Key Takeaways:

- Replimune's (REPL, Financial) shares plummeted 73% due to the FDA's rejection of its melanoma treatment.

- Contrasting fortunes were observed with Iovance Biotherapeutics (IOVA), which saw a 16% rise in shares after receiving approval for a comparable treatment.

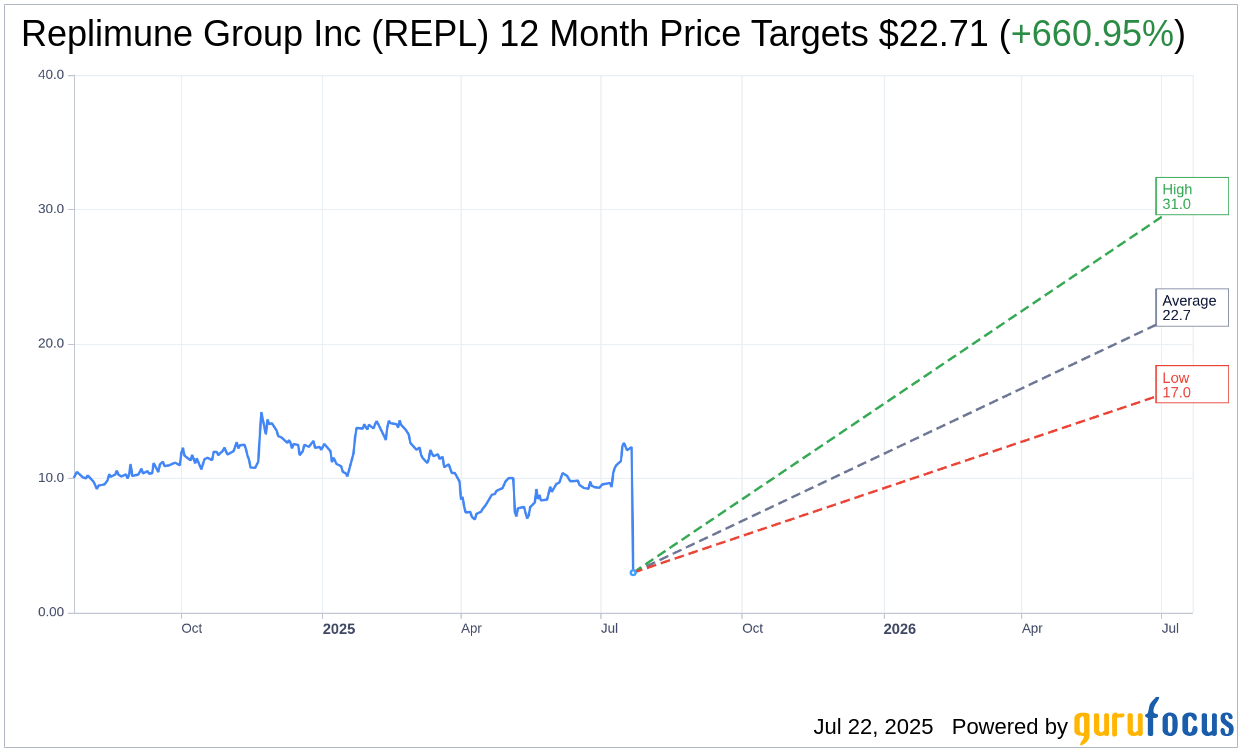

- Wall Street analysts still foresee significant potential upside for Replimune, with an average price target of $22.71.

Replimune Faces FDA Setback

In a dramatic turn of events, Replimune Group Inc. (REPL) experienced a sharp decline, with shares tumbling by approximately 73%. This steep drop followed the FDA's decision to reject its promising melanoma treatment, RP1. The rejection was attributed to the inadequacy of the IGNYTE trial data. In stark contrast, Iovance Biotherapeutics (IOVA) witnessed a surge of around 16% in its share price after its similar treatment secured regulatory approval.

Wall Street Analysts' Optimism

Despite recent challenges, Wall Street analysts maintain a positive outlook on Replimune Group Inc. (REPL, Financial). According to the one-year price targets provided by seven analysts, the average target price is set at $22.71. This represents a remarkable upside potential of 660.95% from the current price of $2.99. High and low estimates are pegged at $31.00 and $17.00, respectively. Investors seeking more detailed estimate data should visit the Replimune Group Inc (REPL) Forecast page.

Analyst Recommendations

Replimune's current consensus recommendation from nine brokerage firms stands at an average of 1.7, which indicates an "Outperform" rating. This rating system ranges from 1 to 5, where a score of 1 signifies a Strong Buy, and 5 denotes a Sell. This optimistic stance from analysts suggests confidence in Replimune's potential recovery and future growth prospects.