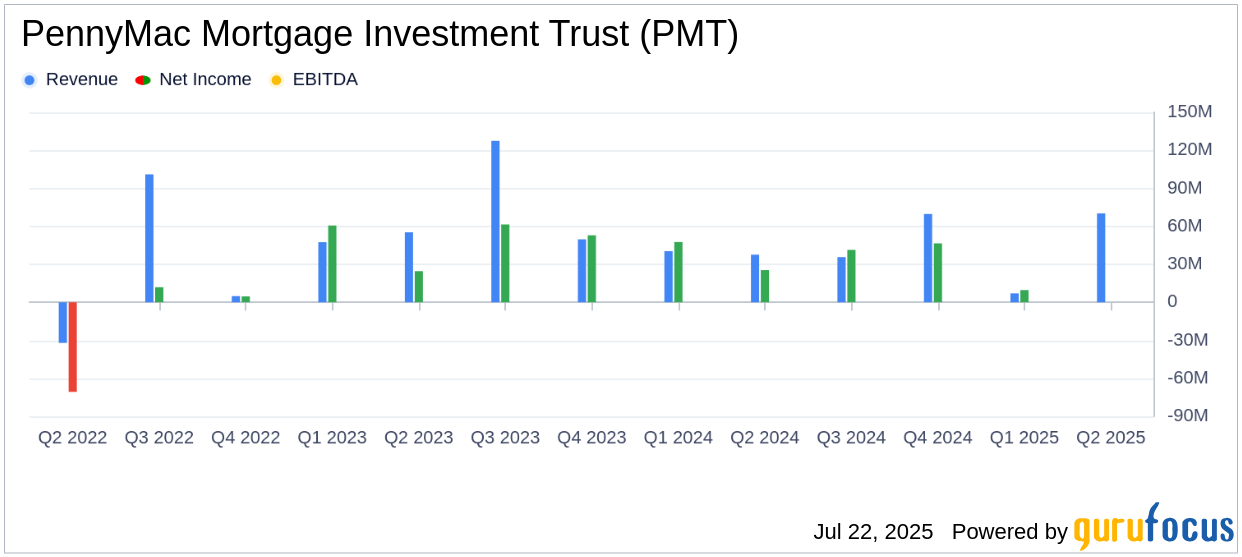

PennyMac Mortgage Investment Trust (PMT, Financial) released its 8-K filing on July 22, 2025, reporting a net loss attributable to common shareholders of $2.9 million, or $(0.04) per common share for the second quarter of 2025. This performance was below the analyst estimate of $0.36 earnings per share. The company also reported net investment income of $70.2 million, which fell short of the estimated revenue of $94.28 million.

PennyMac Mortgage Investment Trust is a specialty finance company that invests primarily in residential mortgage loans and mortgage-related assets. The company's operations include the production and servicing of financial securities based on residential loans and the pooling and reselling of high-credit-quality mortgages. PMT operates through three segments: correspondent production, credit-sensitive strategies, and interest-rate-sensitive strategies.

Performance and Challenges

PMT's second-quarter performance was impacted by market-driven value changes and a non-recurring tax expense of $14.0 million due to state apportionment changes. The company's book value per common share decreased to $15.00 from $15.43 at the end of the previous quarter. Despite these challenges, PMT maintained solid levels of income excluding market-driven value changes.

“PMT produced solid levels of income excluding market-driven value changes in the second quarter,” said Chairman and CEO David Spector. “This positive core performance was offset by net fair value declines due to interest rate volatility as well as a non-recurring tax adjustment.”

Financial Achievements

PMT demonstrated strong access to capital markets by issuing $105 million in unsecured senior notes, which strengthened its balance sheet and extended its debt maturity profile. The company also executed four private label securitizations totaling $1.4 billion in unpaid principal balance (UPB), with retained investments of more than $150 million at attractive returns. These achievements are crucial for a mortgage REIT like PMT, as they enhance liquidity and investment diversification.

Segment Performance

The Credit Sensitive Strategies segment reported pretax income of $21.8 million on net investment income of $21.9 million, a significant improvement from the prior quarter. This was driven by net gains on investments, particularly PMT's organically-created GSE CRT investments, which saw net gains of $20.3 million.

The Interest Rate Sensitive Strategies segment experienced a pretax loss of $4.9 million on net investment income of $20.7 million. This segment's performance was affected by extreme rate volatility, impacting hedging activities and fair value exposures.

The Correspondent Production segment generated pretax income of $13.7 million, up from $10.1 million in the prior quarter. PMT acquired $29.8 billion in UPB of loans, marking a 30% increase from the previous quarter, highlighting the segment's growth and contribution to PMT's overall performance.

Financial Statements and Metrics

PMT's consolidated balance sheets and statements of operations provide insights into its financial health. Key metrics such as net interest income, segment revenues, and expenses are critical for assessing the company's operational efficiency and profitability.

| Segment | Pretax Income | Net Investment Income |

|---|---|---|

| Credit Sensitive Strategies | $21.8 million | $21.9 million |

| Interest Rate Sensitive Strategies | $(4.9) million | $20.7 million |

| Correspondent Production | $13.7 million | $26.9 million |

Analysis and Outlook

PMT's second-quarter results reflect the challenges posed by interest rate volatility and legislative changes affecting tax expenses. While the company missed analyst estimates, its strategic initiatives in capital markets and securitizations demonstrate resilience and adaptability. The ongoing relationship with PennyMac Financial Services, Inc. (PFSI) provides PMT with a competitive edge through access to technology and a high-quality loan pipeline.

As PMT navigates the evolving mortgage landscape, its focus on diversifying credit-sensitive investments and managing interest rate exposures will be crucial for future performance. Investors and stakeholders will closely monitor PMT's ability to leverage its strategic advantages and mitigate market uncertainties.

Explore the complete 8-K earnings release (here) from PennyMac Mortgage Investment Trust for further details.