Key Highlights:

- Medpace Holdings stock jumped 45% following strong Q2 results.

- Wall Street analysts provide a mixed outlook with a "Hold" recommendation.

- GuruFocus projects a potential upside of 20.88% based on GF Value estimates.

Medpace Holdings, Inc. (MEDP) recently experienced a notable 45% surge in its share price, following the release of second quarter financial results that exceeded market expectations. The company's impressive performance included beating both revenue and earnings estimates. Additionally, Medpace has revised its full-year and 2025 outlook upward, reflecting its confidence in continued growth. The organization also executed $518.5 million in share buybacks this quarter, signaling strong financial health and shareholder commitment.

Wall Street Analysts Forecast

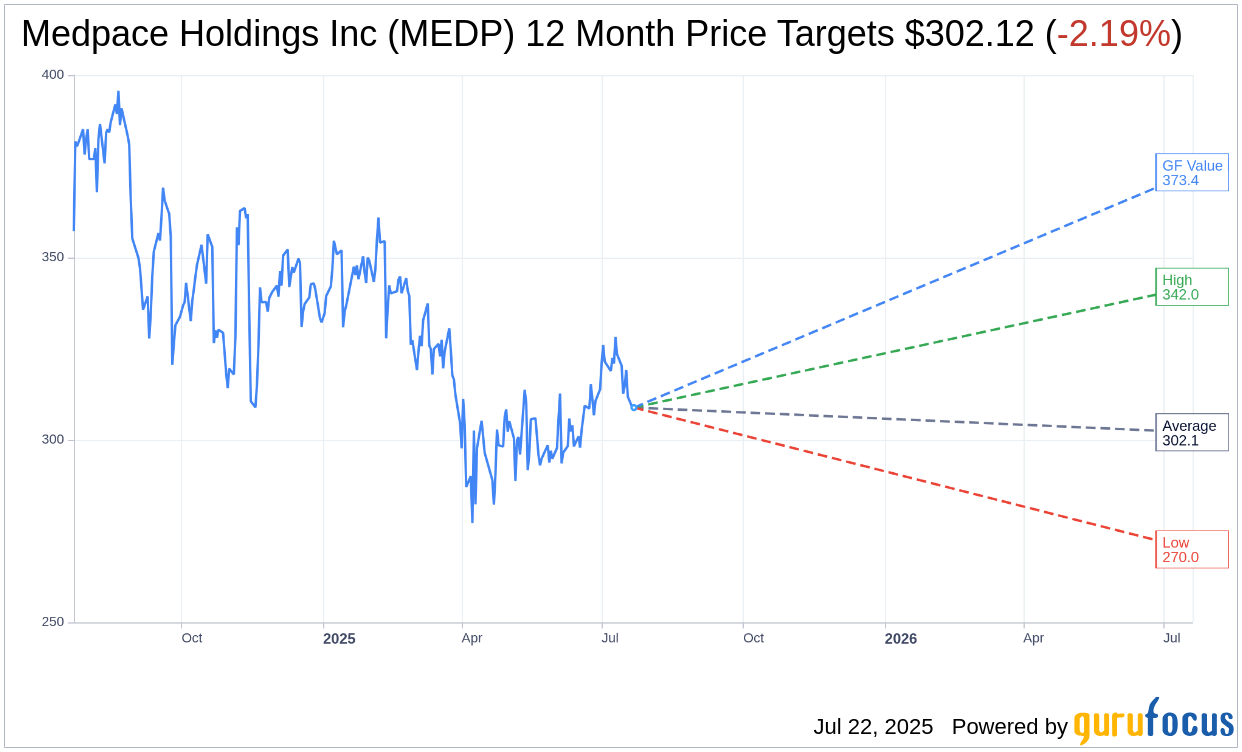

According to projections from 11 analysts, the average one-year price target for Medpace Holdings (MEDP) stands at $302.12. This target spans from a high of $342.00 to a low of $270.00, suggesting a potential downside of 2.19% from the current share price of $308.88. For a deeper dive into these estimates, visit the Medpace Holdings Inc (MEDP, Financial) Forecast page.

The consensus recommendation from 12 brokerage firms is a "Hold," with an average rating of 2.8. This rating falls on a scale where 1 represents a "Strong Buy" and 5 a "Sell," indicating that while analysts recognize the potential, they advise caution.

GuruFocus projects a GF Value for Medpace Holdings (MEDP) at $373.37 in the next year, suggesting an upside of 20.88% from the current price of $308.88. This GF Value reflects GuruFocus' analysis of the stock's fair trading value, considering historical trading multiples, past business growth, and future performance projections. For more detailed information, check out the Medpace Holdings Inc (MEDP, Financial) Summary page.