Key Highlights:

- NXP Semiconductors delivers a non-GAAP EPS of $2.72 in Q2 2025, outperforming estimates by $0.06.

- Despite a 6.4% annual decline, revenue of $2.93 billion surpasses forecasts by $30 million.

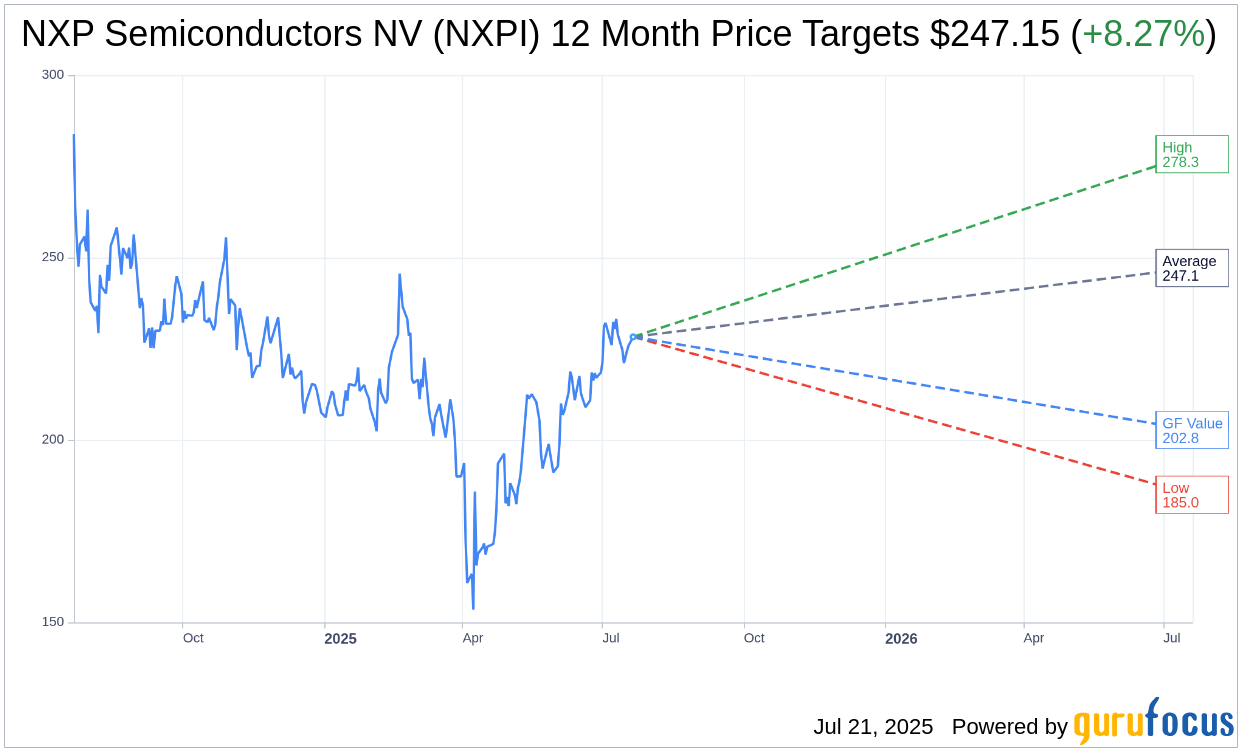

- Analysts set an average 12-month price target of $247.15, suggesting an 8.27% potential upside from the current stock price.

NXP Semiconductors (NXPI, Financial) recently announced its second-quarter results for 2025, revealing a commendable non-GAAP earnings per share (EPS) of $2.72. This exceeded expectations by $0.06, showcasing the company's resilience in navigating market challenges. Despite facing a 6.4% decline compared to the previous year, NXPI's revenue rose to $2.93 billion, surpassing forecasts by $30 million. However, the announcement led to a 2.66% drop in share value during after-hours trading.

Wall Street Analysts' Insights

Wall Street analysts remain optimistic about NXP Semiconductors NV (NXPI, Financial), with an average one-year price target of $247.15. This target represents an 8.27% upside from the current stock price of $228.27. The high estimate among analysts is $278.34, and the low estimate is $185.00. For further insight into these forecasts, you can visit the NXP Semiconductors NV (NXPI) Forecast page.

Currently, the consensus recommendation from 32 brokerage firms rates NXP Semiconductors NV's (NXPI, Financial) stock as "Outperform," with an average rating of 2.0 on a scale where 1 indicates a Strong Buy and 5 denotes a Sell.

Long-term Valuation Assessment

GuruFocus has projected the GF Value for NXP Semiconductors NV (NXPI, Financial) to be $202.76 in the next year. This suggests a potential downside of 11.18% from the current price of $228.27. The GF Value is a reflection of the stock's fair trade value, derived from historical trading multiples, past business growth, and future performance projections. More comprehensive details and metrics are available on the NXP Semiconductors NV (NXPI) Summary page.