Quick Highlights:

- IBM's upcoming earnings announcement is eagerly anticipated, with EPS projected at $2.65.

- IBM's Power11 chips are poised to enhance AI operations, impacting its market position.

- Analysts offer diverse price targets ranging from $190.00 to $325.00.

International Business Machines Corp (IBM, Financial) is gearing up to unveil its second-quarter earnings on July 23. Analysts have projected the company's earnings per share (EPS) to be $2.65 with expected revenues of $16.59 billion. IBM's cutting-edge Power11 chips are anticipated to significantly boost AI operations, strengthening their foothold in the competitive tech industry.

Wall Street Analysts Forecast

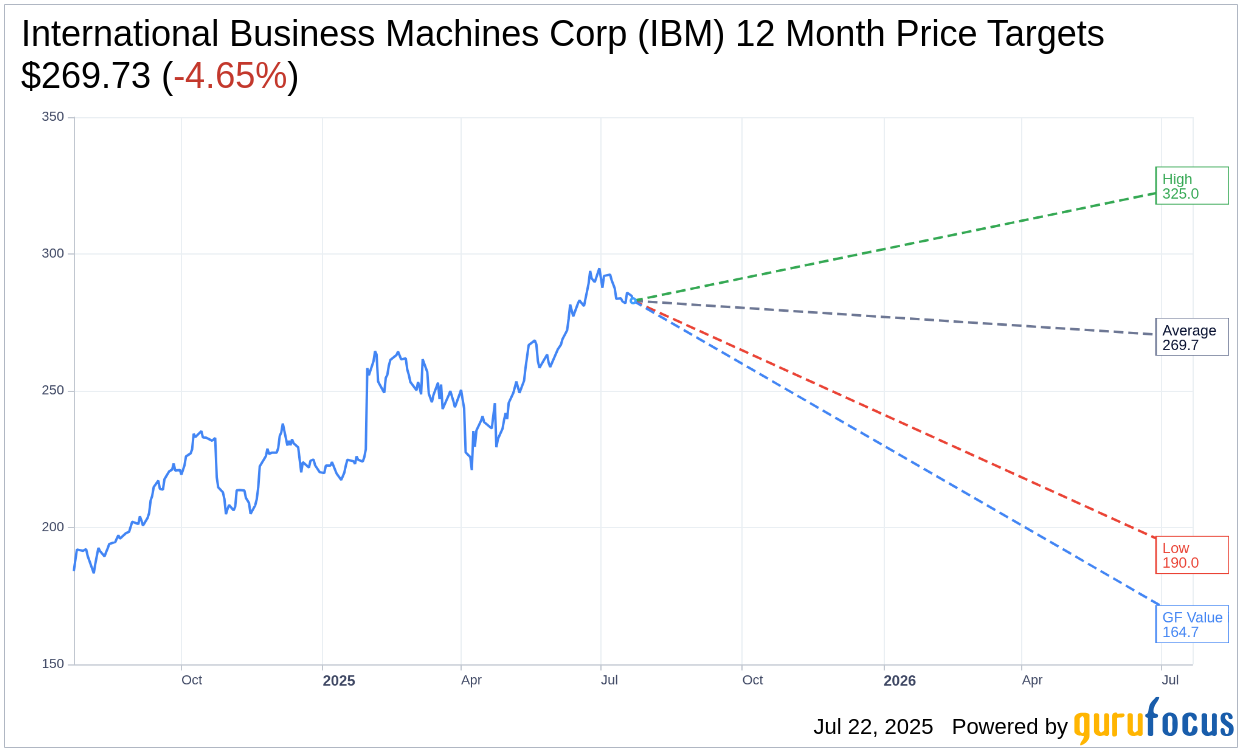

Market analysts have proposed diverse one-year price targets for IBM, with an average target price of $269.73. The projections vary, presenting a high estimate of $325.00 and a low estimate of $190.00. Notably, these projections imply a potential downside of 4.65% from IBM's current trading price of $282.90. For more comprehensive analysis, visit the International Business Machines Corp (IBM, Financial) Forecast page.

Consensus from 23 brokerage firms awards IBM an average brokerage recommendation score of 2.5, suggesting it is regarded as "Outperform." This rating utilizes a scale where 1 denotes a Strong Buy, while 5 indicates a Sell.

Understanding IBM's GF Value

According to GuruFocus estimates, IBM's GF Value is projected at $164.72 for the coming year. This represents a potential downside of 41.77% from its current price of $282.895. GF Value is GuruFocus’ intrinsic value estimate, calculated by considering IBM’s historical trading multiples, past business growth, and future performance forecasts. For more detailed insights, explore the International Business Machines Corp (IBM, Financial) Summary page.