MSCI (MSCI, Financial) announced its second-quarter revenue of $772.7 million, surpassing the anticipated $764.28 million. This growth was propelled by a robust 17% increase in asset-based fee run rates, driven by unprecedented assets under management in exchange-traded funds (ETFs) linked to their indices. The company reported significant inflows into equity ETFs compared to other index providers. Key client segments, including banks, broker-dealers, wealth managers, hedge funds, and asset owners, experienced double-digit subscription run-rate growth. Additionally, MSCI maintained steady growth and high client retention among asset managers.

MSCI continues to broaden its solutions, addressing various use cases and catering to a wider client base. The company's strong financial framework and integrated product offerings provide the scalability and innovation clients seek to enhance their strategies. This adaptability underscores MSCI's commitment to supporting its diverse clientele and advancing the financial industry's needs.

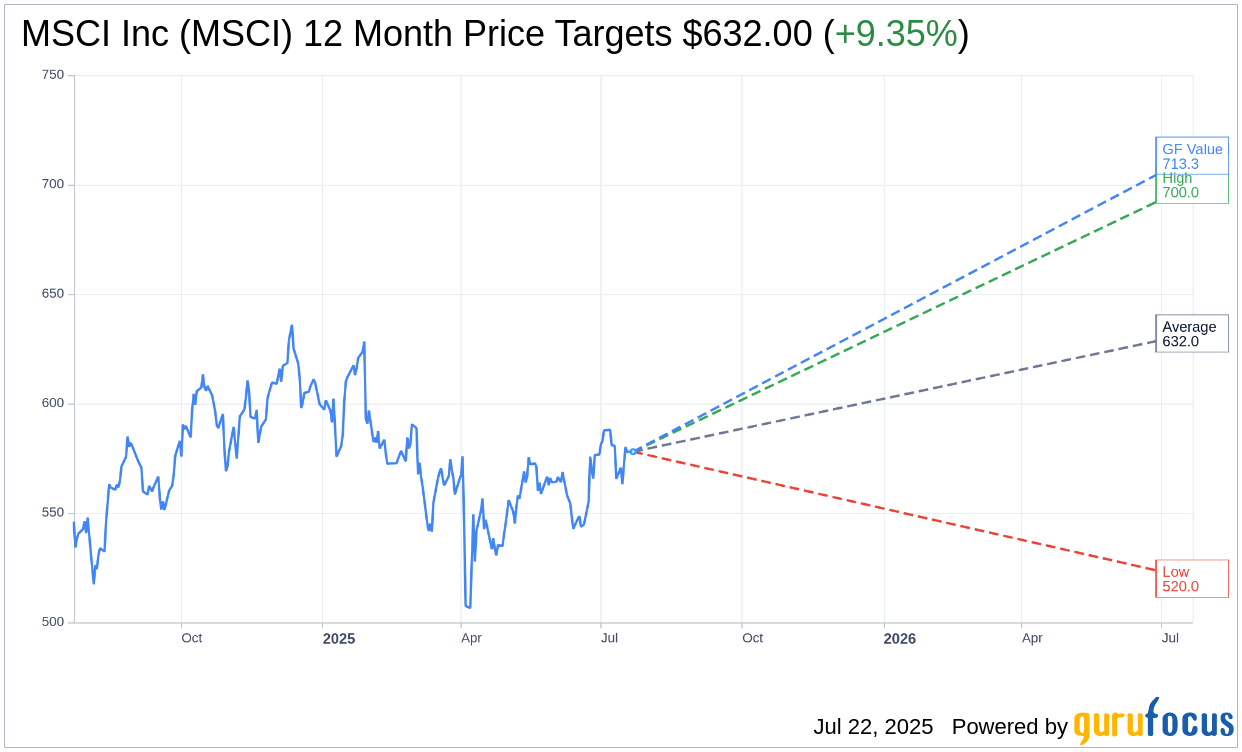

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for MSCI Inc (MSCI, Financial) is $632.00 with a high estimate of $700.00 and a low estimate of $520.00. The average target implies an upside of 9.35% from the current price of $577.97. More detailed estimate data can be found on the MSCI Inc (MSCI) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, MSCI Inc's (MSCI, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for MSCI Inc (MSCI, Financial) in one year is $713.25, suggesting a upside of 23.41% from the current price of $577.97. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the MSCI Inc (MSCI) Summary page.

MSCI Key Business Developments

Release Date: April 22, 2025

- Organic Revenue Growth: 10% in Q1 2025.

- Adjusted EBITDA Growth: 11% in Q1 2025.

- Adjusted Earnings Per Share Growth: Almost 14% in Q1 2025.

- Share Repurchases: $225 million worth of MSCI shares repurchased during Q1 and through April 21, 2025.

- Retention Rate: Over 95% in Q1 2025.

- Organic Subscription Run Rate Growth: 8% in Q1 2025.

- Asset-Based Fee Gross Revenue Growth: 18% in Q1 2025.

- Recurring Net New Sales Growth: Over 60% for Index and Analytics product lines.

- Private Capital (Trades, Portfolio) Solutions Sales Growth: 24% net new recurring subscription sales growth.

- Direct Indexing AUM: Increased by 30% to more than $131 billion.

- ETF and Non-ETF AUM Linked to MSCI Climate Indexes: Grew by 50%, reaching $387 billion.

- Non-ETF AUM Linked to MSCI Indexes: Nearly $3.9 trillion, growing 20% year-over-year.

- MSCI-Linked Equity ETFs: Ending balance of $1.78 trillion with nearly $42 billion of inflows.

- Fixed Income ETF AUM Linked to MSCI: Over $76 billion, growing 20% from a year ago.

- Analytics Subscription Run Rate Growth: 7% in Q1 2025.

- Sustainability and Climate Subscription Run Rate Growth: Almost 10% in Q1 2025.

- Private Capital (Trades, Portfolio) Solutions Run Rate Growth: Mid-teens growth.

- Gross Leverage Ratio: 2.6 times the last 12 months adjusted EBITDA.

- Effective Tax Rate: 12.8% in Q1 2025, with an expected range of 19% to 21% for the rest of 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- MSCI Inc (MSCI, Financial) reported strong financial metrics with organic revenue growth of 10%, adjusted EBITDA growth of 11%, and adjusted earnings per share growth of almost 14%.

- The company achieved a retention rate of over 95% and organic subscription run rate growth of 8%, indicating strong client loyalty and recurring revenue.

- MSCI Inc (MSCI) saw significant growth in asset-based fee revenue, with an 18% increase, driven by strong ETF and non-ETF AUM linked to MSCI Indices.

- The company reported a 24% growth in net new recurring subscription sales for Private Capital (Trades, Portfolio) Solutions, highlighting its expanding footprint in private assets.

- MSCI Inc (MSCI) has a robust capital allocation policy, demonstrated by the repurchase of $225 million worth of shares during Q1, reflecting confidence in its stock value.

Negative Points

- New recurring subscription sales were down compared to Q1 of 2024, indicating potential challenges in acquiring new clients or expanding existing accounts.

- The Sustainability and Climate segment saw net new sales decline, with muted demand particularly in the US and regulatory complexities in Europe affecting growth.

- Real Assets activity remained muted, facing headwinds related to client consolidation, particularly among brokers and developers.

- The company noted that some deals did not close in Q1 and are expected to close in Q2, indicating potential delays in sales cycles.

- MSCI Inc (MSCI) faces a complex operating environment with market volatility and uncertainty, which could impact future financial performance and client spending.