- BlackRock is implementing stringent data protocols for employees traveling to China, impacting device and network usage.

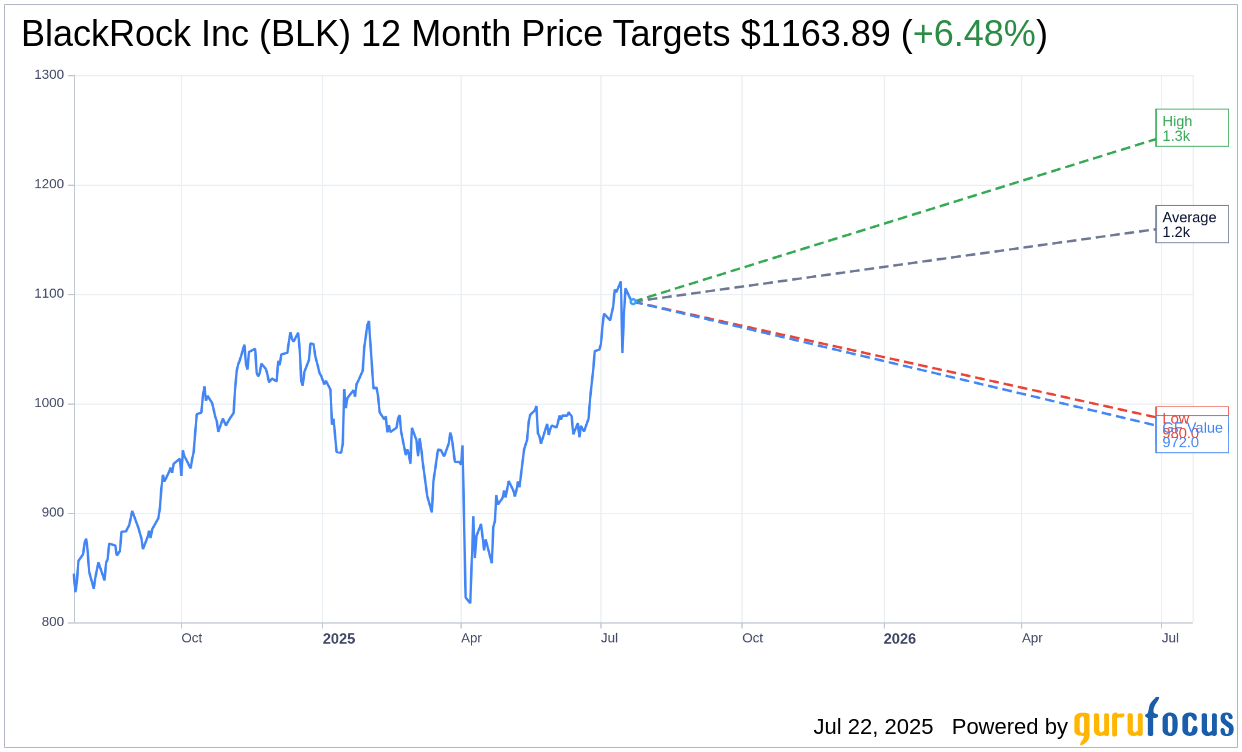

- Analysts project a potential 6.48% upside for BlackRock's stock, highlighting varied price targets.

- Despite the potential downside in GF Value, BlackRock maintains a positive brokerage rating of "Outperform."

In a strategic move to safeguard data, BlackRock Inc. (NYSE: BLK) has mandated that its employees traveling to China use temporary phones instead of company-issued laptops and iPhones. Furthermore, access to the company's VPN during these trips has been restricted. These measures underscore the firm's heightened vigilance in response to China's stringent data control policies.

Wall Street Analysts' Insights

According to the latest insights from 15 Wall Street analysts, BlackRock's stock shows an average price target of $1,163.89. The projections range from a high of $1,252.00 to a low of $980.00, suggesting a potential upswing of 6.48% from its current price of $1,093.02. For more detailed price target data, visit the BlackRock Inc (BLK, Financial) Forecast page.

The average brokerage recommendation for BlackRock, based on consensus from 18 firms, stands at 1.9, translating to an "Outperform" rating. This scale evaluates from 1 (Strong Buy) to 5 (Sell), illustrating a generally favorable outlook among analysts.

Understanding the GF Value Estimate

GuruFocus's proprietary metric, the GF Value, estimates BlackRock Inc's fair stock price at $972.02 within the next year. This figure indicates a possible downside of 11.07% from its current market price of $1,093.02. The GF Value is derived from historical trading multiples and business performance projections. Detailed evaluation and forecasts are accessible on the BlackRock Inc (BLK, Financial) Summary page.

While navigating the complexities of international data policies, BlackRock remains a compelling entity in the investment landscape, balancing potential upside with cautious optimism reflected in analyst recommendations.