Key Highlights:

- AstraZeneca plans a $50 billion U.S. investment by 2030, focusing on expanding its manufacturing capabilities.

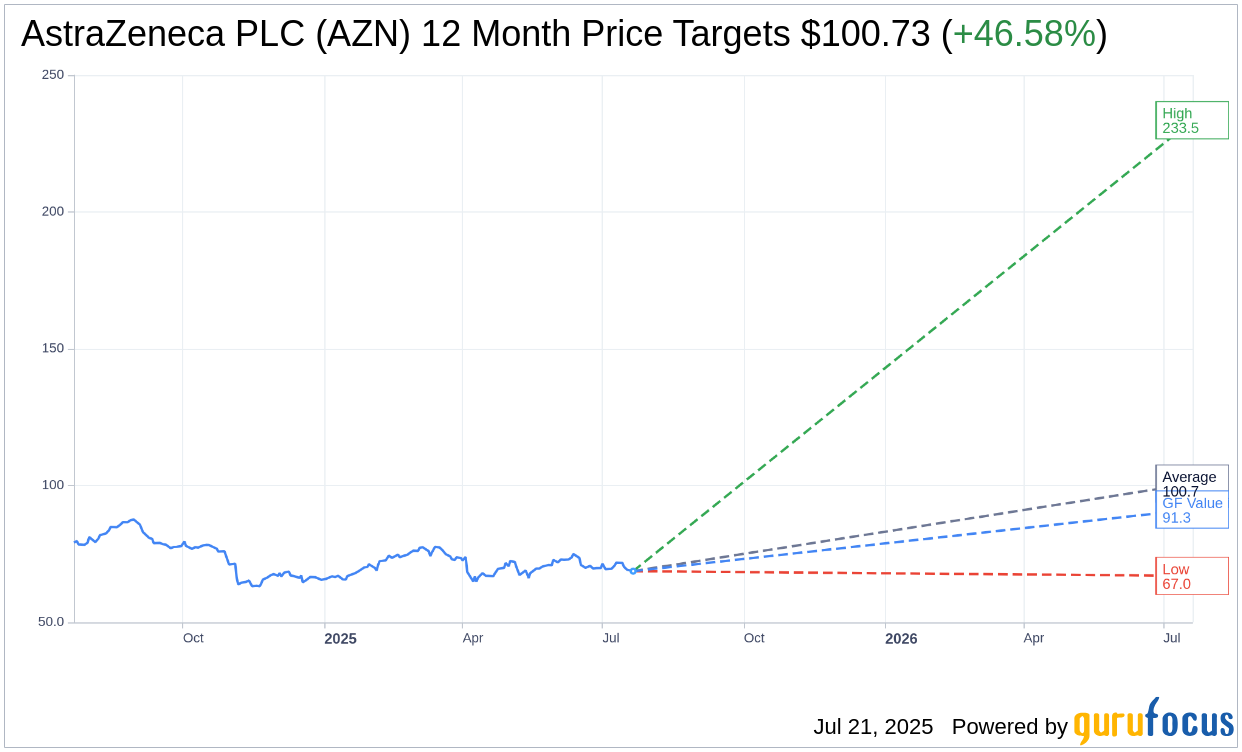

- Average analyst price target suggests a potential 46.58% upside.

- GF Value estimate indicates a 32.8% upside within a year.

AstraZeneca PLC (AZN) is poised for significant growth as the company has unveiled an ambitious plan to invest $50 billion in the United States by 2030. This strategic initiative is set to include the development of a new major manufacturing facility in Virginia, highlighting the company's commitment to bolstering its presence in the U.S. market, particularly within the weight management and metabolic drug sectors. As part of this expansion, AstraZeneca anticipates a notable increase in its revenue contribution from the U.S. market.

Analysts' Price Targets and Predictions

According to the projections from 11 esteemed analysts, AstraZeneca PLC (AZN, Financial) shows a compelling potential upside. With an average target price of $100.73, the estimates span from a high of $233.53 to a low of $67.00. This average target underscores a promising potential increase of 46.58% from the current trading price of $68.72. Investors can delve deeper into these predictions on the AstraZeneca PLC (AZN) Forecast page.

Brokerage Recommendations

The consensus among 13 brokerage firms demonstrates confidence in AstraZeneca's growth trajectory. The company's average brokerage recommendation is 1.8, reflecting an "Outperform" status. This rating falls within a scale where 1 represents a Strong Buy, and 5 denotes a Sell, indicating a favorable outlook from financial experts.

Evaluating GF Value Estimates

In terms of GuruFocus insights, the projected GF Value for AstraZeneca PLC (AZN, Financial) one year from now stands at $91.26. This represents an estimated upside of 32.8% from its present price of $68.72. The GF Value metric is derived from the historical multiples at which the stock has been traded, combined with the company's past performance and future growth projections. Investors seeking comprehensive insights can explore additional data on the AstraZeneca PLC (AZN) Summary page.