Investment firm Baird has upgraded its rating for STMicroelectronics (STM, Financial) from Neutral to Outperform and revised its price target significantly upwards to $50 from $23. This optimistic outlook is based on several positive indicators including an expected recovery in the industry cycle, improvements in the company's gross margins, and increased presence of STM's components in new products. Despite a recent sharp decrease in revenue from industrial and automotive sectors—64% and 47% respectively—Baird foresees a normalization of inventories in these markets by the end of the year. This is expected to lead to favorable comparisons starting in the first half of 2026.

The analyst also predicts that STM's margin recovery will gain momentum in the third quarter as utilization rates improve. The insights delivered by Baird are part of their recent analysis aimed at guiding investors towards potential opportunities in the semiconductor sector.

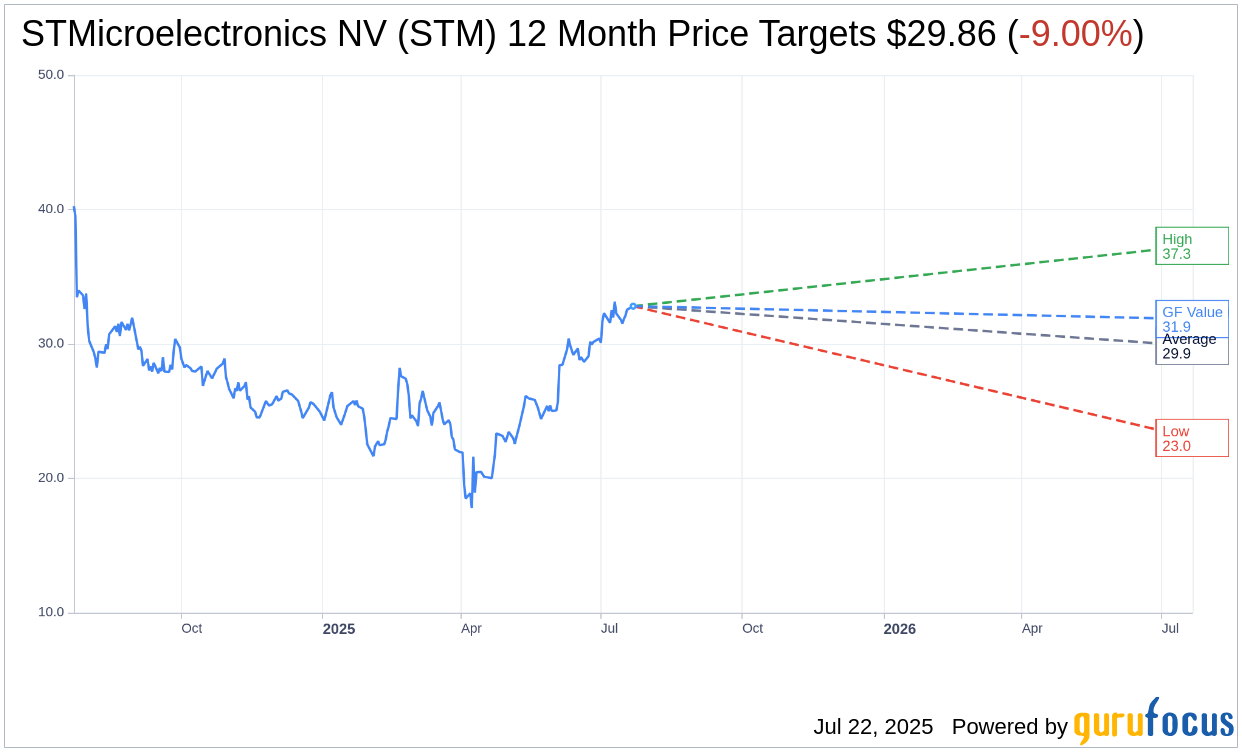

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for STMicroelectronics NV (STM, Financial) is $29.86 with a high estimate of $37.30 and a low estimate of $23.00. The average target implies an downside of 9.00% from the current price of $32.81. More detailed estimate data can be found on the STMicroelectronics NV (STM) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, STMicroelectronics NV's (STM, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for STMicroelectronics NV (STM, Financial) in one year is $31.85, suggesting a downside of 2.93% from the current price of $32.81. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the STMicroelectronics NV (STM) Summary page.