Sherwin-Williams (SHW, Financial) recorded second-quarter revenue of $6.31 billion, slightly surpassing the consensus estimate of $6.3 billion. Despite facing a volatile demand environment, the company's strategic execution remained steadfast. According to CEO Heidi Petz, Sherwin-Williams achieved a consistent expansion in gross margins for the twelfth consecutive quarter, although the demand was softer than expected.

In response to ongoing demand challenges, which are projected to persist or worsen in the latter half of the year, the company accelerated and expanded its restructuring efforts, incurring $59 million in pre-tax expenses. Furthermore, developments in their new buildings project advanced more rapidly than anticipated, contributing to approximately $40 million in pre-tax transition and related costs, initially expected in the second half of the year.

The company also reported strong cash flow, returning $716 million to its shareholders through dividends and share buybacks during this quarter.

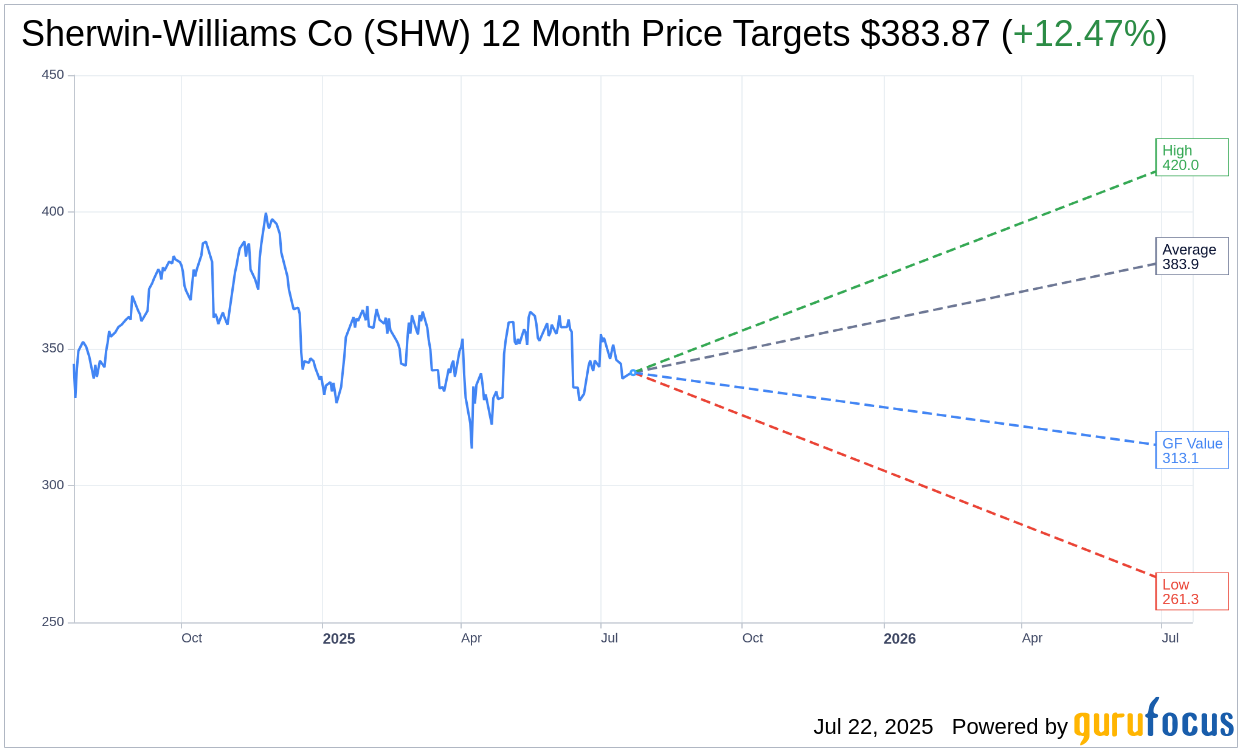

Wall Street Analysts Forecast

Based on the one-year price targets offered by 21 analysts, the average target price for Sherwin-Williams Co (SHW, Financial) is $383.87 with a high estimate of $420.00 and a low estimate of $261.34. The average target implies an upside of 12.47% from the current price of $341.30. More detailed estimate data can be found on the Sherwin-Williams Co (SHW) Forecast page.

Based on the consensus recommendation from 29 brokerage firms, Sherwin-Williams Co's (SHW, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Sherwin-Williams Co (SHW, Financial) in one year is $313.05, suggesting a downside of 8.28% from the current price of $341.3. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Sherwin-Williams Co (SHW) Summary page.

SHW Key Business Developments

Release Date: April 29, 2025

- Adjusted Earnings Per Share: Increased by 3.7% to $2.25 per share.

- Share Repurchases: $352 million invested in share repurchases.

- Dividend Increase: Dividend increased by 10%.

- Paint Stores Group Sales: Grew by a low single-digit percentage; price/mix up by mid-single digits, volume down low single digits.

- Segment Margin Expansion: Paint Stores Group margin expanded by 120 basis points to 18.4%.

- New Store Openings: 18 new stores opened in the quarter.

- Consumer Brands Group Sales: Within expected range; adjusted segment margin expanded to 21.3%.

- Performance Coatings Group Sales: Below expectations; adjusted segment margin decreased by 60 basis points to 16.5%.

- SG&A Expense: Decreased by a low single-digit percentage in Performance Coatings Group; down a mid-teens percentage in administrative functions.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Sherwin-Williams Co (SHW, Financial) reported a 3.7% increase in adjusted earnings per share to $2.25.

- The company expanded its gross margin and gross profit dollars, demonstrating effective cost management.

- Sherwin-Williams Co (SHW) increased its dividend by 10% and invested $352 million in share repurchases.

- The Paint Stores Group saw sales growth driven by a mid-single-digit increase in price/mix.

- The acquisition of Suvinil is expected to enhance the Consumer Brands Group, offering multiple profitable growth opportunities.

Negative Points

- Consolidated sales were within the guided range but offset by softness in two segments.

- Performance Coatings Group sales were below expectations, with declines in FX, price mix, and volume.

- Commercial and property maintenance sales remained under pressure due to weak commercial construction and delayed CapEx spending.

- The Consumer Brands Group experienced a sales decrease, partly due to unfavorable FX and soft DIY demand in North America.

- Sherwin-Williams Co (SHW) faces uncertainty in the market related to tariffs, which could impact raw material costs.