In a recent development, Replimune Group (REPL, Financial) has been downgraded by JP Morgan analyst Anupam Rama. The downgrade reflects a change from an "Overweight" rating to a "Neutral" position. This adjustment highlights a shift in the analyst's outlook for the company's stock performance.

The downgrade is accompanied by a significant reduction in the price target for Replimune Group (REPL, Financial). The previous price target was set at USD 19.00, but it has now been lowered to USD 9.00. This represents a substantial 52.63% decrease from the prior estimate, indicating a more cautious stance on the stock's potential future value.

Investors may need to reassess their positions in Replimune Group (REPL, Financial) following this adjustment by JP Morgan. The new price target and rating suggest a more tempered view of the company's growth prospects in the current market environment.

The changes were officially reported on July 22, 2025, and reflect the analyst's latest evaluation of Replimune Group's performance and market conditions.

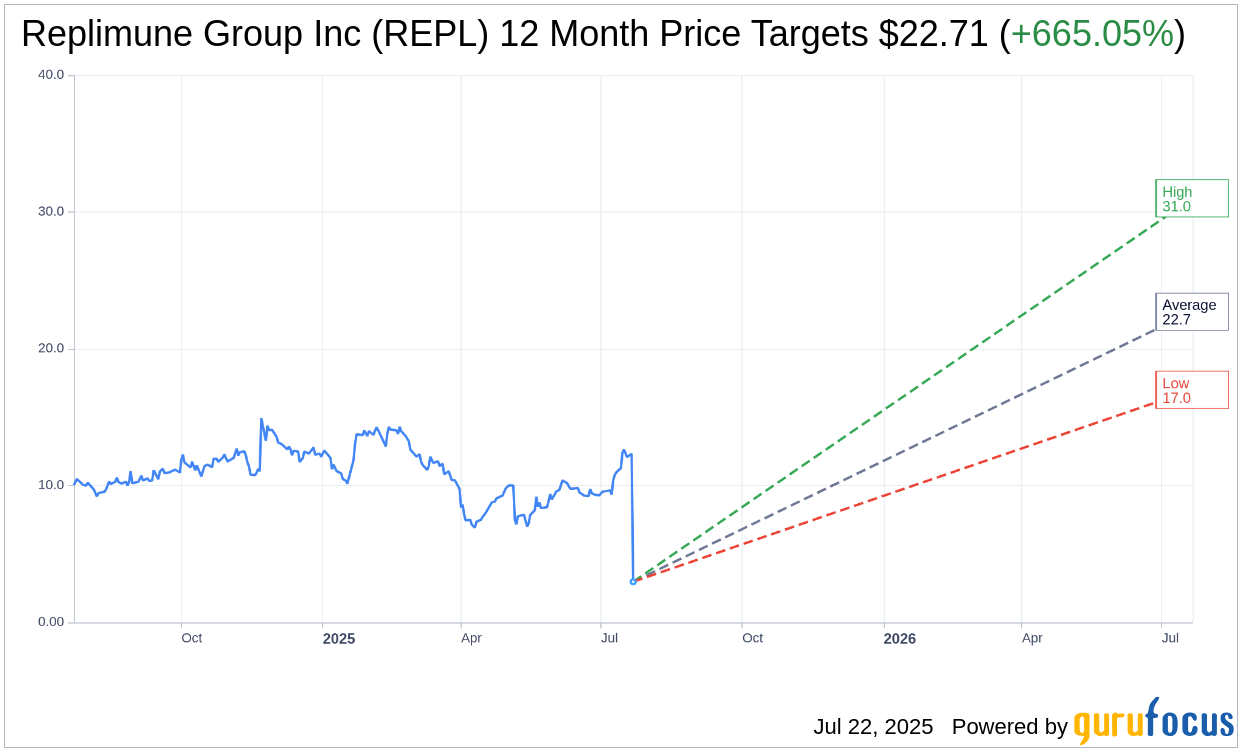

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Replimune Group Inc (REPL, Financial) is $22.71 with a high estimate of $31.00 and a low estimate of $17.00. The average target implies an upside of 665.05% from the current price of $2.97. More detailed estimate data can be found on the Replimune Group Inc (REPL) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Replimune Group Inc's (REPL, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.