Key Highlights:

- Sherwin-Williams' restructuring aims for $105 million in savings amidst weak demand.

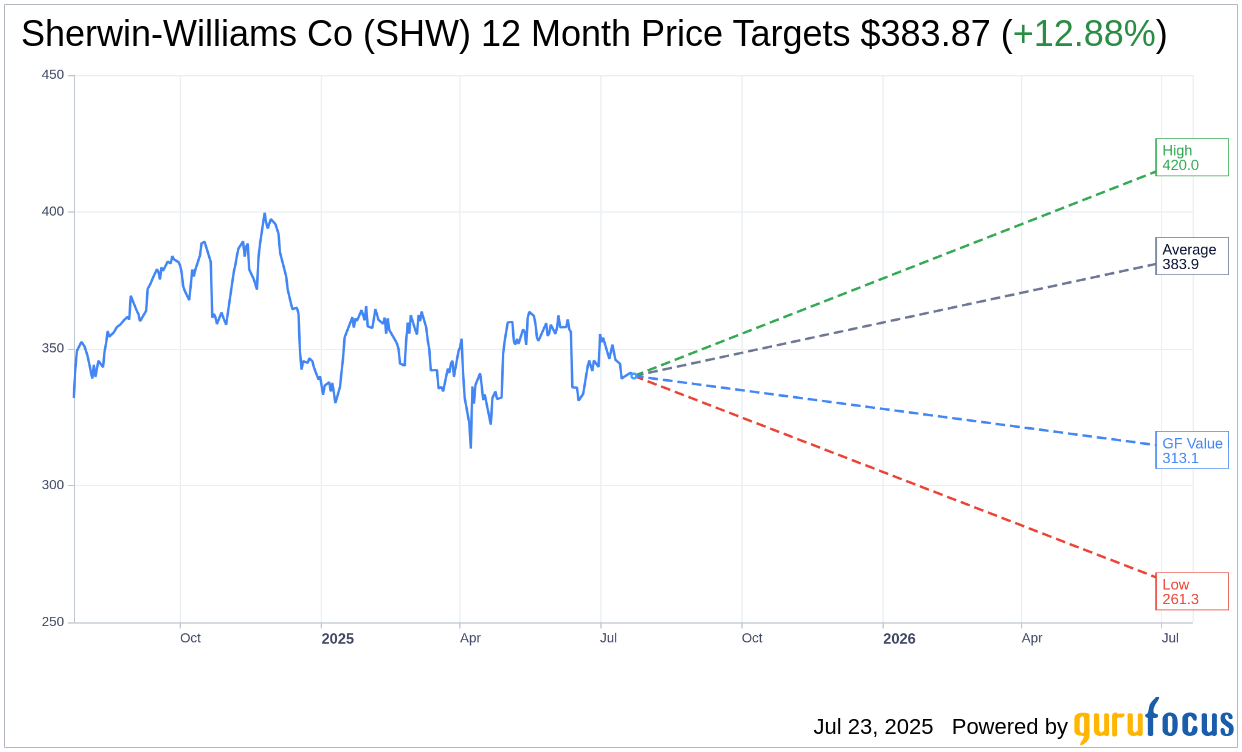

- Analysts offer a mixed outlook with an average price target of $383.87, signaling a potential 12.88% upside.

- GuruFocus places the stock's GF Value at $313.05, indicating a 7.95% downside risk.

Sherwin-Williams Co. (SHW, Financial) has delivered a mixed bag in its Q2 2025 earnings report. CEO Heidi Petz announced ambitious restructuring efforts geared towards achieving $105 million in cost savings. Despite a challenging demand environment, the company successfully launched 20 new stores this quarter. However, these achievements are overshadowed by the downward revision of the full-year sales and earnings forecasts, attributed to persistent sluggish sales and ongoing supply chain disruptions.

Wall Street Analysts Forecast

Analyst sentiments on Sherwin-Williams Co (SHW, Financial) offer a nuanced perspective. The one-year price targets from 21 analysts present an average target price of $383.87, with projections ranging from a high of $420.00 to a low of $261.34. This average target suggests a potential upside of 12.88% from the current trading price of $340.07. Investors can explore more detailed estimate data on the Sherwin-Williams Co (SHW) Forecast page.

The brokerage consensus, derived from 29 firms, positions Sherwin-Williams Co (SHW, Financial) with an average recommendation of 2.4, reflecting an "Outperform" rating. This rating scale spans from 1 (Strong Buy) to 5 (Sell), offering a framework for investors to gauge market sentiment.

From a valuation standpoint, GuruFocus estimates the GF Value of Sherwin-Williams Co (SHW, Financial) to be $313.05 in the coming year. This presents a potential downside risk of 7.95% from its current trading price. The GF Value is a composite measure, taking into account historical multiples, business growth trends, and future performance estimates. For a comprehensive overview, investors are encouraged to visit the Sherwin-Williams Co (SHW) Summary page.