In a recent development, Replimune Group (REPL, Financial) has experienced a notable shift in analyst sentiment. On July 22, 2025, analyst Robert Driscoll from Wedbush downgraded the company's rating from 'Outperform' to 'Neutral'. This change highlights a shift in the outlook for the company that investors might find noteworthy.

Accompanying the downgrade, Wedbush has significantly revised its price target for Replimune Group (REPL, Financial). The price target has been lowered from $19.00 to $4.00, representing a substantial decrease of approximately 78.95%. This adjustment underscores a reassessment of the company's potential in the current market environment.

The downgrade and lowered price target for Replimune Group (REPL, Financial) could influence investor sentiment and trading decisions. Investors and market watchers will likely keep a close eye on further developments regarding the company's strategies and performance moving forward.

Wall Street Analysts Forecast

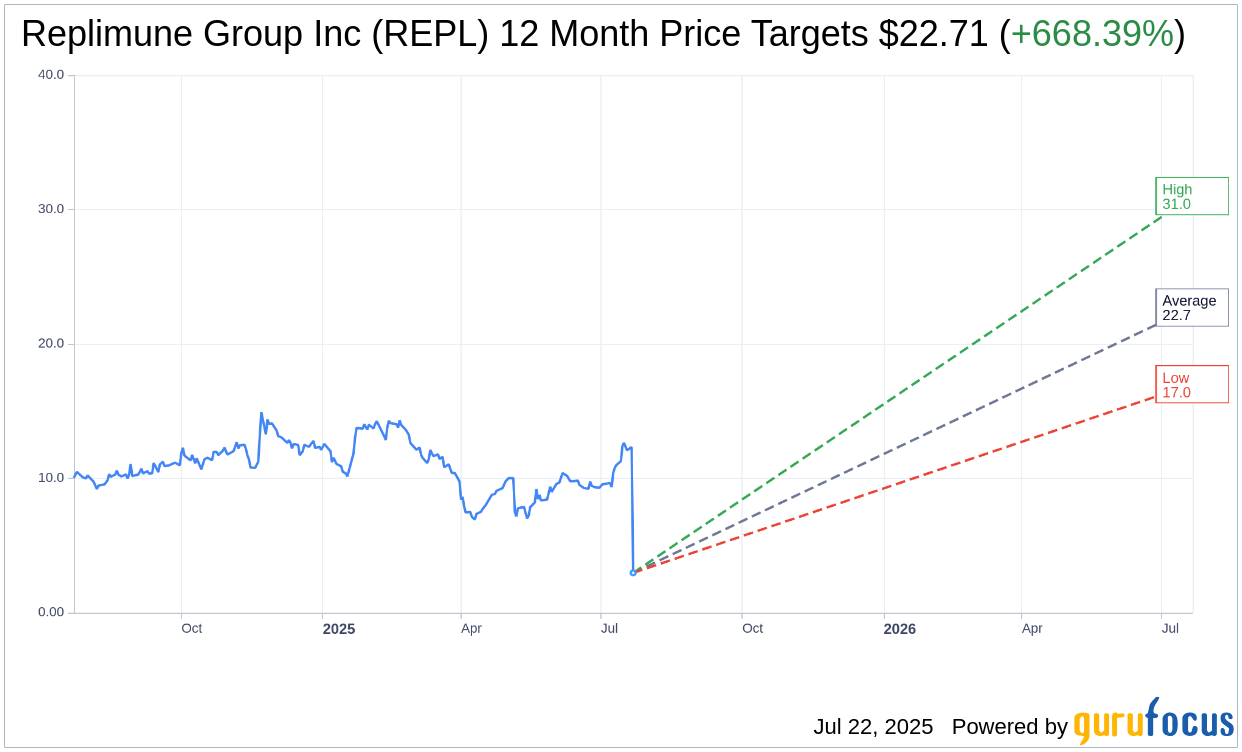

Based on the one-year price targets offered by 7 analysts, the average target price for Replimune Group Inc (REPL, Financial) is $22.71 with a high estimate of $31.00 and a low estimate of $17.00. The average target implies an upside of 668.39% from the current price of $2.96. More detailed estimate data can be found on the Replimune Group Inc (REPL) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Replimune Group Inc's (REPL, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.