- ARMOUR Residential REIT (ARR, Financial) maintains its monthly dividend of $0.24, yielding 17.27%.

- Analysts set an average one-year price target of $17.33, indicating a potential 3.92% upside.

- Current brokerage consensus rates ARR as a "Hold" with a score of 2.7 on a 1-5 scale.

ARMOUR Residential REIT (ARR) continues to attract investor attention with its stable dividend policy and high yield. The company has announced a monthly dividend of $0.24 per share, keeping its previous payout rate intact. This consistency translates to a substantial forward yield of 17.27%. Shareholders registered by August 15 will receive the dividend, which will be distributed on August 29. The ex-dividend date is also set for August 15, aligning with the record date.

Wall Street Projections for ARMOUR Residential REIT

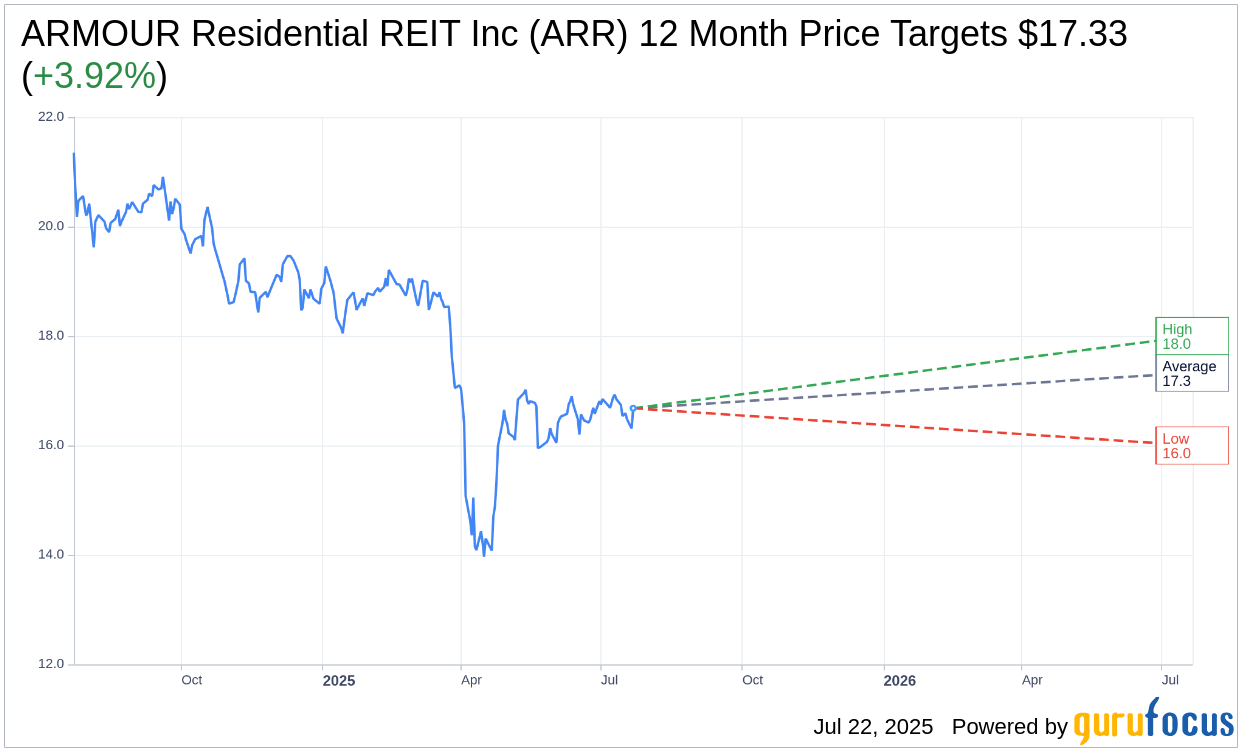

When assessing the outlook for ARMOUR Residential REIT Inc (ARR, Financial), analysts have provided a variety of price targets for the year ahead. The average target price among three analysts is $17.33, with expectations ranging between a high of $18.00 and a low of $16.00. This average projection suggests a potential upside of 3.92% from the current trading price of $16.68. Investors seeking in-depth forecast data can explore more on the ARMOUR Residential REIT Inc (ARR) Forecast page.

Brokerage Firm Recommendations

According to consensus recommendations from six brokerage firms, ARMOUR Residential REIT Inc (ARR, Financial) holds an average brokerage rating of 2.7. This places the stock in a "Hold" category on a scale where 1 indicates a Strong Buy and 5 suggests Sell. This rating reflects a cautious optimism about the company's performance, acknowledging both potential risks and opportunities in the market.

Also check out: (Free Trial)