Key Takeaways:

- Target (TGT, Financial) will cease its price-matching policy with Amazon and Walmart on July 28.

- The company's new strategy aligns price matching only with Target's own outlets for 14 days post-purchase.

- Analysts provide a one-year average target price of $104.64, suggesting minimal downside from current levels.

Target Corp (TGT) has announced a significant change in its pricing strategy, set to take effect on July 28. This change involves ending its price-matching policy with major competitors Amazon and Walmart. Instead, Target will focus on matching prices from its own outlets, whether in-store or online, for up to 14 days post-purchase. Following this strategic shift, Target's stock experienced a 2.8% increase, reflecting investor optimism.

Wall Street Analysts Forecast

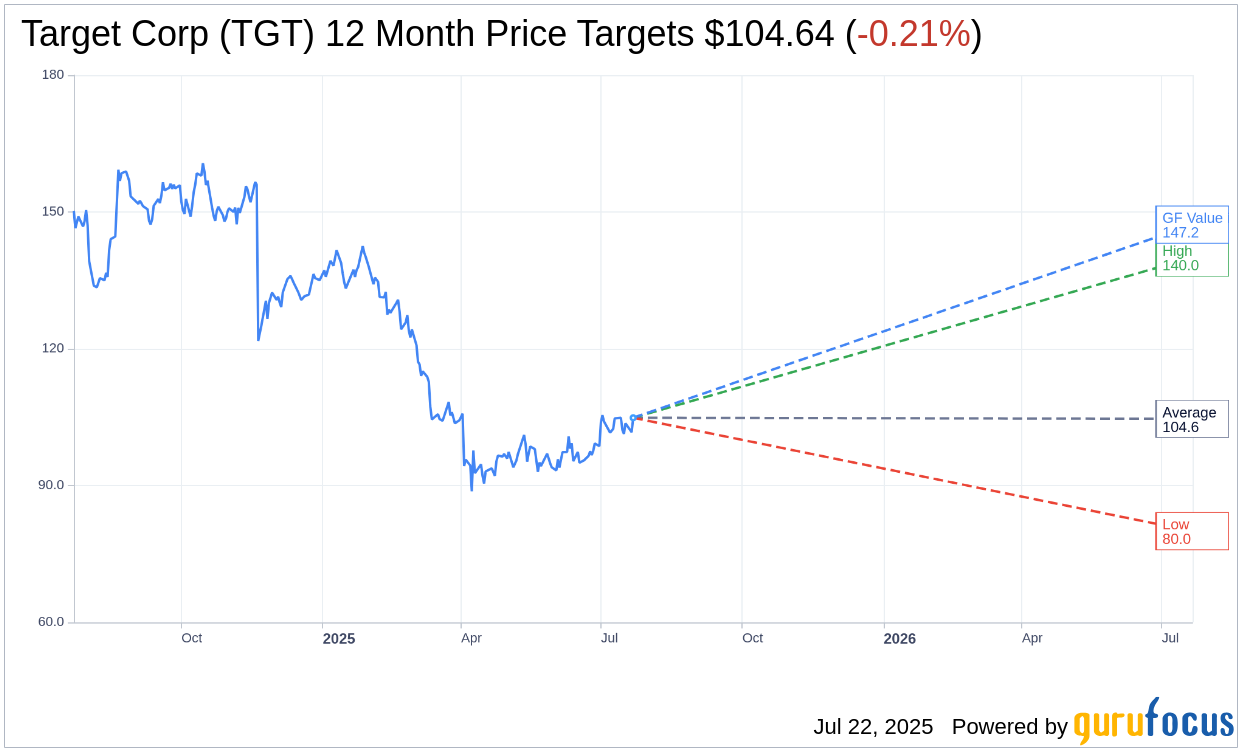

According to 30 analysts' one-year forecasts, the average target price for Target Corp (TGT, Financial) stands at $104.64, with high and low estimates of $140.00 and $80.00, respectively. This average target suggests a minor downside of 0.21% from the current price of $104.87. For further insights, visit the Target Corp (TGT) Forecast page.

The consensus recommendation from 38 brokerage firms rates Target Corp (TGT, Financial) at 2.7, indicating a "Hold" status. This rating operates on a scale from 1 to 5, where 1 represents a Strong Buy, and 5 signifies a Sell.

GuruFocus estimates show the GF Value for Target Corp (TGT, Financial) in one year at $147.21. This indicates a potential upside of 40.37% from the current trading price of $104.87. The GF Value is a calculation based on historical trading multiples and the company's anticipated growth and performance. More comprehensive data is available on the Target Corp (TGT) Summary page.