Provident Bank has appointed Maheshkumar Kandasamy as the Senior Vice President and Enterprise Architecture Director. In his new role, he will lead the technical initiatives of the bank, managing the enterprise and business solutions architecture functions. Reporting to Satish Harikrishnan, Senior Vice President of Technology Services, Kandasamy's focus will be on aligning the bank’s technology strategies with its broader business goals.

His responsibilities will include ensuring the scalability, security, and compliance of Provident Bank's systems. Kandasamy will also spearhead the development and maturity of the enterprise architecture practice, emphasizing modernization, the integration of AI and machine learning, and enhancing platform resilience. Before joining Provident Bank, he held the position of Director of Core Banking at Teachers Federal Credit Union.

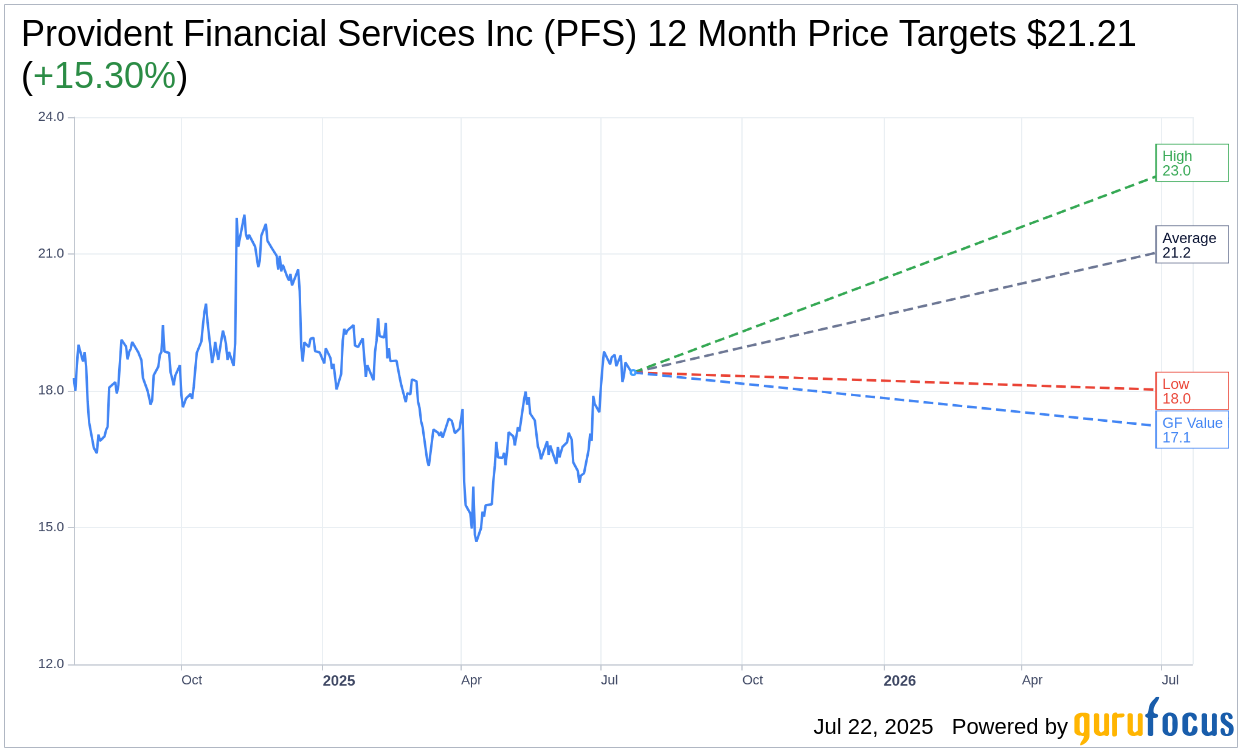

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Provident Financial Services Inc (PFS, Financial) is $21.21 with a high estimate of $23.00 and a low estimate of $18.00. The average target implies an upside of 15.30% from the current price of $18.40. More detailed estimate data can be found on the Provident Financial Services Inc (PFS) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Provident Financial Services Inc's (PFS, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Provident Financial Services Inc (PFS, Financial) in one year is $17.15, suggesting a downside of 6.79% from the current price of $18.4. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Provident Financial Services Inc (PFS) Summary page.

PFS Key Business Developments

Release Date: April 25, 2025

- Net Earnings: $64 million or $0.49 per share.

- Adjusted Return on Average Assets: 1.11%.

- Adjusted Return on Average Tangible Equity: 16.15%.

- Tangible Book Value per Share: Increased by $0.69 to $14.15.

- Tangible Common Equity Ratio: Expanded to 7.9%.

- Quarterly Cash Dividend: $0.24 per share.

- Deposits: Declined by $175 million or 0.94%.

- Average Cost of Total Deposits: Decreased 14 basis points to 2.11%.

- Net Interest Margin: Increased 6 basis points to 3.34%.

- Commercial Loan Portfolio Growth: Increased by 3.8%.

- Total Loan Pipeline: Approximately $2.8 billion.

- Nonperforming Loan Ratio: Increased to 0.54%.

- Net Charge-Offs: Decreased to $2 million from $5.5 million.

- Provident Protection Plus Growth: 19% organic growth in new business.

- Beacon Trust Assets Under Management: Decreased by approximately 4%.

- Revenue: Increased to $208.8 million.

- Core Net Interest Margin: Increased 9 basis points to 2.94%.

- Noninterest Income: Increased to $27 million.

- Noninterest Expenses: $113.6 million, with an efficiency ratio of 54.4%.

- Effective Tax Rate: Increased to 30.3%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Provident Financial Services Inc (PFS, Financial) reported strong net earnings of $64 million or $0.49 per share for the first quarter.

- The company's tangible book value per share grew by $0.69 to $14.15, indicating solid financial health.

- Provident Financial Services Inc (PFS) achieved a significant increase in its commercial loan portfolio, which grew by 3.8% during the quarter.

- The company's net interest margin improved by 6 basis points to 3.34%, reflecting effective management of interest expenses.

- Provident Financial Services Inc (PFS) experienced a 19% organic growth in new business for its Provident Protection Plus segment, showcasing strong performance in fee-based businesses.

Negative Points

- Deposits declined by $175 million or 0.94% during the quarter, primarily due to seasonal outflows of municipal deposits.

- Nonperforming loans increased to 0.54%, attributed to two well-secured loans, indicating some challenges in credit quality.

- Beacon Trust assets under management and fee income decreased by approximately 4% due to market conditions.

- The company faced a $2.7 million write-down associated with the pending sale of a foreclosed commercial property.

- Provident Financial Services Inc (PFS) experienced a $31.2 million increase in nonperforming loans, impacting overall asset quality.