Key Points:

- Sherwin-Williams (SHW, Financial) stock experienced a 4.2% premarket drop due to disappointing second-quarter results.

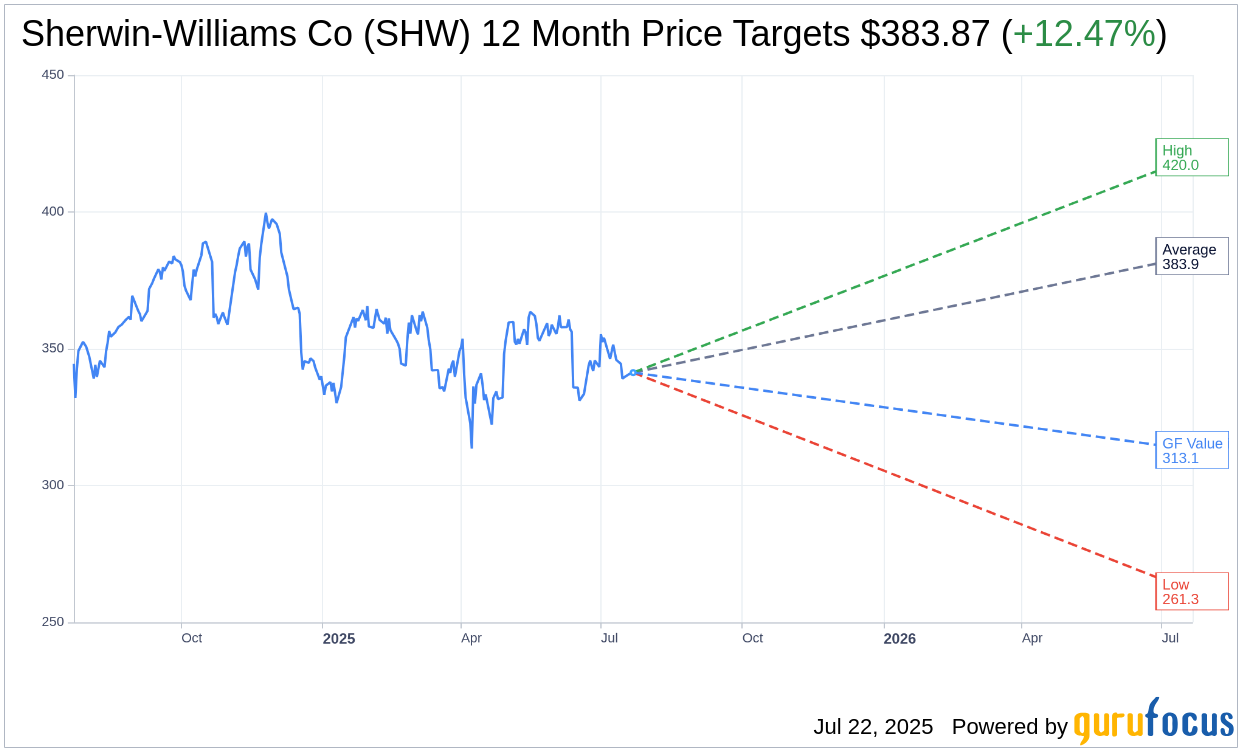

- Analysts provide an average price target of $383.87, indicating a potential upside of 12.47% from the current price.

- GuruFocus estimates suggest a 8.28% downside to a fair value of $313.05.

Sherwin-Williams Co. (NYSE: SHW) recently faced a 4.2% decline in its stock price during premarket trading, coinciding with the release of its second-quarter results, which fell short of expectations. The company also revised its full-year earnings forecast downwards. Despite a modest 0.7% increase in net sales, the company struggled, particularly in its Consumer Brands and Performance Coatings segments. Restructuring and transition costs further contributed to a decline in earnings.

Wall Street Analysts' Projections

Looking ahead, Wall Street analysts have provided a range of price targets for Sherwin-Williams Co (SHW, Financial). With input from 21 analysts, the average target price is set at $383.87. This includes a high estimate of $420.00 and a low estimate of $261.34. This average target suggests a potential upside of 12.47% from the current stock price of $341.30. For a more comprehensive analysis, investors can visit the Sherwin-Williams Co (SHW) Forecast page.

Brokerage Recommendations

The consensus from 29 brokerage firms indicates an average brokerage recommendation of 2.4 for Sherwin-Williams Co (SHW, Financial), signifying an "Outperform" rating. The rating scale employed spans from 1 to 5, where 1 reflects a Strong Buy and 5 indicates a Sell.

GuruFocus Valuation

According to GuruFocus' valuation metrics, the estimated GF Value for Sherwin-Williams Co (SHW, Financial) in one year is $313.05, which suggests a potential downside of 8.28% from the current price of $341.30. This GF Value represents the fair value at which the stock should ideally trade, derived from historical trading multiples, past business growth, and future performance estimates. For additional insights, investors are encouraged to explore the Sherwin-Williams Co (SHW) Summary page.