On July 22, 2025, Matador Resources Co (MTDR, Financial) released its 8-K filing detailing its financial and operational results for the second quarter of 2025. Matador Resources Co, an independent energy company, focuses on the exploration, development, production, and acquisition of oil and natural gas resources, primarily in the United States. The company operates in two segments: exploration and production, and midstream.

Record Production and Financial Highlights

Matador Resources Co reported a record quarterly production of 209,013 barrels of oil and natural gas equivalent per day (BOE/d), surpassing its guidance range. This includes 122,875 barrels of oil per day (Bbl/d). The company's integrated upstream and midstream business generated net cash provided by operating activities of $501 million and adjusted free cash flow of $133 million, showcasing an industry-leading free cash flow margin.

San Mateo Midstream, a subsidiary of Matador, increased its processing capacity by 38% to 720 million cubic feet of natural gas per day (MMcf/d) with the startup of the Marlan Plant expansion. This contributed to a record quarterly net income of $66 million and Adjusted EBITDA of $85.5 million for San Mateo.

Financial Achievements and Metrics

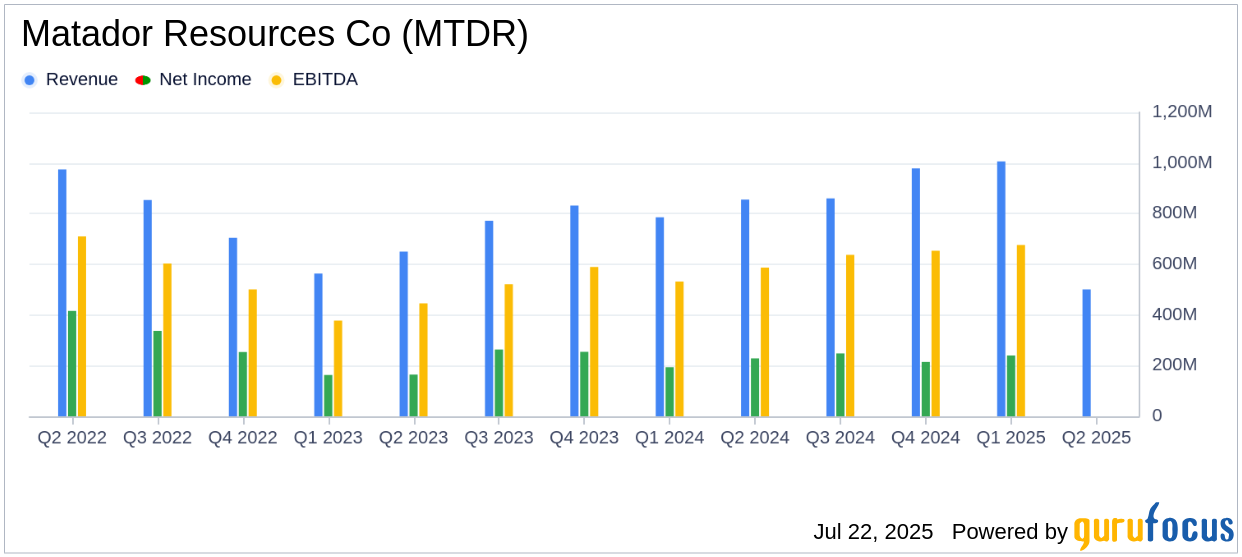

Matador Resources Co achieved a net income of $150 million and Adjusted EBITDA of $594 million for the second quarter. The company maintained a resilient balance sheet with over $1.8 billion of liquidity and a leverage ratio of less than 1.0x as of June 30, 2025. The company declared a quarterly base dividend of $0.3125 per share, representing an annualized yield of approximately 2.5%.

Operational Efficiency and Cost Management

Matador demonstrated operational efficiency with drilling and completions costs of approximately $825 per completed lateral foot and lease operating expenses of $5.56 per BOE. The company also repurchased 1.1 million shares of its common stock at an average price of $40.37 per share, compared to the current share price of $49.86 per share as of July 21, 2025.

Guidance and Future Outlook

Matador increased its full-year 2025 guidance range for total daily production from 198,000 – 202,000 BOE/d to 200,000 – 205,000 BOE/d, reflecting improved capital efficiency. The company plans to continue its strategic focus on operational improvements and capital allocation to enhance shareholder value.

Joseph Wm. Foran, Matador’s Founder, Chairman and CEO, commented, “Matador is pleased to report our second quarter where we achieved record production alongside robust free cash flow. Throughout Matador’s 40-year history, we have consistently pursued long-term value creation for our shareholders through prudent capital allocation, just as we continue to do today, so that our oil and natural gas production and our free cash flow can grow in tandem.”

Analysis and Conclusion

Matador Resources Co's strong performance in the second quarter of 2025, marked by record production and robust financial metrics, underscores its operational efficiency and strategic focus on shareholder value. The company's ability to surpass production guidance and maintain a strong balance sheet positions it well for future growth in the volatile oil and gas industry. Value investors may find Matador's disciplined capital allocation and focus on free cash flow generation particularly appealing.

Explore the complete 8-K earnings release (here) from Matador Resources Co for further details.