The recent financial results for PMT show a rise in net interest income to $2.1 million, an increase from $1.4 million in the previous quarter. The interest income improved to $21.0 million from the earlier $19.5 million, while interest expenses increased slightly from $18.1 million to $18.8 million.

However, the book value per common share has seen a slight decline, dropping to $15.00 as of June 30, 2025, down from $15.43 at the end of the previous quarter. Despite these fluctuations, the company reported solid income levels, although these were impacted by net fair value declines attributed to volatile interest rates and a one-time tax adjustment.

During this period, PMT strategically issued $105 million in unsecured senior notes, reinforcing its robust market access while also enhancing its balance sheet and debt maturity timeline. Additionally, PMT has established itself as a significant player in private label securitizations, executing deals totaling $1.4 billion in UPB with over $150 million in retained investments at favorable returns. This activity underscores PMT's commitment to diversifying and expanding its credit-sensitive investments, showcasing its adaptability to the dynamic mortgage market.

Wall Street Analysts Forecast

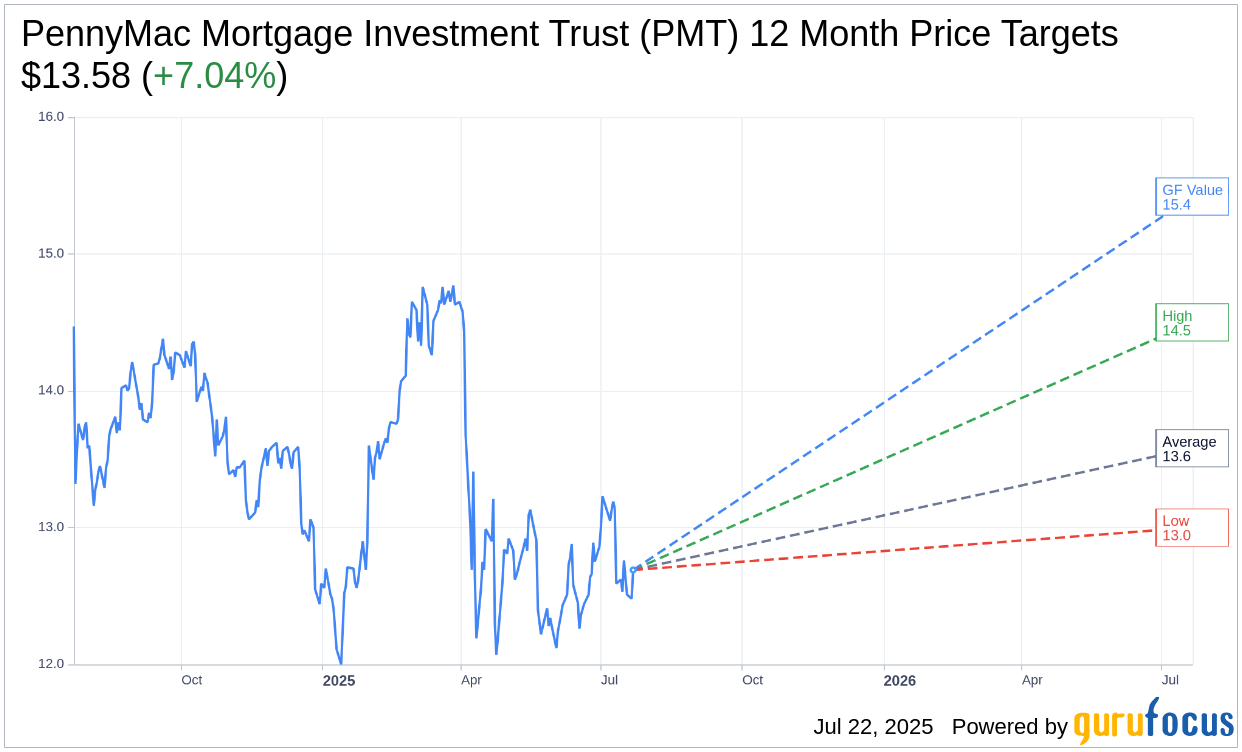

Based on the one-year price targets offered by 6 analysts, the average target price for PennyMac Mortgage Investment Trust (PMT, Financial) is $13.58 with a high estimate of $14.50 and a low estimate of $13.00. The average target implies an upside of 7.04% from the current price of $12.69. More detailed estimate data can be found on the PennyMac Mortgage Investment Trust (PMT) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, PennyMac Mortgage Investment Trust's (PMT, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for PennyMac Mortgage Investment Trust (PMT, Financial) in one year is $15.42, suggesting a upside of 21.51% from the current price of $12.69. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the PennyMac Mortgage Investment Trust (PMT) Summary page.

PMT Key Business Developments

Release Date: April 22, 2025

- Net Loss: $1 million net loss to common shareholders for Q1 2025.

- Earnings Per Share: Negative $0.01 diluted EPS.

- Dividend: $0.40 per share declared for Q1.

- Book Value Per Share: $15.43 as of March 31, down from December 31.

- MSR Fair Value: $3.8 billion at the end of Q1.

- Correspondent Loan Acquisition Volume: $23 billion in Q1, down 18% from the prior quarter.

- Correspondent Loans for PMT's Account: $3 billion, down 20% from the prior quarter.

- Net Income Excluding Market-Driven Changes: $41 million, down from $51 million in the prior quarter.

- Run Rate Return Potential: Quarterly average of $0.35 per share, down from $0.37 per share in the prior quarter.

- Unsecured Senior Notes Issued: $173 million due in 2030.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- PennyMac Mortgage Investment Trust (PMT, Financial) declared a first quarter common dividend of $0.40 per share, demonstrating a commitment to returning value to shareholders.

- The company's diversified investment portfolio and strong risk management practices, including a well-established interest rate hedging program, have enabled it to manage through challenging market conditions effectively.

- PMT's synergistic relationship with PFSI provides competitive advantages, such as access to a large and agile multichannel origination business and the ability to execute private label securitizations.

- The company successfully completed three securitizations of investor loans totaling $1 billion, retaining $94 million in new investments with expected returns on equity in the mid-teens.

- PMT's MSR investments, which account for approximately half of its deployed equity, are expected to continue producing stable cash flows due to low expected prepayments and a higher interest rate environment.

Negative Points

- PMT reported a net loss to common shareholders of $1 million in the first quarter, or negative $0.01 per diluted common share, primarily due to interest rate volatility and credit spread widening.

- The interest rate sensitive strategies contributed a pretax loss of $5 million, with fair value declines on MSR investments amounting to $56 million.

- Total correspondent loan acquisition volume was $23 billion in the first quarter, down 18% from the prior quarter, reflecting a decline in the size of the origination market.

- The company's book value per share decreased by about 2% to 3% since the end of the quarter due to higher hedge costs, interest rate volatility, and spread widening.

- PMT's run rate return potential reflects a quarterly average of $0.35 per share, down from $0.37 per share in the prior quarter, due to compression between longer-dated asset yields and short-term financing rates.