Blackstone (BX, Financial) has revealed a significant investment through Blackstone Growth and its associated funds in NetBrain Technologies, a leader in network automation and AI solutions. This strategic move values NetBrain at $750 million and aims to enhance the company's innovation capabilities, broaden its global reach, and scale its AI-driven platform to cater to the growing demand for automated network management solutions.

NetBrain is at the forefront of intent-based network automation, creating digital replicas of networks to facilitate AI in streamlining and automating numerous manual network operations tasks. As enterprise networks expand and increase in complexity with advancements like cloud computing and Software-Defined Networking (SDN), conventional automation tools struggle to provide efficient and measurable results. NetBrain's cutting-edge platform, developed in collaboration with leading network operators, reduces manual intervention in critical operations and security processes. By leveraging automation and AI, NetBrain is transforming traditional hybrid network management.

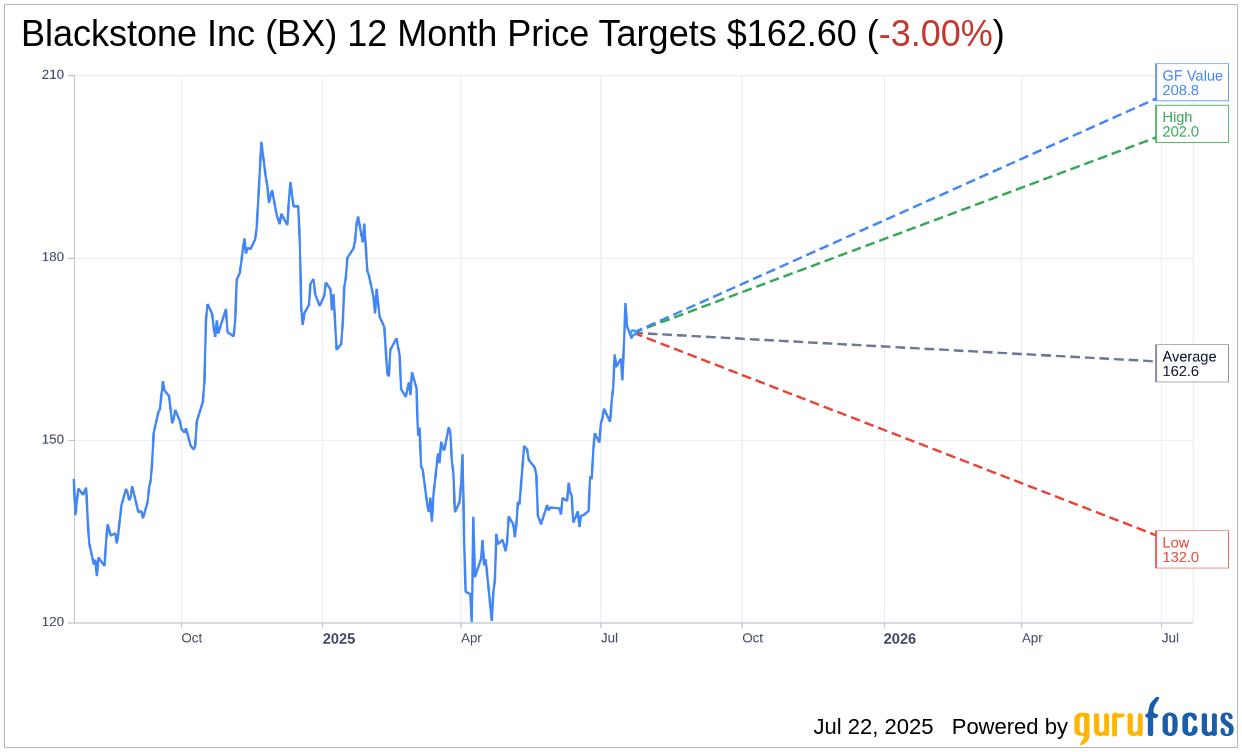

Wall Street Analysts Forecast

Based on the one-year price targets offered by 19 analysts, the average target price for Blackstone Inc (BX, Financial) is $162.60 with a high estimate of $202.00 and a low estimate of $132.00. The average target implies an downside of 3.00% from the current price of $167.63. More detailed estimate data can be found on the Blackstone Inc (BX) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Blackstone Inc's (BX, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Blackstone Inc (BX, Financial) in one year is $208.83, suggesting a upside of 24.58% from the current price of $167.63. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Blackstone Inc (BX) Summary page.