Key Highlights:

- NXP Semiconductors (NXPI, Financial) experienced a 5% dip in share price after reporting a 6.4% revenue decline for Q2 2025.

- The company's future projections exceed market expectations despite surpassing current earnings and revenue predictions.

- Analyst forecasts indicate a potential 8.27% upside with an "Outperform" consensus recommendation.

NXP Semiconductors (NXPI) witnessed a notable 5% drop in after-hours trading following its Q2 2025 earnings report, which revealed a 6.4% decrease in revenue year-over-year. Despite this decline, the company managed to exceed both earnings and revenue expectations, recording a revenue of $2.93 billion. The forward-looking projections further bolster confidence, steering past current consensus estimates.

Analyst Price Targets and Recommendations

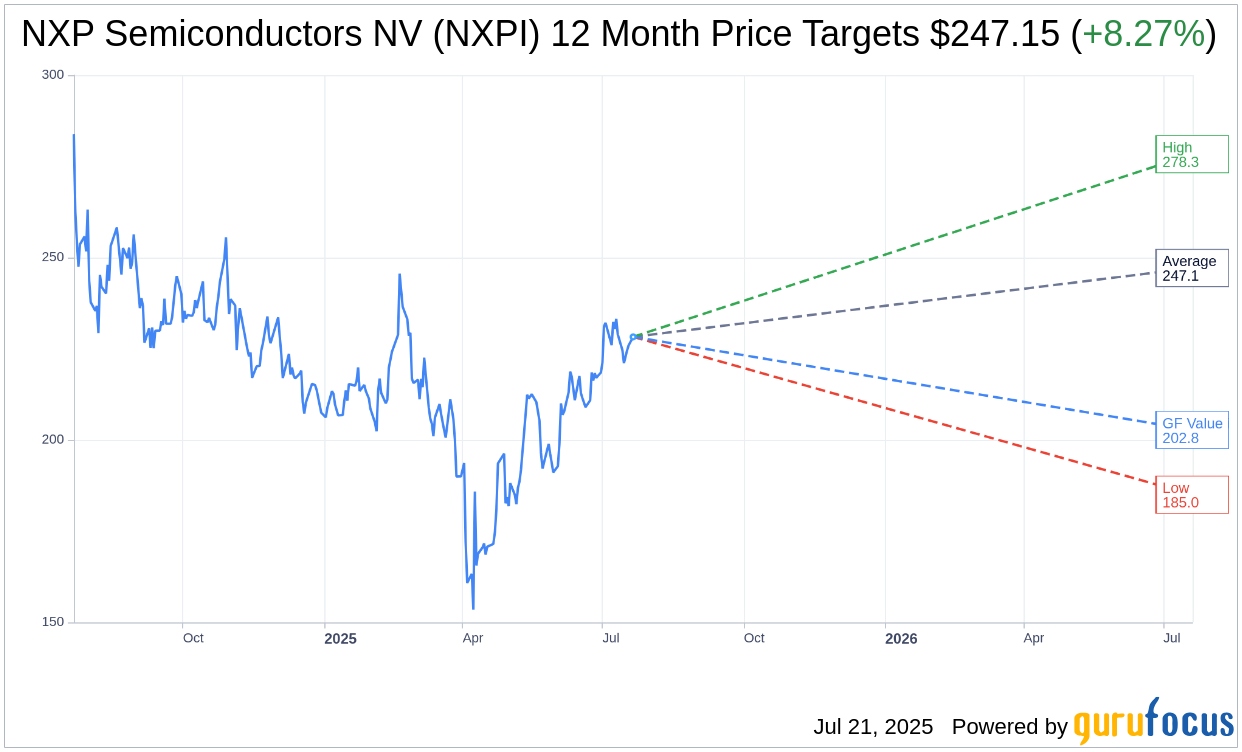

According to 29 Wall Street analysts, NXP Semiconductors NV (NXPI, Financial) has an average one-year price target of $247.15. This estimate spans a high of $278.34 and a low of $185.00. The average target suggests a potential upside of 8.27% from the current share price of $228.27. For more detailed forecast data, visit the NXP Semiconductors NV (NXPI) Forecast page.

The consensus recommendation from 32 brokerage firms rates NXP Semiconductors NV's (NXPI, Financial) at an average of 2.0, indicating an "Outperform" status. This rating scale ranges from 1 to 5, with 1 representing a Strong Buy and 5 a Sell.

Estimating Future Value with GF Value

Based on GuruFocus estimates, the anticipated GF Value for NXP Semiconductors NV (NXPI, Financial), projected one year ahead, is $202.76. This estimation implies a potential downside of 11.18% from the current stock price of $228.27. The GF Value represents GuruFocus' calculated fair value of the stock, derived from historical trading multiples, previous business growth, and future performance projections. Further insights are available on the NXP Semiconductors NV (NXPI) Summary page.