Citi has revised its price target for BBVA (BBVA, Financial), raising it to EUR 15.10 from the previous EUR 13.80. The firm continues to recommend a Buy rating for the stock, indicating positive sentiment towards its potential performance.

Wall Street Analysts Forecast

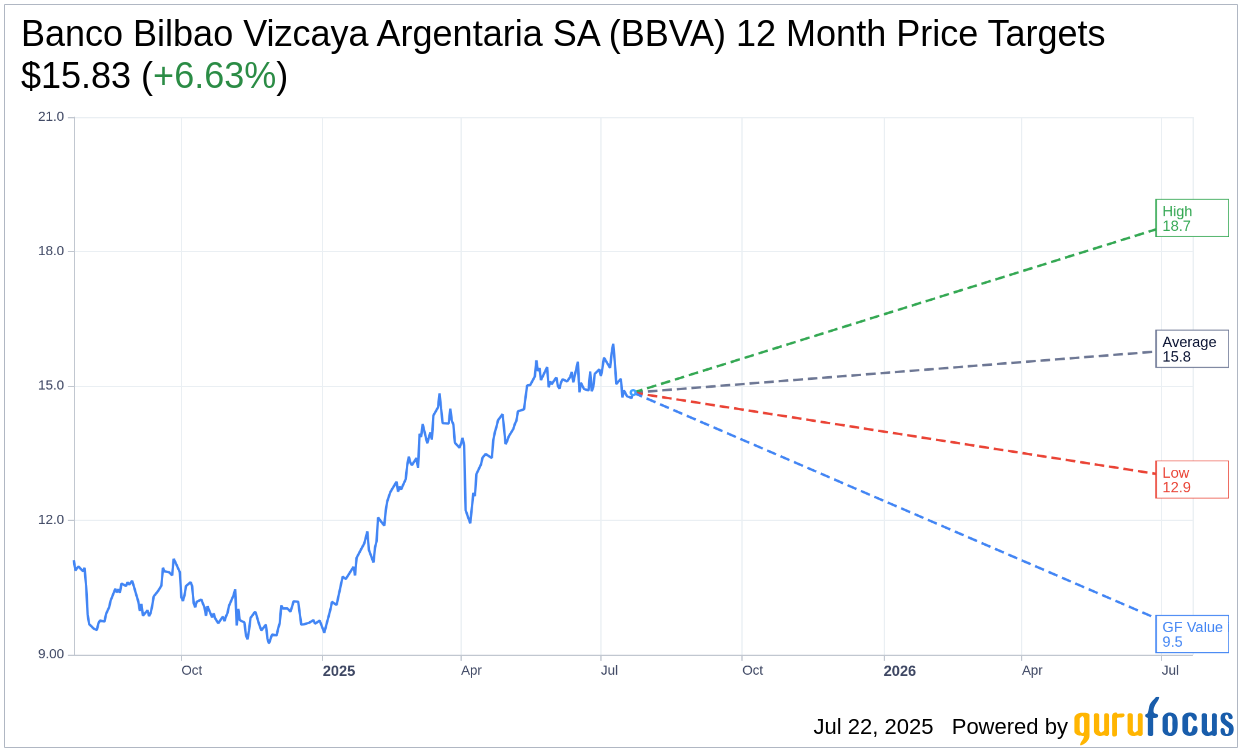

Based on the one-year price targets offered by 2 analysts, the average target price for Banco Bilbao Vizcaya Argentaria SA (BBVA, Financial) is $15.83 with a high estimate of $18.75 and a low estimate of $12.91. The average target implies an upside of 6.63% from the current price of $14.85. More detailed estimate data can be found on the Banco Bilbao Vizcaya Argentaria SA (BBVA) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Banco Bilbao Vizcaya Argentaria SA's (BBVA, Financial) average brokerage recommendation is currently 1.0, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Banco Bilbao Vizcaya Argentaria SA (BBVA, Financial) in one year is $9.46, suggesting a downside of 36.27% from the current price of $14.845. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Banco Bilbao Vizcaya Argentaria SA (BBVA) Summary page.

BBVA Key Business Developments

Release Date: April 29, 2025

- Tangible Book Value Growth: Increased by 14.1% year over year and 3.3% in the quarter.

- Return on Tangible Equity: 20.2% for the first quarter of 2025.

- Return on Equity: 19.3% for the first quarter of 2025.

- Net Attributable Profit: EUR 2,698 million, a 23% increase year over year and 10.9% higher than the previous quarter.

- Earnings Per Share: EUR 0.45, a 24% increase year over year.

- CET1 Fully Loaded Capital Ratio: Improved by 21 basis points to 13.09%.

- Net Interest Income Growth: 8.5% year over year.

- Net Fees and Commissions Growth: 19% year over year.

- Efficiency Ratio: Improved to 38.2%.

- Cost of Risk: 130 basis points.

- New Customer Acquisition: 2.9 million new customers in the first quarter.

- Loan Growth: 15.1% year over year at the group level.

- Spain Loan Growth: 6.6% year over year.

- Mexico Loan Growth: 17.2% year over year.

- Gross Income Growth: 28% year over year in constant terms.

- Asset Quality: NPL ratio at 2.9% and coverage ratio at 82%.

- Turkey Net Profit: EUR 158 million, a 10% increase year over year.

- South America Net Profit: Exceeded EUR 200 million in the first quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Banco Bilbao Vizcaya Argentaria SA (BBVA, Financial) reported a strong increase in tangible book value per share plus dividends, up 14.1% year over year.

- The bank achieved an outstanding return on tangible equity of 20.2% and return on equity of 19.3%, positioning it as one of the most profitable European banks.

- Net attributable profit for the quarter reached EUR 2,698 million, a 23% increase compared to the same quarter last year.

- Net interest income grew by 8.5% year-over-year, driven by strong business activity and a 15.1% growth in activity.

- BBVA attracted a record 2.9 million new customers in the quarter, with 66% joining through digital channels.

Negative Points

- The bank experienced a significant impact from currency depreciations, affecting financial metrics.

- There is uncertainty regarding the macroeconomic environment, particularly due to global trade tensions and tariff discussions.

- In Turkey, the bank expects net profit to be somewhat lower than EUR 1 billion due to higher-than-anticipated inflation and interest rates.

- The cost of risk in Turkey was slightly above the full-year guidance, reflecting higher provisioning needs in the retail segment.

- Despite strong performance, BBVA remains cautious about upgrading guidance for loan growth in Mexico due to economic uncertainties.