Barclays has increased its price target for Gaming and Leisure Properties (GLPI, Financial), moving it from $54 to $55 while maintaining an Equal Weight rating. This adjustment comes as part of a preview of second-quarter earnings for net lease real estate investment trusts. The sector has seen weaker performance over the past three months, influenced by a shift towards riskier market positions. Despite ongoing uncertainty related to tariffs, Barclays notes that tenant credit concerns have diminished since the first quarter.

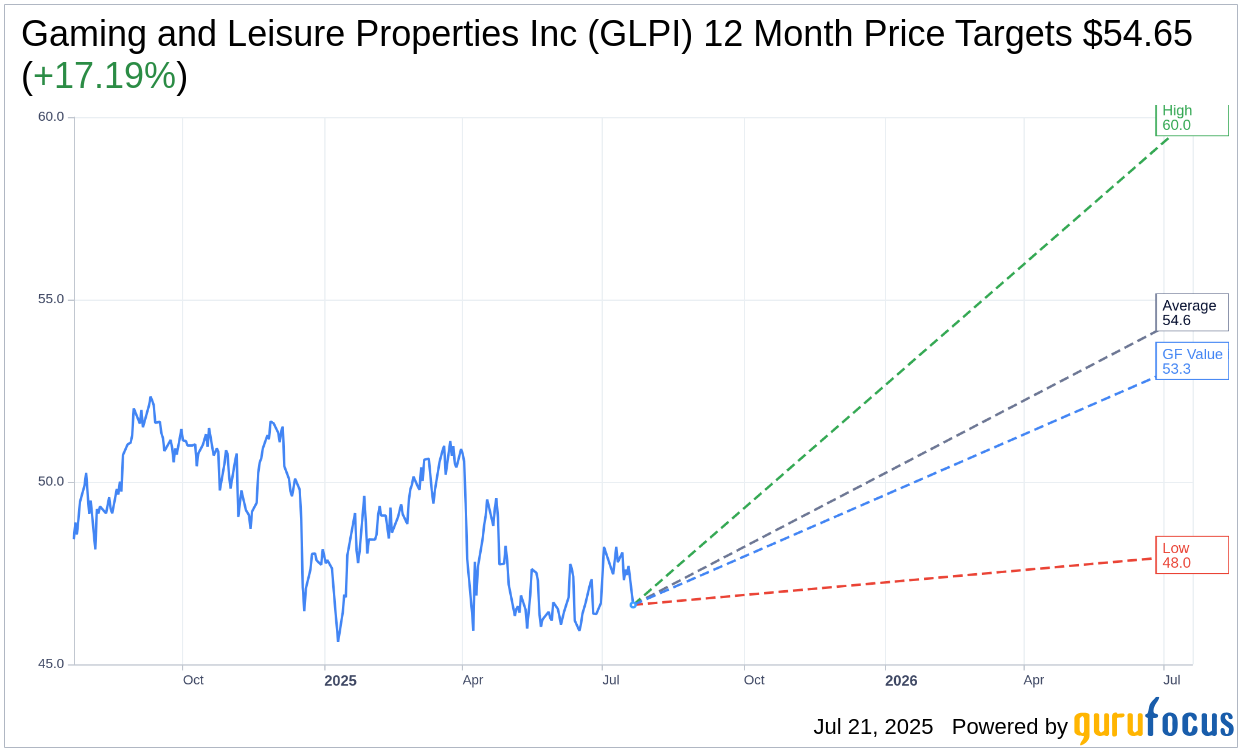

Wall Street Analysts Forecast

Based on the one-year price targets offered by 22 analysts, the average target price for Gaming and Leisure Properties Inc (GLPI, Financial) is $54.65 with a high estimate of $60.00 and a low estimate of $48.00. The average target implies an upside of 17.19% from the current price of $46.63. More detailed estimate data can be found on the Gaming and Leisure Properties Inc (GLPI) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Gaming and Leisure Properties Inc's (GLPI, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Gaming and Leisure Properties Inc (GLPI, Financial) in one year is $53.32, suggesting a upside of 14.35% from the current price of $46.63. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Gaming and Leisure Properties Inc (GLPI) Summary page.