In the second quarter, Peoples Bancorp, Inc. (PEBO, Financial) reported revenue of $115.02 million, surpassing the market consensus of $113.2 million. Additionally, the tangible book value per share was recorded at $21.18. The company's Common Equity Tier 1 (CET1) capital ratio stood at a robust 11.95% during this period.

The company experienced notable growth, with a particular emphasis on annualized loan increases and improvements in net interest margin. The leadership expressed commitment to maintaining sustainable growth and enhancing shareholder returns.

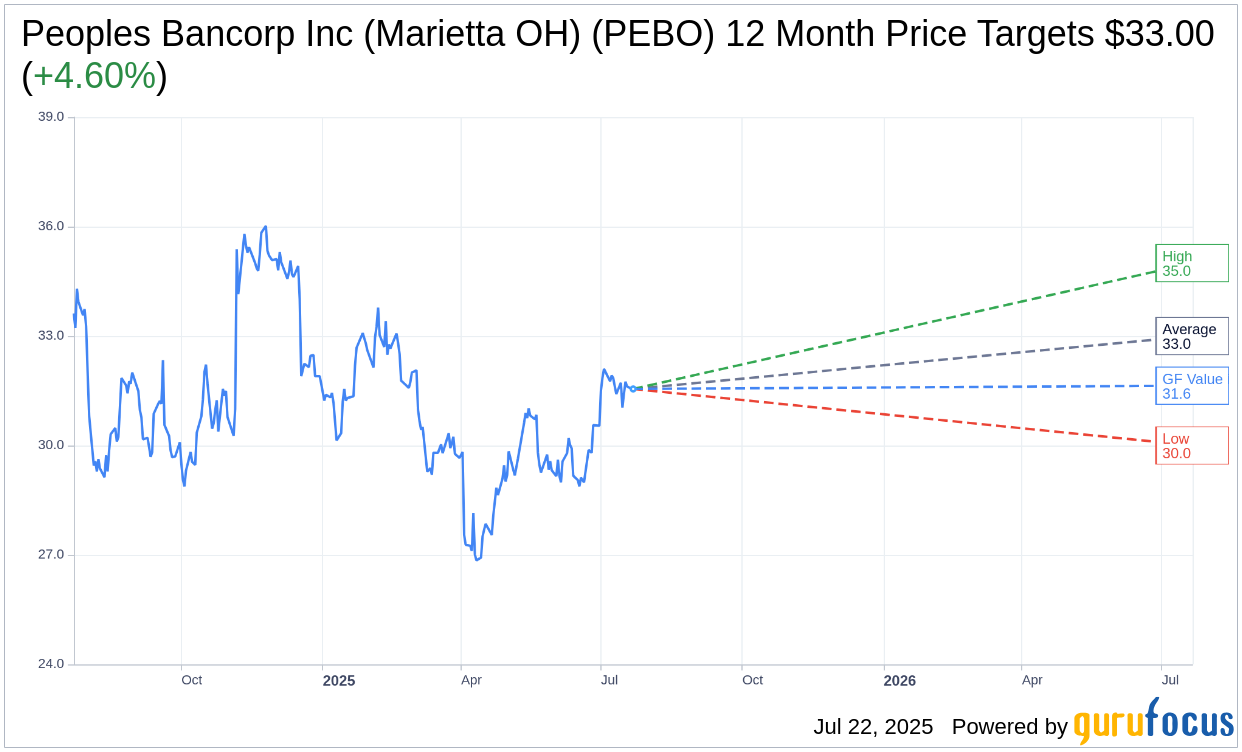

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Peoples Bancorp Inc (Marietta OH) (PEBO, Financial) is $33.00 with a high estimate of $35.00 and a low estimate of $30.00. The average target implies an upside of 4.60% from the current price of $31.55. More detailed estimate data can be found on the Peoples Bancorp Inc (Marietta OH) (PEBO) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Peoples Bancorp Inc (Marietta OH)'s (PEBO, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Peoples Bancorp Inc (Marietta OH) (PEBO, Financial) in one year is $31.64, suggesting a upside of 0.29% from the current price of $31.55. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Peoples Bancorp Inc (Marietta OH) (PEBO) Summary page.

PEBO Key Business Developments

Release Date: April 22, 2025

- Diluted Earnings Per Share: $0.68 for the first quarter.

- Annualized Loan Growth: Over 4%.

- Deposit Balances Growth: 2% increase.

- Core Deposit Growth: Over 3%.

- Book Value Per Share: Grew 2% to $31.90.

- Tangible Book Value Per Share: Improved 4% to $20.68.

- Tangible Equity to Tangible Assets Ratio: Improved to 8.34% from 8.01% at year-end.

- Net Interest Income: Down 1% compared to the linked quarter.

- Net Interest Margin: Down 3 basis points, but expanded 3 basis points on a core basis.

- Fee-Based Income Growth: Over 2% increase.

- Non-Interest Expense: Increased slightly due to one-time expenses.

- Annualized Net Charge-Off Rate: Declined to 52 basis points from 61 basis points in the fourth quarter.

- Non-Performing Assets: Decreased over $3 million, representing 50 basis points of total assets.

- Allowance for Credit Losses: Grew nearly $2 million to 1.01% of total loans.

- Provision for Credit Losses: Increased nearly $4 million compared to the linked quarter.

- Quarterly Dividend: Increased for the 10th consecutive year to $0.41 per share.

- Efficiency Ratio: 60.7%, up from 59.6% in the linked quarter.

- Loan-to-Deposit Ratio: 83%, consistent with year-end.

- Investment Portfolio: Declined $40 million, representing 20.3% of total assets.

- Deposit Composition: 76% retail deposit balances, 24% commercial deposit balances.

- Regulatory Capital Ratios: Improved compared to year-end.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Peoples Bancorp Inc (Marietta OH) (PEBO, Financial) reported a 4% annualized loan growth for the first quarter, aligning with their 2025 guidance.

- The company saw improvements in asset quality metrics, including reductions in net charge-off rate, non-performing assets, and criticized and classified loans.

- Deposit balances grew by 2%, driven by higher money market and governmental deposit account balances, with a reduction in brokered CDs.

- The tangible equity to tangible assets ratio improved to 8.34% at the end of the first quarter, up from 8.01% at year-end.

- Peoples Bancorp Inc (Marietta OH) (PEBO) announced an increase in their quarterly dividend for the 10th consecutive year, reflecting strong shareholder returns.

Negative Points

- Net interest income declined by 1% compared to the linked quarter, and net interest margin decreased by 3 basis points.

- The company experienced a slight increase in non-interest expenses due to one-time costs related to stock-based compensation and employer health savings account contributions.

- The provision for credit losses increased by nearly $4 million compared to the linked quarter, driven by net charge-offs.

- Fee-based income growth was modest at 2%, with declines in commercial loan swap fees, deposit account service charges, and electronic banking income.

- The small ticket leasing business continued to drive net charge-offs, although there was a decline compared to the previous quarter.