Canaccord Genuity has adjusted its price target for Scotiabank (BNS, Financial), raising it from C$81 to C$85. The firm continues to uphold a Buy rating on the bank's shares. This change reflects Canaccord's positive outlook on Scotiabank's potential performance in the market.

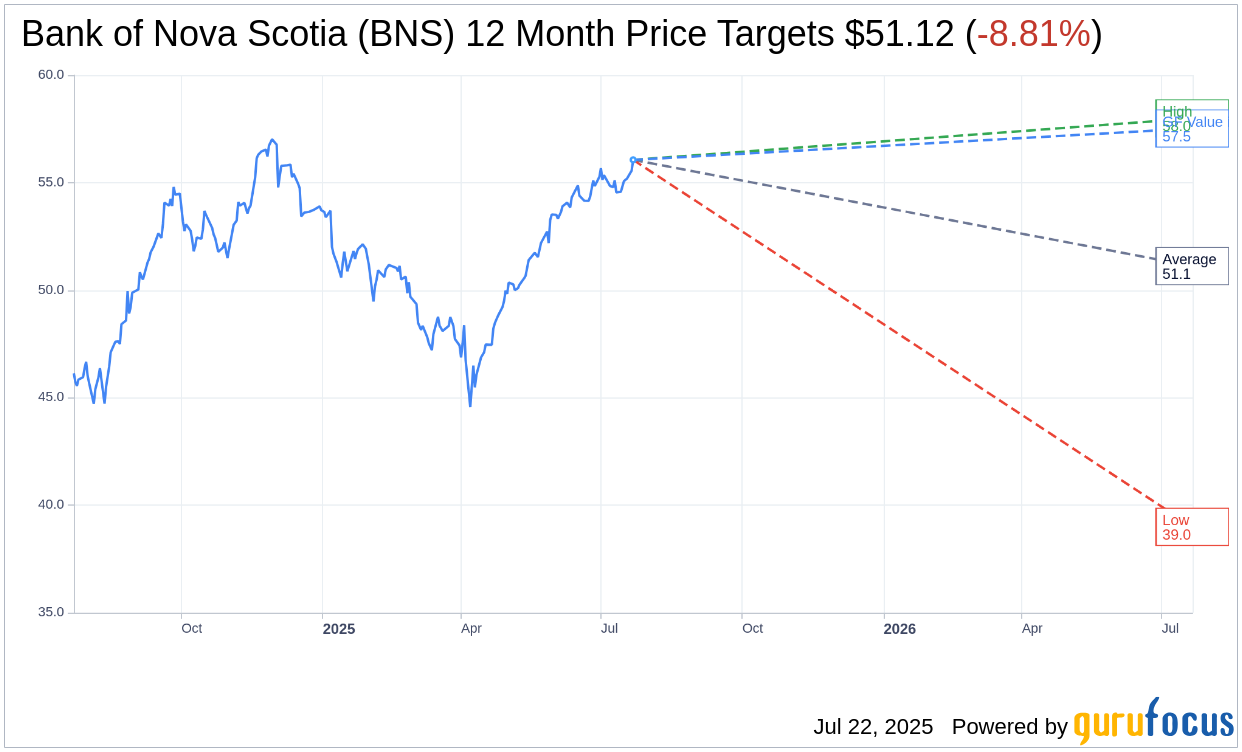

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Bank of Nova Scotia (BNS, Financial) is $51.12 with a high estimate of $57.99 and a low estimate of $38.99. The average target implies an downside of 8.81% from the current price of $56.06. More detailed estimate data can be found on the Bank of Nova Scotia (BNS) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Bank of Nova Scotia's (BNS, Financial) average brokerage recommendation is currently 3.7, indicating "Underperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Bank of Nova Scotia (BNS, Financial) in one year is $57.52, suggesting a upside of 2.6% from the current price of $56.06. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Bank of Nova Scotia (BNS) Summary page.

BNS Key Business Developments

Release Date: May 27, 2025

- Adjusted Earnings: $2.1 billion or $1.52 per share.

- CET1 Ratio: 13.2%, up 30 basis points quarter-over-quarter.

- Quarterly Dividend: Increased by $0.04 to $1.10 per share.

- Share Buyback Program: Launch of a program for 20 million shares.

- Loan-to-Deposit Ratio: Improved to 104%.

- Global Wealth Management Earnings: $405 million, up 17% year-over-year.

- Global Banking and Markets Earnings: $413 million.

- International Banking Earnings: $681 million.

- Net Interest Income Growth: 12% year-over-year.

- Noninterest Income: $3.8 billion, up 5% year-over-year.

- Provision for Credit Losses: Approximately $1.4 billion, PCL ratio of 75 basis points.

- Operating Leverage: Positive 2% year-to-date.

- Productivity Ratio: 55.7%, improved by 50 basis points year-over-year.

- Canadian Banking Earnings: $613 million, down 31% year-over-year.

- Global Banking and Markets Revenue Growth: 18% year-over-year.

- International Banking Net Interest Margin: Expanded by 4 basis points year-over-year.

- Allowance for Credit Losses: Cumulative build of $1.8 billion since the end of 2022.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Bank of Nova Scotia (BNS, Financial) delivered adjusted earnings of $2.1 billion or $1.52 per share, showcasing strong financial performance despite global economic uncertainty.

- The bank's CET1 ratio improved to 13.2%, up 30 basis points quarter-over-quarter, indicating a strong capital position.

- Global Wealth Management earnings increased by 17% year-over-year, driven by growth in asset management and advisory businesses.

- BNS announced a quarterly dividend increase by $0.04 to $1.10 per share and launched a share buyback program for 20 million shares, reflecting confidence in capital generation.

- The bank demonstrated strong expense discipline in International Banking, contributing to improved return on equity and lower impaired loan loss provisions.

Negative Points

- The provision for credit losses increased to approximately $1.4 billion, with a PCL ratio of 75 basis points, primarily due to higher performing loan provisions.

- Canadian Banking reported a 31% year-over-year decline in earnings, impacted by significant performing PCLs.

- Net interest margin in Canadian Banking declined by 4 basis points quarter-over-quarter and 14 basis points year-over-year due to deposit margin compression.

- The bank's return on equity was 10.4%, down 90 basis points year-over-year, primarily driven by higher performing PCLs.

- The outlook for loan growth remains cautious due to weaker consumer and business confidence, impacting near-term growth prospects.