Key Takeaways:

- Hewlett Packard Enterprise (HPE, Financial) secured a landmark legal victory with a $944 million award from a London High Court.

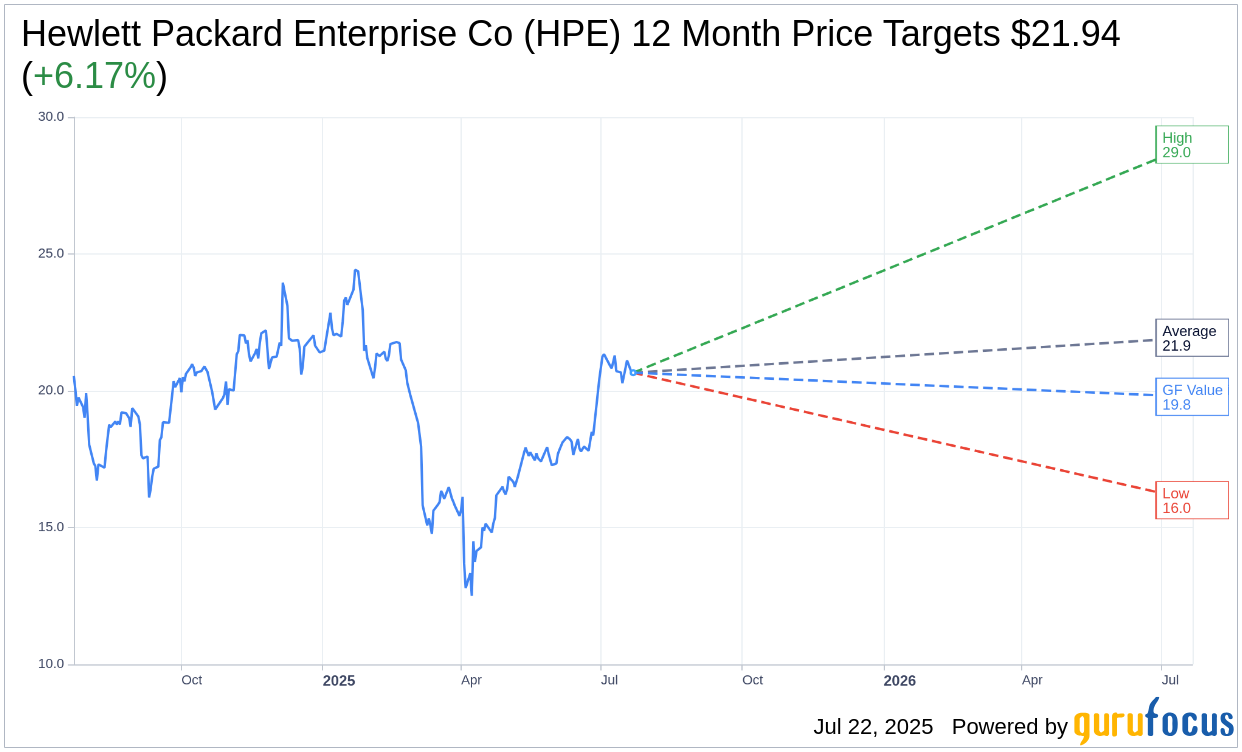

- Wall Street analysts predict moderate growth with an average price target of $21.94, indicating a potential upside of 6.17%.

- HPE holds an "Outperform" status with an average brokerage recommendation of 2.3.

Hewlett Packard Enterprise (HPE) recently emerged victorious in a protracted legal battle, winning over 700 million pounds, roughly $944 million, from a London High Court. This significant ruling follows HPE's 2011 acquisition of the software firm Autonomy, resolving a decade-long dispute. The court identified financial misrepresentations by Autonomy's late founder, Mike Lynch, and former CFO, Sushovan Hussain, leading to this momentous award and additional compensation for deceit claims. HPE's triumph marks a pivotal moment in its quest for justice.

Analyst Predictions: Growth Potential

According to 14 Wall Street analysts, Hewlett Packard Enterprise Co (HPE, Financial) has a one-year price target averaging $21.94, with estimates varying between a high of $29.00 and a low of $16.00. This average target suggests a potential upside of 6.17% from its current trading price of $20.66. For more detailed estimates, visit the Hewlett Packard Enterprise Co (HPE) Forecast page.

Brokerage Recommendations: Outperform Status

The consensus from 19 brokerage firms positions Hewlett Packard Enterprise Co (HPE, Financial) with an average recommendation of 2.3, reflecting "Outperform" status. This rating scale ranges from 1, indicating a Strong Buy, to 5, representing a Sell.

GF Value: Assessing Fair Value

GuruFocus estimates the GF Value for HPE at $19.78 in one year, hinting at a potential downside of 4.26% from the current price of $20.66. The GF Value metric evaluates the stock's fair trading value, based on historical trading multiples, previous business growth, and future performance projections. More detailed insights are accessible on the Hewlett Packard Enterprise Co (HPE, Financial) Summary page.