Barclays has lowered its rating on Replimune (REPL, Financial) from Overweight to Equal Weight, significantly adjusting the price target from $17 to $3. This shift follows a complete response letter concerning Replimune’s RP1, which has introduced considerable uncertainty regarding its main and future projects. The analyst notes that the same underlying technology is deployed across many of Replimune's offerings, creating broader implications for the company's prospects.

Furthermore, Barclays has decreased the anticipated success probability for RP1 and RP2, while also delaying their potential market introduction by three years. This development has prompted a reassessment of Replimune's trajectory amidst the challenges posed by these setbacks.

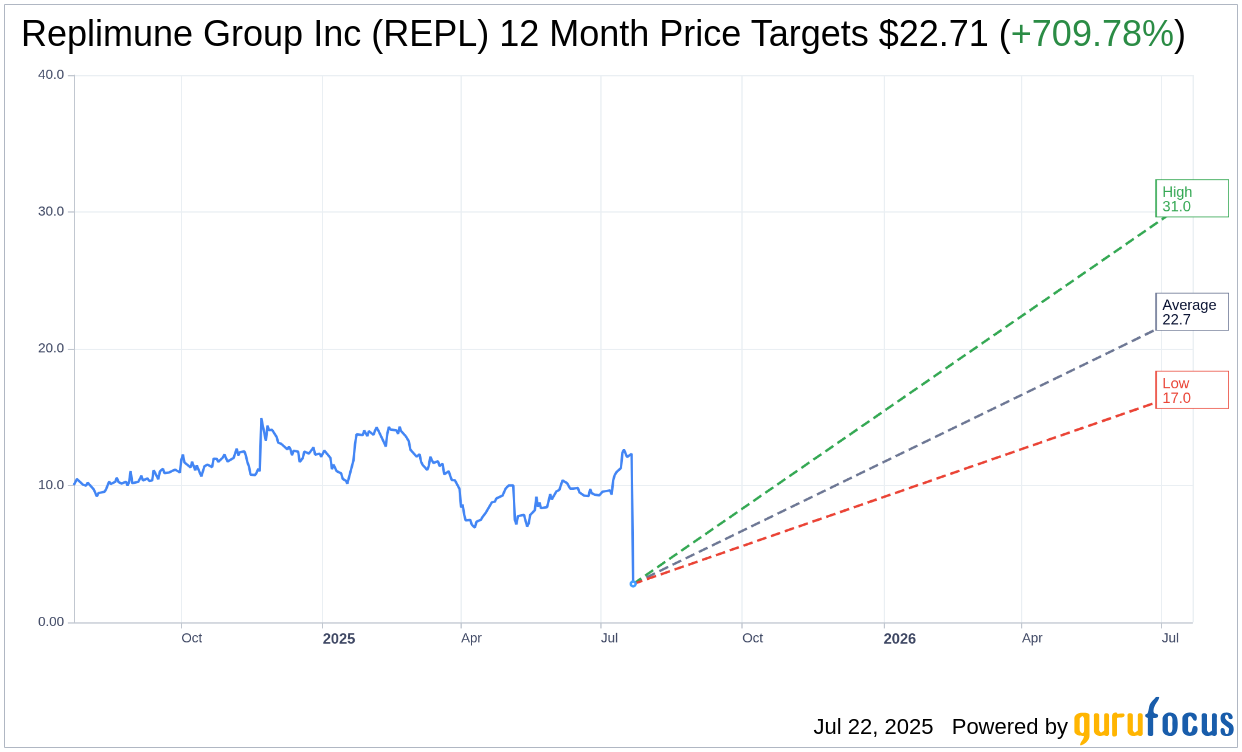

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Replimune Group Inc (REPL, Financial) is $22.71 with a high estimate of $31.00 and a low estimate of $17.00. The average target implies an upside of 709.78% from the current price of $2.81. More detailed estimate data can be found on the Replimune Group Inc (REPL) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Replimune Group Inc's (REPL, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

REPL Key Business Developments

Release Date: May 22, 2025

- Cash and Cash Equivalents: $483.8 million as of March 31, 2025.

- Research and Development Expenses: $54 million for Q4 2025; $189.4 million for the fiscal year ended March 31, 2025.

- Selling, General and Administrative Expenses: $25.4 million for Q4 2025; $72.2 million for the fiscal year ended March 31, 2025.

- Net Loss: $74.1 million for Q4 2025; $247.3 million for the fiscal year ended March 31, 2025.

- Cash Runway: Expected to fund operations into Q4 2026.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Replimune Group Inc (REPL, Financial) is on track for the potential approval and launch of RP1, with a PDUFA date set for July 22, 2025.

- The company has made significant regulatory progress, including recognition of RP1 as a breakthrough therapy with priority review.

- Replimune's US manufacturing facility is prepared to support the RP1 launch with commercial inventory and capacity for long-term global demand.

- The IGNYTE study data shows that approximately one-third of patients achieve durable responses in a high unmet need setting.

- Replimune is well-capitalized, with cash and cash equivalents totaling $483.8 million, expected to fund operations into the fourth quarter of 2026.

Negative Points

- Replimune Group Inc (REPL) reported a net loss of $74.1 million for the fiscal fourth quarter and $247.3 million for the fiscal year ended March 31, 2025.

- Research and development expenses increased to $54 million for the fiscal fourth quarter, reflecting higher personnel-related and facility costs.

- The company's selling, general, and administrative expenses rose to $25.4 million for the fiscal fourth quarter, indicating increased operational costs.

- The IGNYTE-3 confirmatory trial is expected to take a couple of years to complete enrollment, potentially delaying further validation of RP1.

- Despite regulatory progress, the company faces challenges in ensuring broad and rapid adoption of RP1 across diverse healthcare settings.