- MSCI outperforms in Q2 with impressive earnings and revenue growth.

- Analysts predict a potential 9.35% upside in MSCI's stock price.

- GuruFocus estimates a significant 23.41% upside based on GF Value.

MSCI Inc. (MSCI) delivered outstanding results in the second quarter, surpassing market expectations. The company reported a non-GAAP earnings per share (EPS) of $4.17, exceeding analyst estimates by $0.03. Revenue climbed to $772.68 million, marking a 9.1% increase year-over-year and surpassing forecasts by $3.44 million. In a strategic move, MSCI repurchased 250,818 shares, investing $131.2 million at an average price of $523.20.

Robust Earnings Outperformance

MSCI's Q2 performance highlights the company's robust financial health and strategic prowess. The company's ability to generate higher-than-expected earnings and revenue showcases its strength in navigating market dynamics and capitalizing on growth opportunities.

Wall Street Analysts Forecast

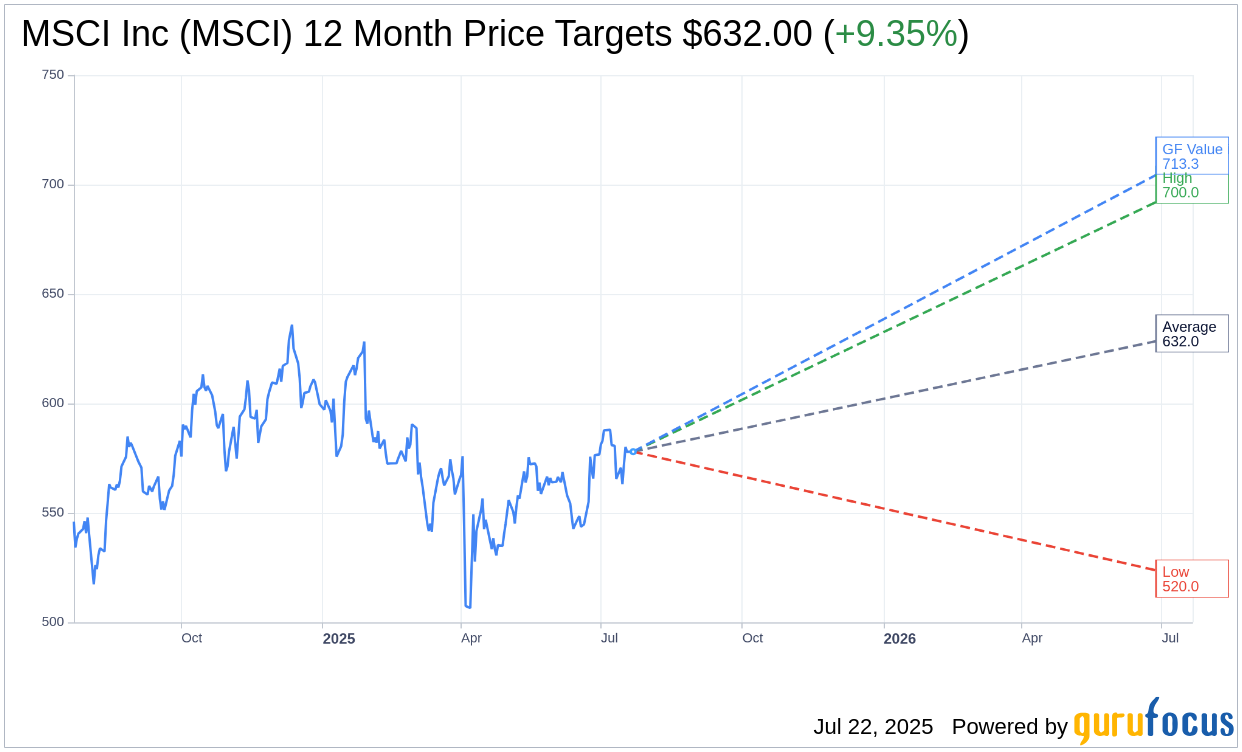

According to price targets provided by 13 analysts, MSCI Inc. is projected to reach an average price target of $632.00 over the next year. Projections range from a high estimate of $700.00 to a low of $520.00, implying a potential upside of 9.35% from its current trading price of $577.97. For detailed insights, visit the MSCI Inc (MSCI, Financial) Forecast page.

Analyst Recommendations

The consensus from 19 brokerage firms rates MSCI Inc. with an average recommendation of 2.3, indicating an "Outperform" status. This rating reflects confidence in MSCI's ability to deliver robust results, with the scale ranging from 1 (Strong Buy) to 5 (Sell).

GuruFocus GF Value Estimation

GuruFocus provides an estimated GF Value for MSCI Inc. of $713.25 in one year, indicating a substantial upside potential of 23.41% from the current price of $577.97. The GF Value is a proprietary metric estimating a stock's fair trading value, considering historical trading multiples, past growth, and future business projections. For further analysis, visit the MSCI Inc (MSCI, Financial) Summary page.

Investors looking for growth opportunities could find MSCI Inc.'s strong performance and promising future outlook appealing, supported by both Wall Street analysts and GuruFocus' comprehensive valuations.