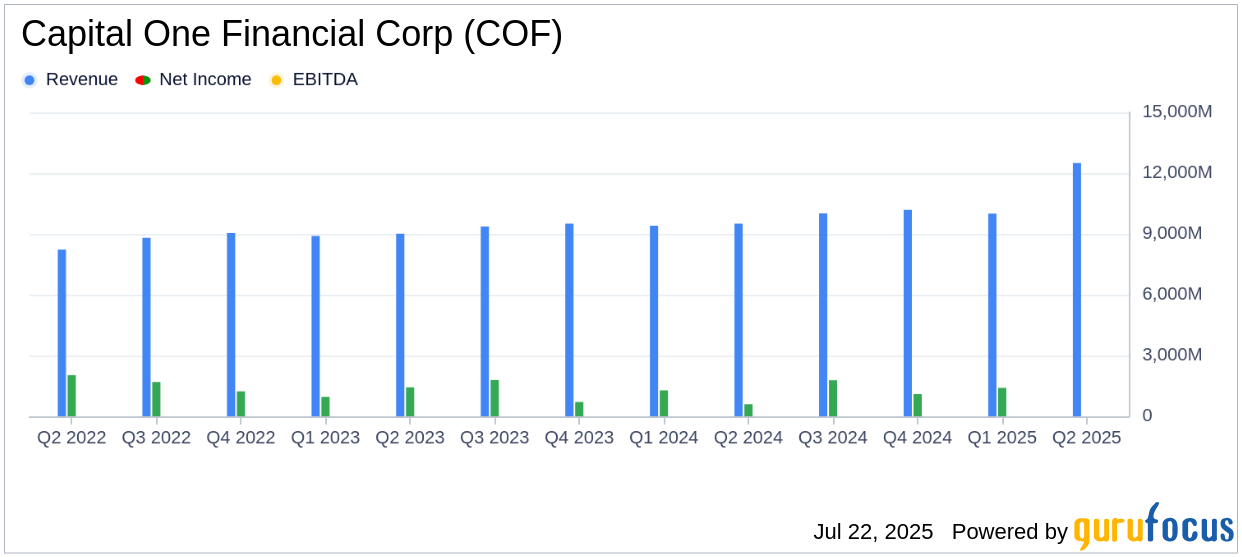

On July 22, 2025, Capital One Financial Corp (COF, Financial) released its 8-K filing, revealing a net loss of $4.3 billion, or $(8.58) per share, for the second quarter of 2025. This result significantly underperformed compared to the analyst estimate of -$6.59 per share. The company's revenue for the quarter was $12.5 billion, slightly below the estimated $12,554.50 million. Capital One, headquartered in McLean, Virginia, is a diversified financial services holding company primarily involved in credit card lending, auto loans, and commercial lending. The recent acquisition of Discover has expanded its personal loan business.

Performance and Challenges

Capital One's performance in the second quarter of 2025 was marked by a substantial net loss, contrasting with a net income of $1.4 billion in the previous quarter and $597 million in the same quarter last year. The acquisition of Discover on May 18, 2025, played a significant role in this financial outcome. The integration of Discover has led to various adjusting items, including an initial allowance build for Discover non-PCD loans amounting to $8.767 billion, which impacted the diluted EPS by $13.04. Additionally, integration expenses and intangible amortization further contributed to the financial challenges.

Financial Achievements and Industry Importance

Despite the net loss, Capital One achieved a 25% increase in total net revenue, reaching $12.5 billion. This growth is crucial for a company in the credit services industry, as it reflects the ability to generate income amidst integration challenges. The company's net interest margin improved to 7.62%, an increase of 69 basis points, indicating efficient management of interest-earning assets.

Key Financial Metrics

The income statement highlights a 34% increase in pre-provision earnings to $5.5 billion, although the provision for credit losses surged by $9.1 billion to $11.4 billion. The balance sheet shows a 36% increase in period-end loans held for investment, totaling $439.3 billion, with credit card loans experiencing a significant 72% rise. The common equity Tier 1 capital ratio stood at 14.0% under the Basel III Standardized Approach, reflecting a strong capital position.

| Metric | Q2 2025 | Q1 2025 | Q2 2024 |

|---|---|---|---|

| Net Income (Loss) | $(4.3) billion | $1.4 billion | $597 million |

| Diluted EPS | $(8.58) | $3.45 | $1.38 |

| Total Net Revenue | $12.5 billion | - | - |

Analysis and Commentary

The acquisition of Discover has undoubtedly posed integration challenges, impacting Capital One's financial performance. However, the strategic move is expected to provide long-term growth opportunities. Richard D. Fairbank, Founder, Chairman, and CEO, stated,

We’re fully mobilized and hard at work on integration which is going well. We’re as excited as ever by the expanding set of opportunities to grow and create value as a combined company."This optimism suggests potential future benefits from the acquisition, despite the current financial setbacks.

Overall, while Capital One's second-quarter results fell short of expectations, the company's strategic initiatives and strong capital position may pave the way for future growth and stability in the competitive credit services industry.

Explore the complete 8-K earnings release (here) from Capital One Financial Corp for further details.