- Enbridge's $900 million Clear Fork solar project aims to boost earnings by summer 2027.

- Analysts have set a one-year average price target of $45.65 for Enbridge stock.

- The stock is rated "Hold" by the consensus of 14 brokerage firms.

Enbridge Inc. (ENB, Financial) is making strides in renewable energy with its commitment to the Clear Fork solar project in Texas. This ambitious 600 MW facility is scheduled to start operations by summer 2027. Supported by a strategic long-term agreement with Meta Platforms (META), the $900 million initiative is projected to bolster Enbridge's cash flow and earnings per share, positioning the company for future growth.

Wall Street Analysts Forecast

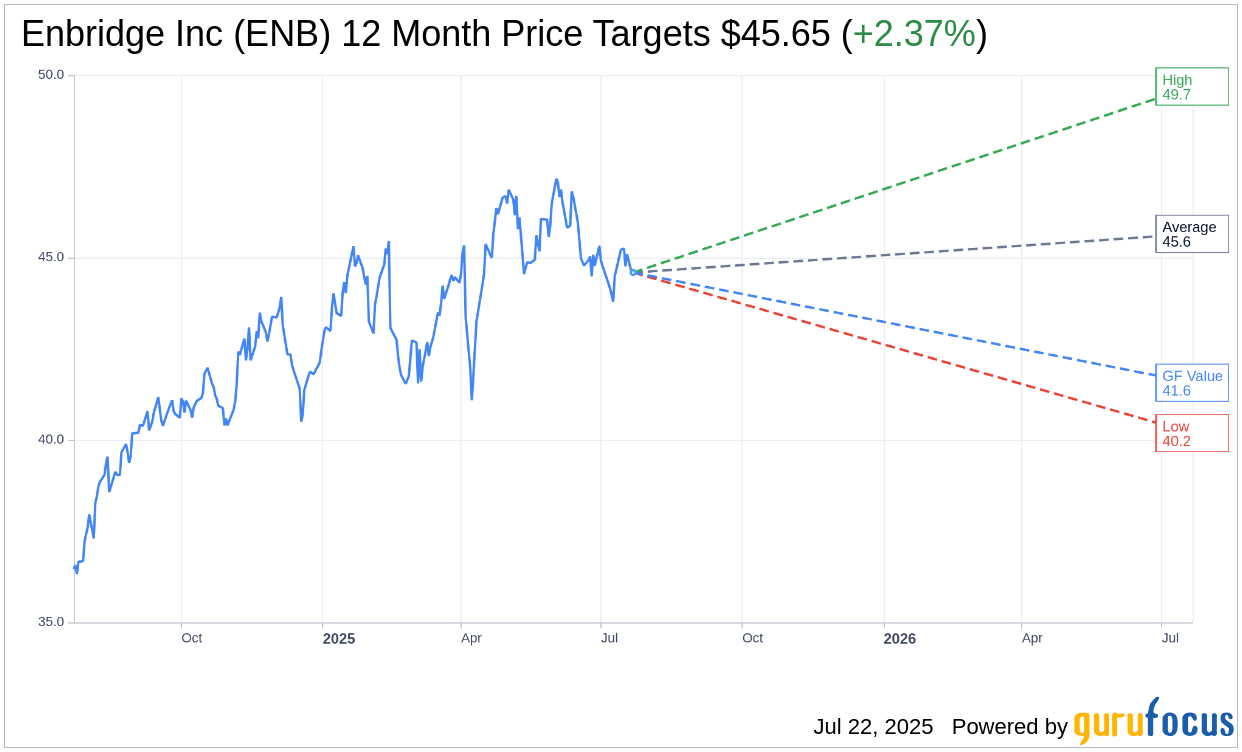

Eight analysts have provided one-year price targets for Enbridge Inc. (ENB, Financial), with an average target of $45.65. The high estimate stands at $49.69, while the low estimate is $40.19. At the current price of $44.59, the average target suggests a modest upside of 2.37%. Investors can explore more detailed estimates on the Enbridge Inc (ENB) Forecast page.

When it comes to brokerage ratings, the consensus recommendation from 14 firms for Enbridge Inc. (ENB, Financial) is 2.6, reflecting a "Hold" status. The rating scale ranges from 1 to 5, with 1 indicating a Strong Buy and 5 a Sell.

GF Value Estimate

According to GuruFocus estimates, the GF Value for Enbridge Inc. (ENB, Financial) in one year is projected at $41.57, indicating a potential downside of 6.77% from the current trading price of $44.59. The GF Value represents GuruFocus' assessment of the stock's fair value, factoring in historical trading multiples, past growth, and future performance projections. Detailed analytics and insights are available on the Enbridge Inc (ENB) Summary page.