Key Takeaways:

- Medpace Holdings (MEDP, Financial) shares soared by 45% post robust Q2 results.

- The company has enhanced its 2025 revenue forecast and full-year GAAP EPS guidance.

- Analysts' average price target suggests a slight downside yet offers substantial long-term growth potential.

Medpace Holdings (MEDP) experienced a significant surge of 45% in after-hours trading, credited to its exceedingly optimistic Q2 financial results. Demonstrating their confidence, the company has revised its 2025 revenue projection to an impressive range of $2.42 billion to $2.52 billion, alongside an uplift in its full-year GAAP EPS guidance to between $13.76 and $14.53. Notably, recent net new business awards have risen to $620.5 million, marking an increase from $551 million year-over-year.

Analyst Forecasts and Price Targets

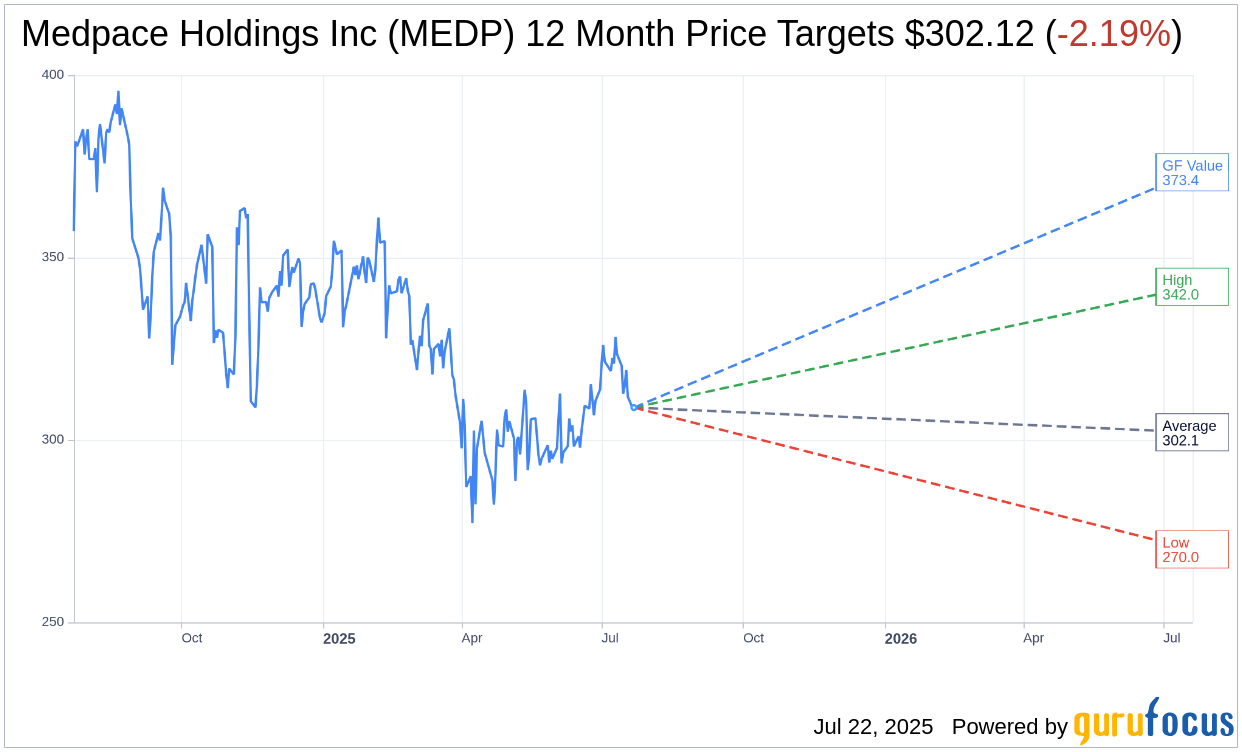

In evaluating the one-year price targets provided by 11 analysts, Medpace Holdings Inc (MEDP, Financial) holds an average target price of $302.12. The estimated price range spans from a high of $342.00 to a low of $270.00, indicating a potential downside of 2.19% from the current trading price of $308.88. For more comprehensive estimate data, visit the Medpace Holdings Inc (MEDP) Forecast page.

Brokerage Recommendations and GF Value Insights

Consistent with the consensus from 12 brokerage firms, Medpace Holdings Inc's (MEDP, Financial) average recommendation currently stands at 2.8, interpreting as a "Hold" status on a scale from 1 (Strong Buy) to 5 (Sell).

According to estimates by GuruFocus, the anticipated GF Value for Medpace Holdings Inc (MEDP, Financial) in one year is projected to be $373.37, indicating a potential upside of 20.88% from its current price of $308.88. The GF Value encapsulates GuruFocus' assessment of the stock's fair trading value, derived from historical trading multiples, past business growth, and future business performance projections. For an in-depth analysis, refer to the Medpace Holdings Inc (MEDP) Summary page.