Key Takeaways:

- Texas Instruments (TXN, Financial) beats Q2 earnings and revenue estimates, yet shares drop 11% in after-hours trading.

- Analysts' average target price suggests a potential downside, reflecting caution around future growth.

- Current "Hold" rating by brokerages reflects uncertainty despite positive earnings performance.

Texas Instruments (TXN) recently reported Q2 earnings, showing a 16% increase in GAAP EPS to $1.41, which surpassed expectations by $0.08. Additionally, revenue reached $4.45 billion, beating estimates by $130 million. Despite the robust performance, the stock experienced an 11% decline in after-hours trading as Q3 guidance aligned with consensus, offering no uplift from new U.S. tax regulations.

Market Predictions and Analyst Insights

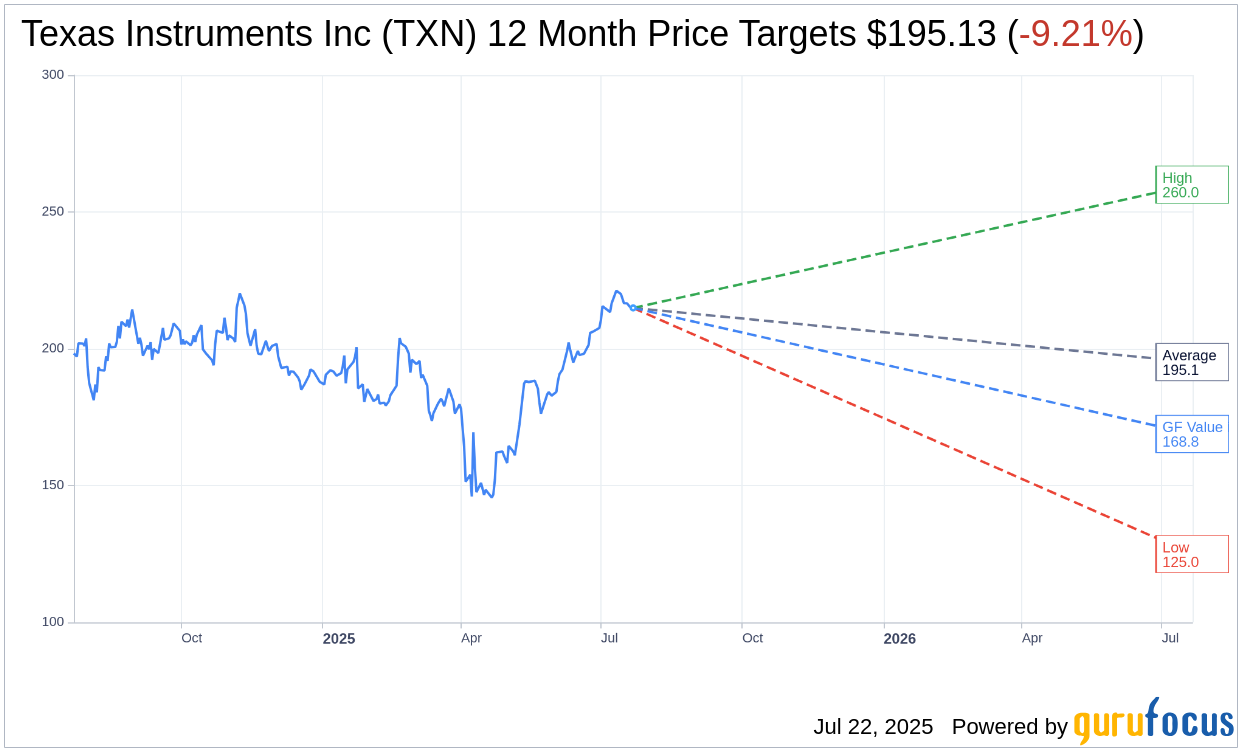

Wall Street analysts have presented a one-year price target range for Texas Instruments Inc (TXN, Financial), averaging at $195.13. The projections feature a high of $260.00 and a low of $125.00. This average target indicates a potential downside of 9.21% from the current trading price of $214.92. For comprehensive forecast data, investors can refer to the Texas Instruments Inc (TXN) Forecast page.

The company’s brokerage recommendation stands at an average of 2.7 according to 41 firms, placing it in the "Hold" category on a scale from 1 (Strong Buy) to 5 (Sell). This consensus reflects a cautious market sentiment despite the positive earnings report.

Evaluating Value with GuruFocus Metrics

According to GF Value estimations from GuruFocus, the predicted fair value for Texas Instruments Inc (TXN, Financial) in the next year is $168.85. This suggests a downside of 21.44% from the current market price of $214.92. The GF Value metric provides a comprehensive valuation based on historical trading multiples, business growth patterns, and future performance forecasts. Investors seeking detailed analysis can find more on the Texas Instruments Inc (TXN) Summary page.