- Wintrust Financial (WTFC, Financial) reports strong earnings, yet shares dip post-announcement.

- Analysts project a moderate upside potential with varied price targets.

- GF Value suggests a potential downside, contrasting with positive market sentiment.

Wintrust Financial (WTFC) has recently released its second-quarter GAAP earnings, revealing an impressive earnings per share of $2.78. This figure has beaten analyst expectations by $0.18. In addition, the company's revenue climbed to $670.8 million, marking a 13.4% increase year-over-year, surpassing predictions by $9.1 million. Despite these encouraging results, the company's stock saw a notable decline of 4.86% in after-hours trading.

Wall Street Analysts Forecast

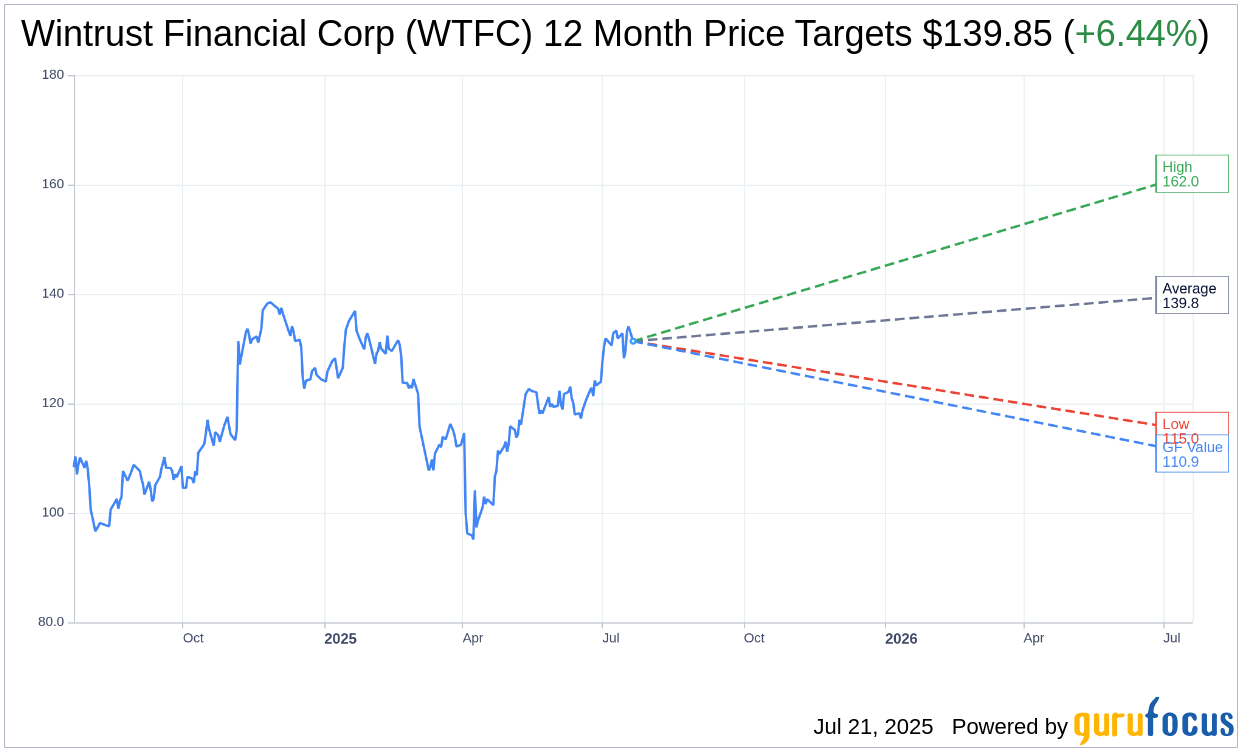

When examining the one-year price targets set by 13 analysts, the average target for Wintrust Financial Corp (WTFC, Financial) stands at $139.85. The projections show a high of $162.00 and a low of $115.00, indicating a potential upside of 6.44% from the current trading price of $131.38. For more in-depth forecast data, please visit the Wintrust Financial Corp (WTFC) Forecast page.

In terms of analyst recommendations, Wintrust Financial Corp is currently rated at 1.8 by 13 brokerage firms, which reflects an "Outperform" standing. This recommendation is part of a rating system ranging from 1 to 5, where 1 stands for Strong Buy and 5 represents Sell.

From the perspective of GuruFocus, the estimated GF Value for Wintrust Financial Corp (WTFC, Financial) in the coming year is $110.86, indicating a potential downside of 15.62% from the current price of $131.38. The GF Value is GuruFocus' estimate of the fair market value of the stock, derived from its historical trading multiples, past growth, and future business performance forecasts. For further details, consult the Wintrust Financial Corp (WTFC) Summary page.