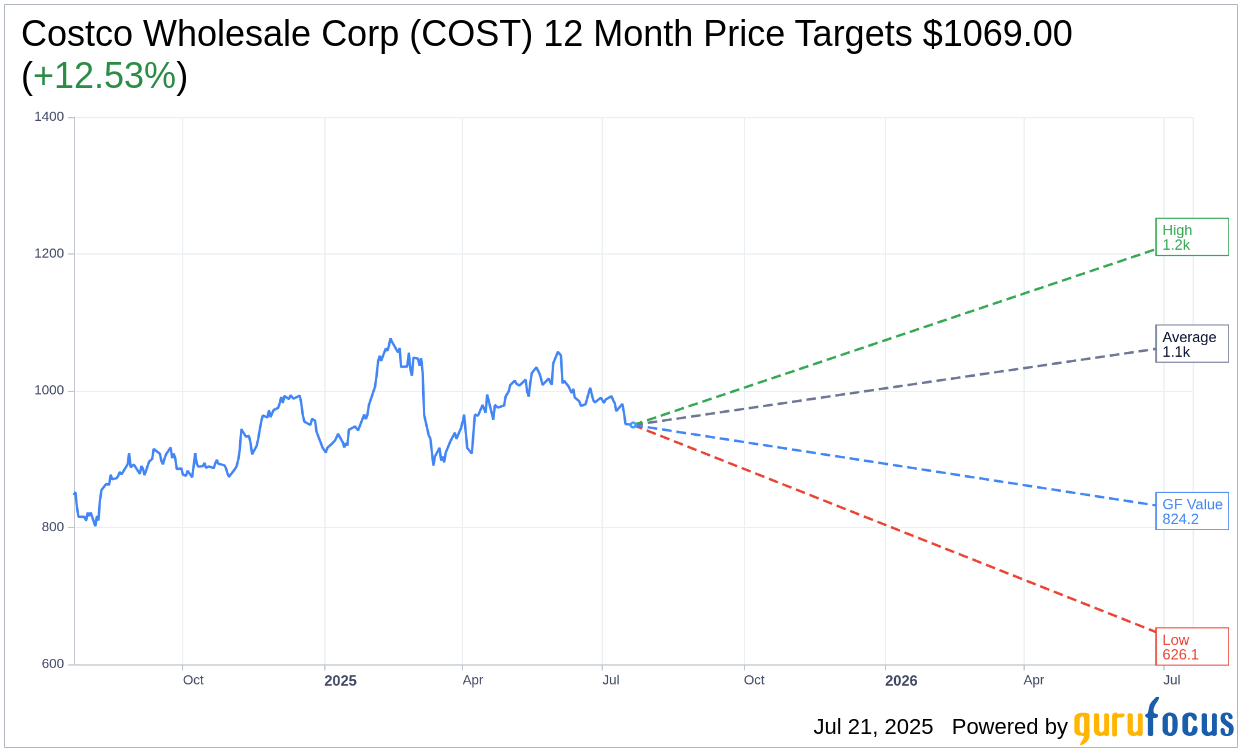

- Wall Street analysts project an average price target of $1,069.00, suggesting a 12.53% upside.

- GuruFocus estimates a potential downside of 13.24% based on their GF Value metric.

Costco's Strategic Expansion into India

In a strategic move to bolster its international presence and accelerate digital transformation, Costco Wholesale Corp (COST) is setting up its first Global Capability Center in Hyderabad, India. This initiative marks a significant step in enhancing the company's global business operations. Initially, the center will employ 1,000 staff, with thoughtful plans for future expansion. Despite these promising developments, Costco's shares have experienced a decline for five consecutive days, highlighting an intriguing dynamic for investors.

Wall Street Analysts' Projections

According to forecasts from 29 financial analysts, Costco Wholesale Corp (COST, Financial) is expected to reach an average price target of $1,069.00 within a year. This projection presents a range, with the highest estimate at $1,225.00 and the lowest at $626.12. The average price target implies a potential upside of 12.53% compared to the current trading price of $949.95. For a more comprehensive analysis, readers can explore the Costco Wholesale Corp (COST) Forecast page.

Brokerage Sentiment and GF Value Insight

The collective recommendation from 37 brokerage firms positions Costco Wholesale Corp (COST, Financial) with an average brokerage rating of 2.1, classifying the stock as "Outperform." This rating scale spans from 1, indicating a Strong Buy, to 5, representing a Sell.

In contrast, GuruFocus provides a different perspective with their estimated GF Value for Costco Wholesale Corp (COST, Financial), projected at $824.21 for the next year. This indicates a potential downside of 13.24% from the current price level of $949.95. The GF Value reflects an intricate calculation based on historical trading multiples, previous business growth metrics, and predictions for future performance. For a deeper dive into these estimates, visit the Costco Wholesale Corp (COST) Summary page.