- Philip Morris International's smoke-free segment shines, contributing significantly to revenue growth.

- Analysts suggest an 'Outperform' rating with potential stock price adjustments.

- GuruFocus estimates indicate potential downside despite strong quarterly performance.

Philip Morris International (PM, Financial) has demonstrated a robust performance in the second quarter, notably driven by its smoke-free product segment, which now accounts for 41% of the company's net revenue. The adjusted operating income showed impressive growth, rising 14.9% to reach $4.25 billion, surpassing market expectations. As a result of this strong performance, the company has adjusted its full-year earnings per share (EPS) guidance upward to a range of $7.43 to $7.56.

Wall Street Analysts Forecast

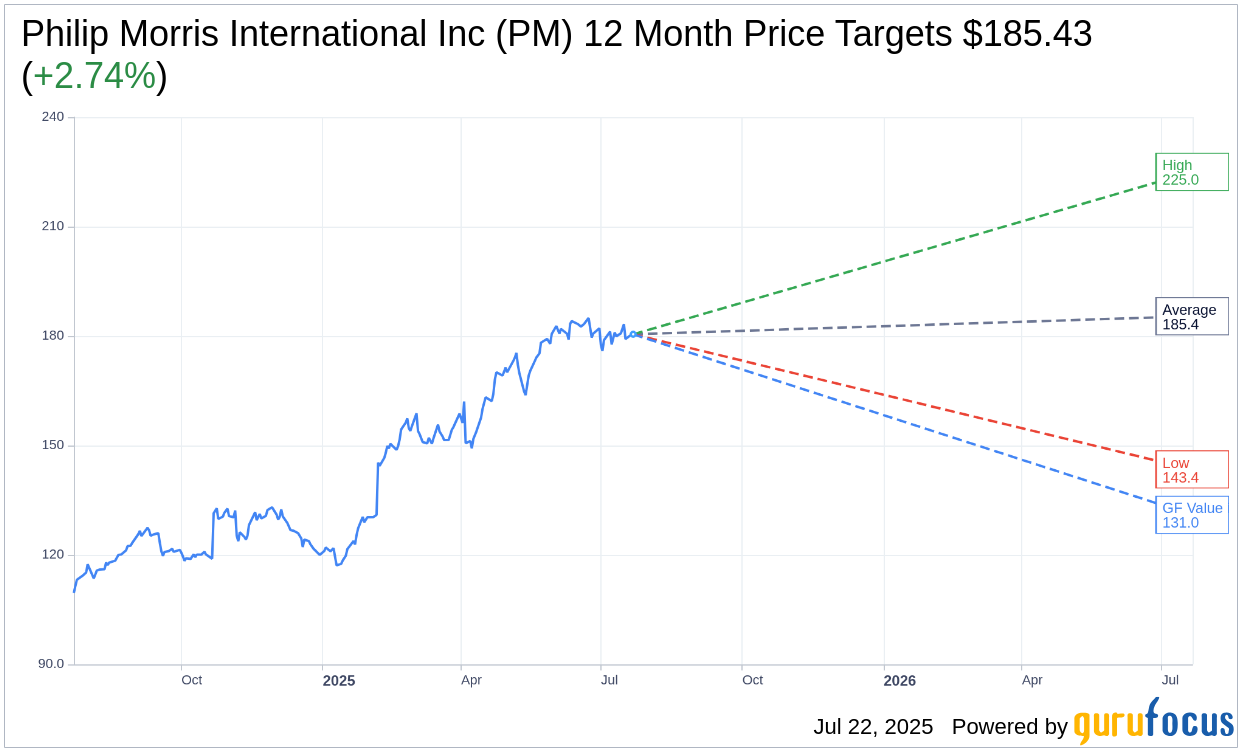

According to projections from 15 analysts, the average one-year price target for Philip Morris International Inc (PM, Financial) stands at $185.43. This includes a high estimate of $225.00 and a low estimate of $143.45, representing a potential upside of 2.74% from the current share price of $180.48. Investors looking for more detailed price target information can visit the Philip Morris International Inc (PM) Forecast page.

On the recommendation front, 18 brokerage firms have given Philip Morris International Inc (PM, Financial) an average rating of 2.1. This suggests an "Outperform" status on the scale, which ranges from 1 (Strong Buy) to 5 (Sell).

GuruFocus Insights and GF Value

The GF Value, GuruFocus' proprietary estimate of the stock's fair value, places Philip Morris International Inc (PM, Financial) at $130.99 over the next year. This indicates a potential downside of 27.42% from the current price of $180.48. The GF Value is derived from historical trading multiples, past business growth, and future performance estimates. For an in-depth look at these metrics, investors can explore the Philip Morris International Inc (PM) Summary page.