On July 22, 2025, IQVIA Holdings Inc (IQV, Financial) released its 8-K filing for the second quarter of 2025, showcasing a revenue of $4,017 million, which surpassed the analyst estimate of $3,962.97 million. However, the company's GAAP diluted earnings per share (EPS) of $1.54 fell short of the estimated EPS of $1.73. Despite this, the adjusted diluted EPS was $2.81, significantly higher than the estimates.

Company Overview

IQVIA Holdings Inc (IQV, Financial) is a prominent global provider of clinical research services, commercial insights, and healthcare intelligence, formed from the merger of Quintiles and IMS Health in 2016. The company operates through its Research & Development Solutions (R&DS) and Technology & Analytics Solutions (TAS) segments, offering comprehensive services to pharmaceutical, device, and diagnostic firms, as well as healthcare providers and policymakers.

Performance and Challenges

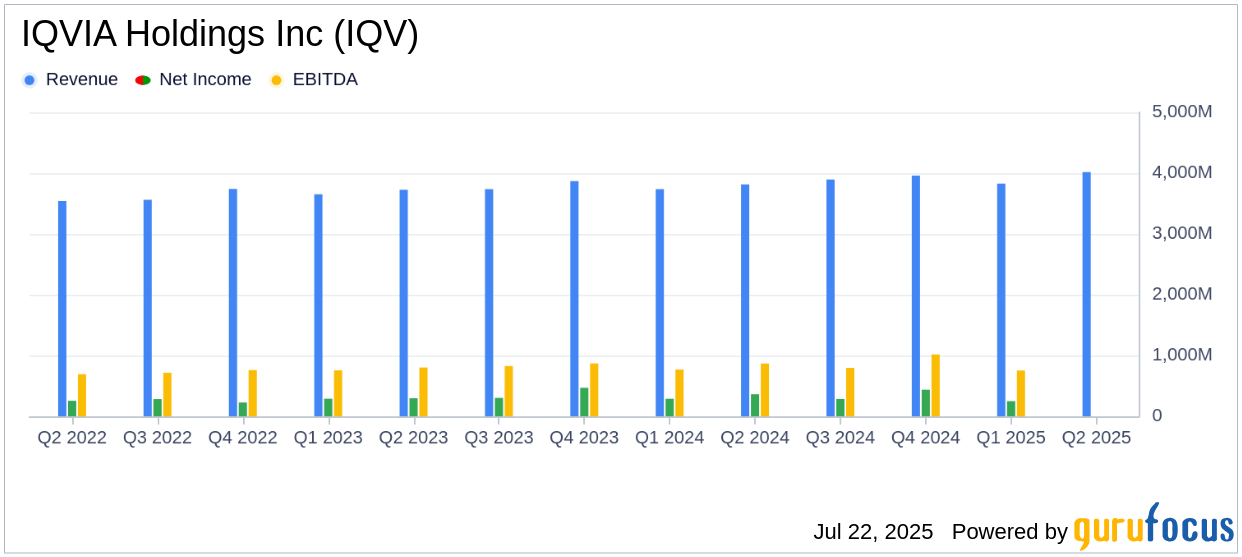

IQVIA's revenue growth of 5.3% year-over-year highlights its robust performance, driven by an 8.9% increase in TAS revenue and a 2.5% rise in R&DS revenue. The company's R&DS segment reported quarterly bookings of $2.5 billion, with a book-to-bill ratio of 1.12x, indicating strong demand. However, the GAAP net income of $266 million reflects a decline from the previous year, posing challenges in maintaining profitability amidst rising costs and restructuring expenses.

Financial Achievements

The company's adjusted EBITDA of $910 million, up 2.6% year-over-year, underscores its operational efficiency. IQVIA's ability to repurchase $607 million of common stock in the quarter, totaling over $1 billion year-to-date, demonstrates its commitment to returning value to shareholders. These achievements are crucial for maintaining investor confidence and supporting the company's strategic objectives in the competitive Medical Diagnostics & Research industry.

Key Financial Metrics

IQVIA's balance sheet reveals a strong cash position with $2,039 million in cash and cash equivalents, offset by a significant debt load of $15,490 million, resulting in a net debt of $13,451 million. The company's net leverage ratio stands at 3.61x trailing twelve-month adjusted EBITDA, indicating a manageable debt level relative to its earnings capacity. Operating cash flow for the quarter was $443 million, with free cash flow at $292 million, reflecting solid cash generation capabilities.

Analysis and Outlook

IQVIA's performance in Q2 2025 highlights its resilience and adaptability in a dynamic market environment. The company's strategic focus on expanding its TAS segment and enhancing its R&DS offerings positions it well for future growth. However, the pressure on GAAP earnings and the need to manage debt levels remain critical areas for improvement. As IQVIA continues to navigate industry challenges, its ability to leverage its diversified portfolio and execute strategic initiatives will be key to sustaining long-term success.

IQVIA delivered strong financial results, with revenue above target and profit towards the high-end of expectations," said Ari Bousbib, chairman and CEO of IQVIA. "These results underscore the resilience of our global diversified portfolio and the team's ability to execute consistently against our strategic and financial objectives."

Explore the complete 8-K earnings release (here) from IQVIA Holdings Inc for further details.