Southern First Bancshares (SFST, Financial) revealed its second-quarter net interest margin climbed to 2.50%, improving from 2.41% in the first quarter of 2025 and 1.98% during the same period in 2024. The company's book value per common share also rose to $42.23 from $41.33 at the end of the previous quarter.

Their common equity tier 1 ratio slightly decreased to 10.71%, compared to 10.75% in the prior quarter. SFST's CEO highlighted that their Q2 achievements underscore the strength of their team, contributing to an impressive 24% annual growth in revenue, marking one of the most lucrative quarters in their 25-year history.

The company's robust business pipelines and solid balance sheet are expected to fuel continued growth, while maintaining top-tier asset quality. SFST recently welcomed three new board members, enhancing leadership with their deep community and professional expertise. The company expresses optimism for sustained financial performance, despite potential challenges from a dynamic operating environment.

Wall Street Analysts Forecast

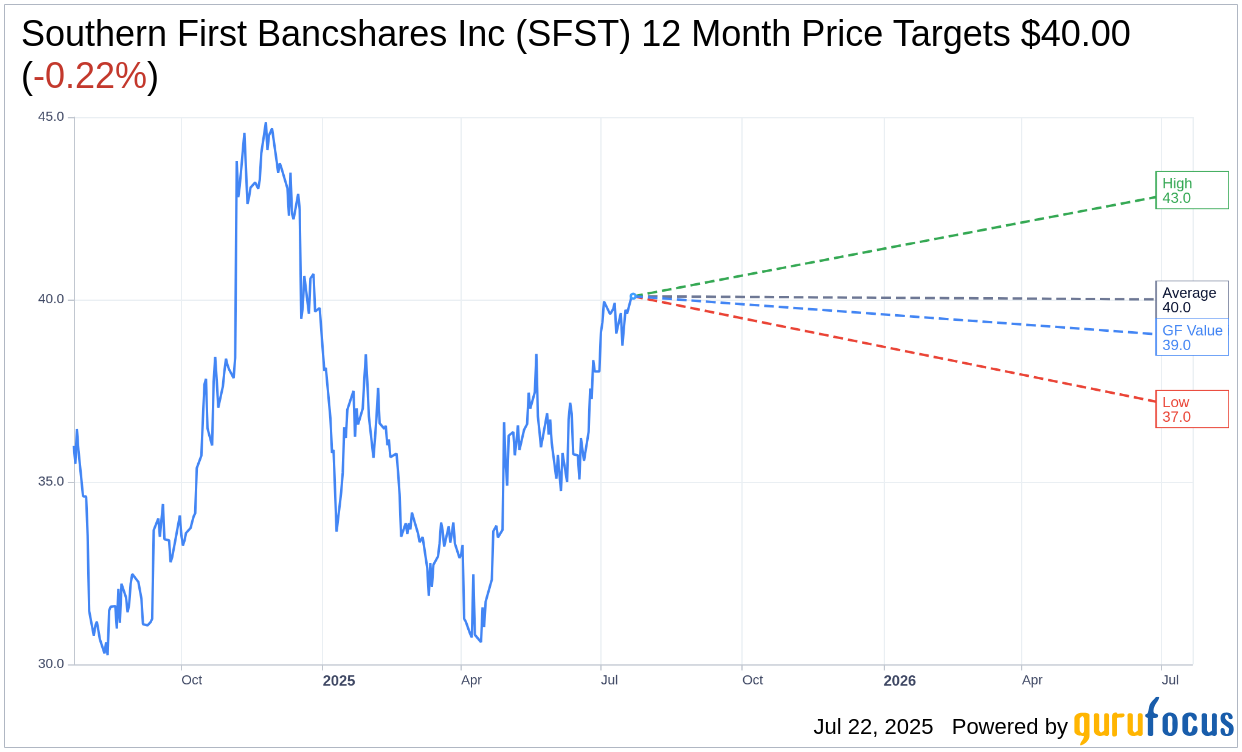

Based on the one-year price targets offered by 2 analysts, the average target price for Southern First Bancshares Inc (SFST, Financial) is $40.00 with a high estimate of $43.00 and a low estimate of $37.00. The average target implies an downside of 0.22% from the current price of $40.09. More detailed estimate data can be found on the Southern First Bancshares Inc (SFST) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Southern First Bancshares Inc's (SFST, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Southern First Bancshares Inc (SFST, Financial) in one year is $38.98, suggesting a downside of 2.77% from the current price of $40.09. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Southern First Bancshares Inc (SFST) Summary page.