Mercantile Bank (MBWM, Financial) announced a tangible book value per share of $35.82 for the second quarter. The bank's Common Equity Tier 1 (CET1) capital ratio stood at 10.9% during this period. According to Ray Reitsma, President and CEO of Mercantile, the company achieved robust financial outcomes despite facing unstable economic conditions in the second quarter of 2025.

The bank's performance was bolstered by growth in net interest income and a resilient net interest margin. There were notable increases in core noninterest income, alongside a marked reduction in federal income tax expenses. Commercial loans saw significant growth, while asset quality and capital levels remained strong.

Mercantile is focused on reducing its loan-to-deposit ratio by generating local deposits. This includes expanding existing deposit relationships and acquiring new clients. Its partnership with Eastern Michigan Financial Corporation aims to strengthen its position as the largest bank founded and headquartered in Michigan. This collaboration is expected to help the bank achieve strategic objectives like enhancing liquidity and expanding its presence in Eastern and Southeastern Michigan.

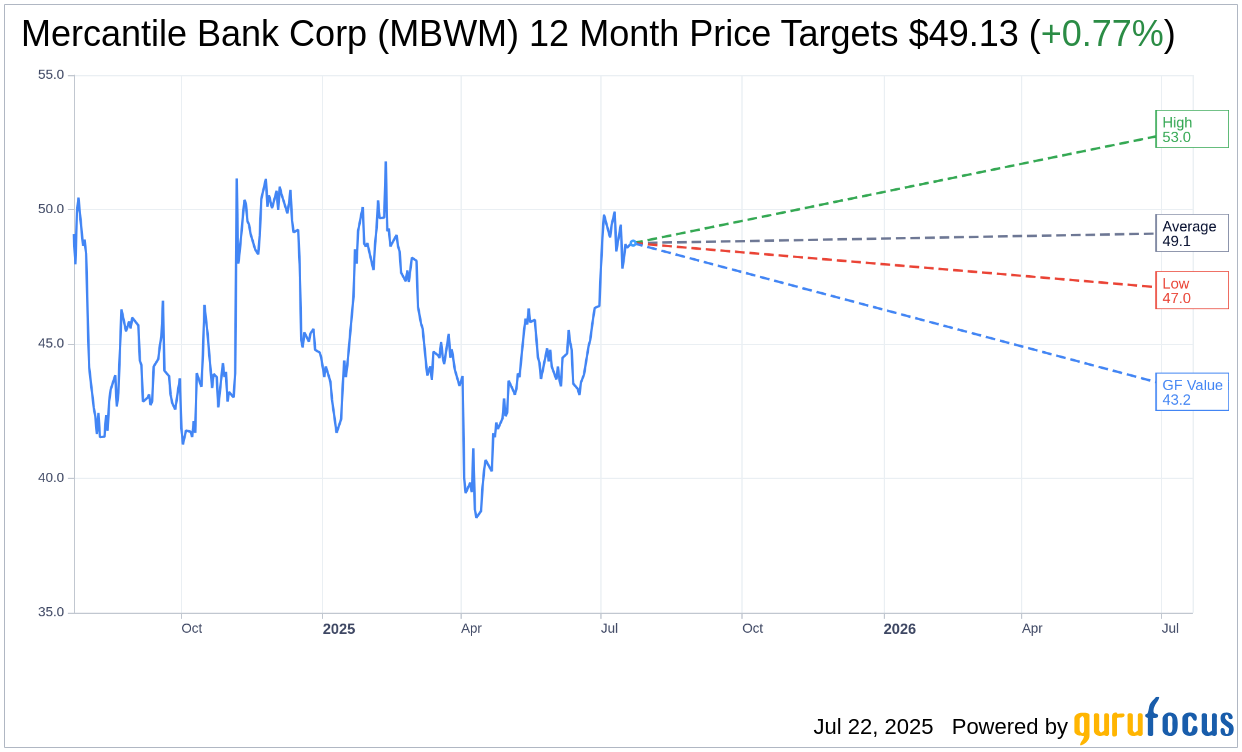

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Mercantile Bank Corp (MBWM, Financial) is $49.13 with a high estimate of $53.00 and a low estimate of $47.00. The average target implies an upside of 0.77% from the current price of $48.75. More detailed estimate data can be found on the Mercantile Bank Corp (MBWM) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Mercantile Bank Corp's (MBWM, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Mercantile Bank Corp (MBWM, Financial) in one year is $43.22, suggesting a downside of 11.34% from the current price of $48.75. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Mercantile Bank Corp (MBWM) Summary page.

MBWM Key Business Developments

Release Date: April 22, 2025

- Net Income: $19.5 million or $1.21 per diluted share for Q1 2025, compared to $21.6 million or $1.34 per diluted share for Q1 2024.

- Loan to Deposit Ratio: Reduced to 99% at the end of Q1 2025 from 108% at the end of Q1 2024.

- Commercial Loan Growth: $44 million during the first three months of 2025, annualized rate of nearly 5%.

- Mortgage Banking Income: Increased by 13% in Q1 2025 compared to Q1 2024.

- Non-Performing Assets: $5.4 million at March 31, 2025, or nine basis points of total assets.

- Total Non-Interest Income Growth: 12% in core areas during Q1 2025 compared to Q1 2024.

- Service Charges on Accounts: Grew 20% in Q1 2025.

- Payroll Services Growth: 16% increase in Q1 2025.

- Net Interest Margin: Increased by 6 basis points in Q1 2025 compared to Q4 2024.

- Average Loans: $4.63 billion during Q1 2025, compared to $4.3 billion during Q1 2024.

- Average Deposits: $4.59 billion during Q1 2025, compared to $3.97 billion during Q1 2024.

- Interest Income Increase: $3.6 million higher in Q1 2025 compared to Q1 2024.

- Interest Expense Increase: $2.4 million higher in Q1 2025 compared to Q1 2024.

- Provision Expense: $2.1 million during Q1 2025.

- Total Risk-Based Capital Ratio: 14.0% at the end of Q1 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Mercantile Bank Corp (MBWM, Financial) successfully reduced its loan to deposit ratio from 110% at year-end 2023 to 99% by the end of the first quarter of 2025.

- Business deposits increased by 24% and personal deposits by 9% over the 12-month period ending March 31, 2025.

- Asset quality remains strong with nonperforming assets totaling only $5.4 million, or nine basis points of total assets.

- Total non-interest income grew by 12% in core areas such as payroll, treasury management, and mortgage banking during the first quarter of 2025 compared to the first quarter of 2024.

- The bank's net interest margin increased by 6 basis points in the first quarter of 2025 compared to the fourth quarter of 2024, despite a 100 basis point decrease in rates by the Fed.

Negative Points

- Net income for the first quarter of 2025 was $19.5 million, down from $21.6 million in the same period of the previous year.

- The loan growth outlook has been tempered due to uncertainty in the environment, with expectations for a slight reduction in commercial loan growth.

- Net interest margin declined by 27 basis points during the first quarter of 2025 compared to the prior year period.

- Interest expense increased by $2.4 million during the first quarter of 2025 compared to the first quarter of 2024.

- Provision expense increased to $2.1 million during the first quarter of 2025, reflecting changes to economic forecasts and increased uncertainty.