General Dynamics (GD, Financial) has secured a $159.68 million modification to an existing contract, which will establish five contract line-item numbers dedicated to acquiring onboard repair parts for Virginia-class submarines SSN 802-806. This award is granted under a sole source provision, following the authority outlined in specific U.S. code and clauses. The project will be conducted in Groton, Connecticut, with an anticipated completion date set for November 2029.

The contract includes options for five additional onboard repair parts shipset line items, which, if exercised, could increase the total contract value by $176.14 million, extending the project timeline to February 2032. Funding from fiscal years 2019, 2020, and 2021, totaling $25 million, will be allocated at the time of the award, with $5 million of these funds set to expire at the conclusion of the current fiscal year. The Supervisor of Shipbuilding Groton facilitates the contracting activity.

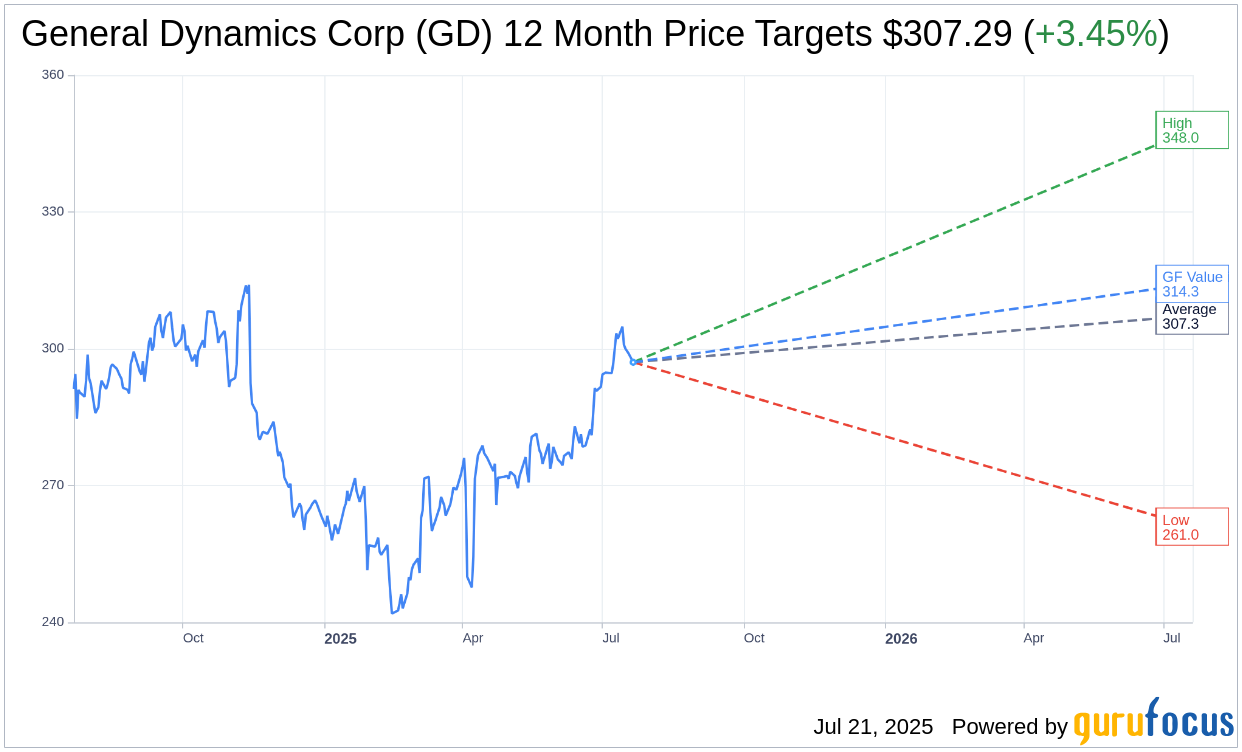

Wall Street Analysts Forecast

Based on the one-year price targets offered by 16 analysts, the average target price for General Dynamics Corp (GD, Financial) is $307.29 with a high estimate of $348.00 and a low estimate of $261.00. The average target implies an upside of 3.45% from the current price of $297.05. More detailed estimate data can be found on the General Dynamics Corp (GD) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, General Dynamics Corp's (GD, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for General Dynamics Corp (GD, Financial) in one year is $314.26, suggesting a upside of 5.79% from the current price of $297.05. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the General Dynamics Corp (GD) Summary page.

GD Key Business Developments

Release Date: April 23, 2025

- Revenue: $12.2 billion, up 13.9% year-over-year.

- Earnings per Diluted Share: $3.66, up 27.1% year-over-year.

- Operating Earnings: $1.268 billion, up 22.4% year-over-year.

- Net Earnings: $994 million, up 24.4% year-over-year.

- Operating Margin: 10.4%, a 70-basis point improvement over the previous year.

- Free Cash Flow: Negative $290 million for the quarter.

- Capital Expenditures: $142 million, 1.2% of sales.

- Shareholder Returns: $980 million returned through dividends and share repurchases.

- Backlog: $89 billion at quarter end.

- Book to Bill Ratio: Overall less than 1, Technologies group at 1.1.

- Aerospace Revenue: $3.03 billion, up 45.2% year-over-year.

- Aerospace Operating Margin: 14.3%.

- Combat Systems Revenue: $2.18 billion, up 3.5% year-over-year.

- Marine Systems Revenue Growth: 7.7% year-over-year.

- Technologies Group Revenue: $3.43 billion, up 6.8% year-over-year.

- Technologies Group Operating Margin: Improved from 9.2% to 9.6%.

- Net Debt Position: $8.4 billion.

- Effective Tax Rate: 17.2% for the quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- General Dynamics Corp (GD, Financial) reported a strong first quarter with earnings of $3.66 per diluted share, a 27.1% increase from the previous year.

- Revenue increased by 13.9% to $12.2 billion, with operating earnings up 22.4% and net earnings up 24.4%.

- The Aerospace segment led with a 45.2% revenue increase, driven by a 50% increase in aircraft deliveries, including the introduction of the G700.

- The Technologies group had a strong quarter with a book-to-bill ratio of 1.1, reflecting robust demand for advanced technology solutions.

- The Marine Systems segment demonstrated impressive revenue growth, driven by Columbia class and Virginia class construction, and increased DDG-51 construction.

Negative Points

- Free cash flow for the quarter was negative $290 million, impacted by inventory buildup and working capital requirements.

- The total backlog decreased slightly to $89 billion due to a book-to-bill ratio of less than one, influenced by a 14% revenue increase.

- The supply chain continues to face delays and quality issues, affecting the Marine Systems segment's ability to achieve operating leverage.

- The Aerospace segment faces potential impacts from tariffs, with uncertainty around how these will affect export revenue.

- The Technologies group faces uncertainty in the IT services market due to the administration's evolving spending priorities.