Shares of Freeport McMoRan (FCX, Financial) experienced a modest increase, gaining 60 cents or 1.35%, to close near $45.41. The options trading for FCX saw about 49,000 contracts being exchanged, maintaining average levels with calls outpacing puts, resulting in a put/call ratio of 0.57, slightly higher than the usual 0.56. The implied volatility (IV30) dipped by 0.8, reaching 36.82, which is below the median for the past year, indicating an anticipated daily stock move of approximately $1.05. The put-call skew leveled off, hinting at a slightly positive outlook, despite a downgrade to Equal Weight by Morgan Stanley.

Anticipating its upcoming earnings report scheduled before the market opens on July 23, 2025, the options market is forecasting a 50% chance that FCX stock will move more than 4.45% or $2.02. Investors are keenly observing these developments as they strategize their investment moves in the lead-up to the earnings announcement.

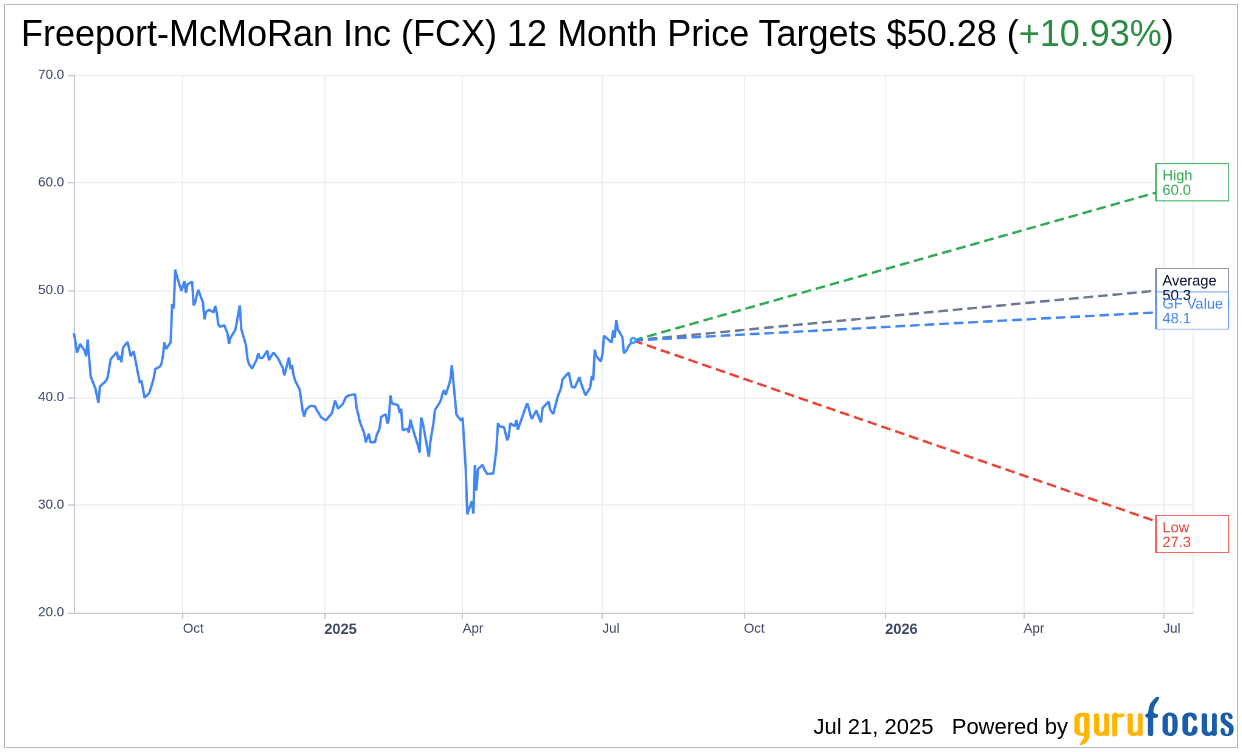

Wall Street Analysts Forecast

Based on the one-year price targets offered by 18 analysts, the average target price for Freeport-McMoRan Inc (FCX, Financial) is $50.28 with a high estimate of $60.04 and a low estimate of $27.32. The average target implies an upside of 10.93% from the current price of $45.32. More detailed estimate data can be found on the Freeport-McMoRan Inc (FCX) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Freeport-McMoRan Inc's (FCX, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Freeport-McMoRan Inc (FCX, Financial) in one year is $48.11, suggesting a upside of 6.16% from the current price of $45.32. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Freeport-McMoRan Inc (FCX) Summary page.