Key Highlights:

- MSCI announces a steady quarterly dividend, providing a forward yield of 1.25%.

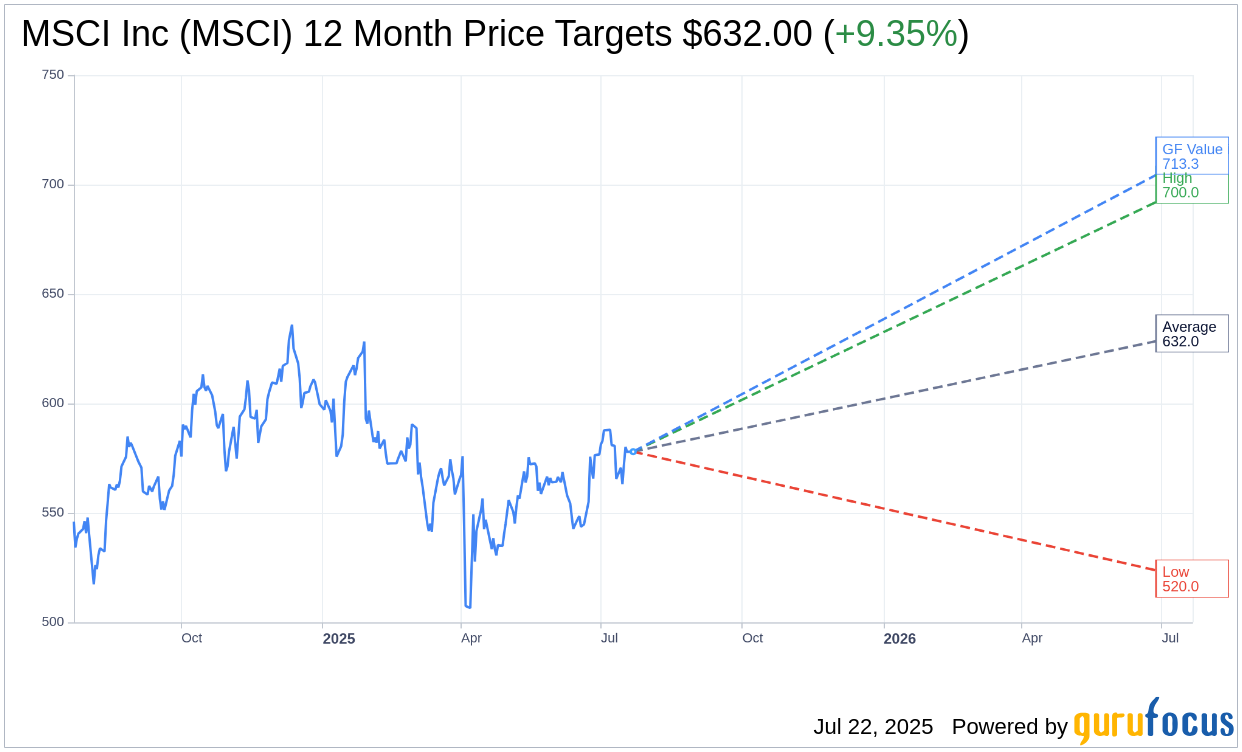

- Analysts predict a potential upside of 9.35% with an average price target of $632.00.

- GuruFocus GF Value estimate suggests a 23.41% upside for MSCI's stock.

MSCI Inc. (MSCI) has declared a consistent quarterly dividend of $1.80 per share, maintaining its previous payout level. This results in a forward yield of 1.25%, offering consistent income to investors. The dividend is scheduled for payment on August 29, with shareholders having a record date of August 15, coinciding with its ex-dividend date. Moreover, the company has exceeded Q2 earnings projections and reaffirmed its fiscal year 2025 outlook, showcasing strong financial health and future potential.

Wall Street Analysts' Price Projections

Current analysis from 13 Wall Street analysts sets the average one-year price target for MSCI Inc. at $632.00. This includes a high estimate of $700.00 and a low of $520.00. With the current stock price at $577.97, the average target suggests a potential upside of 9.35%. Investors can access comprehensive estimate data via the MSCI Inc (MSCI, Financial) Forecast page, offering a detailed perspective on expected stock performance.

The consensus among 19 brokerage firms recommends an "Outperform" status for MSCI Inc., reflected in an average brokerage recommendation score of 2.3 on a scale where 1 is Strong Buy and 5 is Sell. This indicates a positive outlook on the company's market position and potential growth trajectory.

Insight into GuruFocus GF Value Estimate

According to GuruFocus, the estimated GF Value for MSCI Inc. in one year is projected at $713.25. This valuation suggests a substantial upside of 23.41% from the current price of $577.97. The GF Value is a crucial metric, representing GuruFocus' estimate of the stock's fair trading value. This valuation utilizes historical trading multiples, past business growth, and future performance estimates for accurate forecasting. For a deeper dive into MSCI's stock analysis, visit the MSCI Inc (MSCI, Financial) Summary page.