DA Davidson has adjusted its price target for Douglas Dynamics (PLOW, Financial), increasing it to $34 from the previous $32, while maintaining a Buy rating on the stock. The analyst suggests that the agricultural sector has hit a significant low point, particularly in tractor sales, marking a notable phase. However, there are indications of potential challenges emerging in the Class 8 Vocational truck markets. These insights were shared with investors as part of a broader analysis of the market landscape.

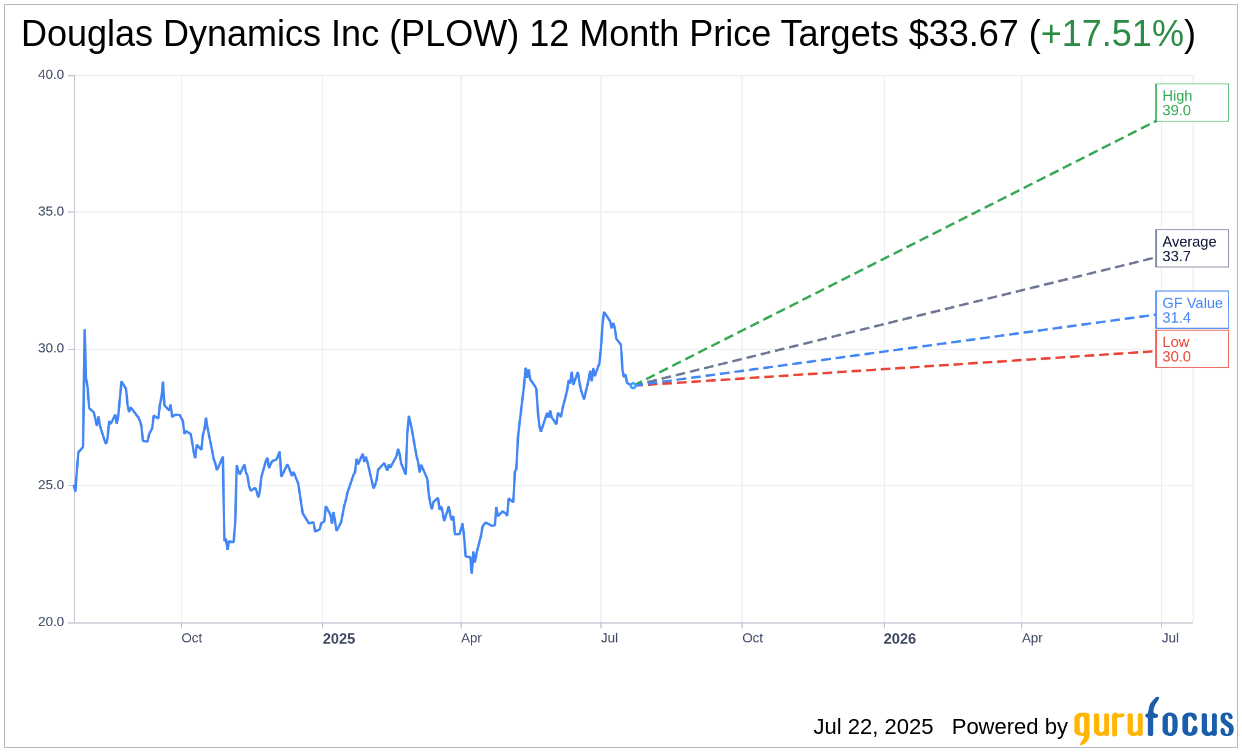

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Douglas Dynamics Inc (PLOW, Financial) is $33.67 with a high estimate of $39.00 and a low estimate of $30.00. The average target implies an upside of 17.51% from the current price of $28.65. More detailed estimate data can be found on the Douglas Dynamics Inc (PLOW) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Douglas Dynamics Inc's (PLOW, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Douglas Dynamics Inc (PLOW, Financial) in one year is $31.43, suggesting a upside of 9.7% from the current price of $28.65. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Douglas Dynamics Inc (PLOW) Summary page.

PLOW Key Business Developments

Release Date: May 06, 2025

- Consolidated Net Sales: Increased 20.3% to $115.1 million.

- Gross Margin: Improved by 470 basis points to 24.5%.

- SG&A Expenses: Increased by $1.9 million to $23.4 million.

- Adjusted EBITDA: Increased to $9.4 million.

- Adjusted Net Income: Improved by $8.7 million to $2.2 million.

- Adjusted Earnings Per Share: Record $0.09.

- Work Truck Attachments Net Sales: Increased 52.9% to $36.5 million.

- Work Truck Solutions Net Sales: Increased 9.5% to $78.6 million.

- Adjusted EBITDA Margin: 8.2%.

- Interest Expenses: Decreased to $2.4 million.

- Leverage Ratio: 2.1 times, down from 3.3 times in 2024.

- Net Cash Used in Operating Activities: Decreased to $1.3 million.

- Capital Expenditures: Increased to $2.2 million.

- 2025 Guidance - Net Sales: Expected between $610 million and $650 million.

- 2025 Guidance - Adjusted EBITDA: Predicted to range from $75 million to $95 million.

- 2025 Guidance - Adjusted EPS: Expected to be in the range of $1.30 to $2.10 per share.

- Effective Tax Rate: Expected to be approximately 24% to 25%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Douglas Dynamics Inc (PLOW, Financial) achieved record revenue and adjusted EPS in the first quarter, a notable accomplishment given the typical seasonality of their business.

- Work Truck Solutions delivered its fourth consecutive quarter of record results, driven by strong municipal volumes and improved price realization.

- The company has a robust backlog, with production dates booked into 2026, indicating strong future demand.

- Operational efficiency improvements and cost savings programs have led to significant margin improvements.

- Douglas Dynamics Inc (PLOW) is well-positioned to manage tariff impacts due to its primarily domestic operations and sourcing.

Negative Points

- There is uncertainty regarding the economic outlook and potential tariff impacts, which could affect future performance.

- The company faces an elongated equipment replacement cycle, which adds uncertainty to preseason demand.

- Some areas of the commercial solutions business are experiencing softening demand due to economic uncertainty.

- The effective tax rate appeared unusually high at 69.8% for the quarter, although this is expected to normalize.

- Despite strong performance, the company is not raising its guidance due to several uncertainties, including economic conditions and tariffs.