Summary:

- Capital One Financial Corporation (COF, Financial) completes acquisition of Discover, aiming to boost global network capabilities.

- Analysts predict a 9.90% upside for COF stock, with a varied price target range.

- Current brokerage recommendation for COF stands at "Outperform," while GF Value suggests a slight downside.

Capital One Financial Corporation (NYSE: COF) has successfully concluded its acquisition of Discover, a strategic move aimed at significantly expanding its foothold in the banking and payments sector. By integrating Discover’s platform, Capital One is poised to enhance its global network capabilities. Despite these ambitious expansion efforts, the company reported $2 billion in revenue and a $6.4 billion net loss this quarter, according to CFO Andrew Young.

Wall Street Analysts Forecast

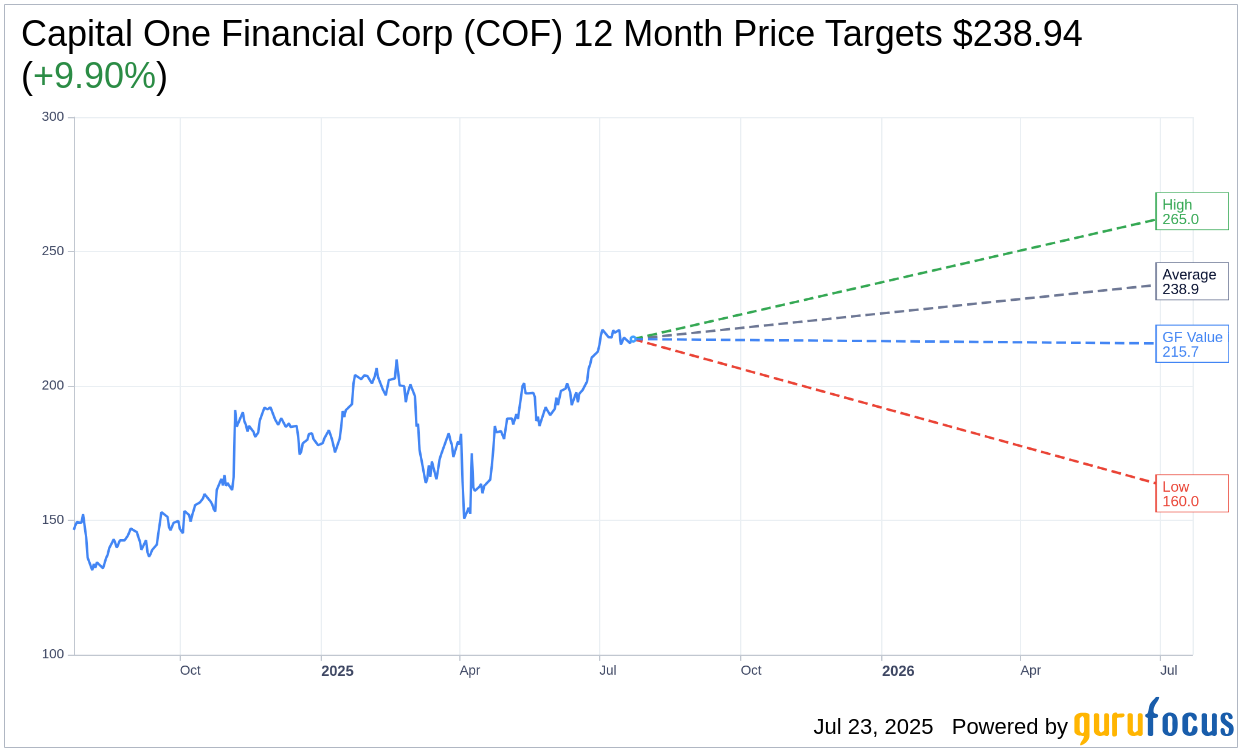

Wall Street analysts have provided one-year price targets for Capital One Financial Corp (COF, Financial), with an average target price set at $238.94. The projections range from a high estimate of $265.00 to a low estimate of $160.00, indicating a potential upside of 9.90% from the current price of $217.42. For more detailed estimates, please refer to the Capital One Financial Corp (COF) Forecast page.

According to the consensus recommendation from 23 brokerage firms, Capital One Financial Corp (COF, Financial) holds an average brokerage recommendation of 1.9, categorizing it as "Outperform." This rating lies on a scale from 1 to 5, where 1 indicates a Strong Buy, and 5 suggests a Sell.

Additionally, based on GuruFocus estimates, the projected GF Value for Capital One Financial Corp (COF, Financial) over the next year is $215.71, pointing to a slight downside of 0.79% from the current price of $217.42. The GF Value metric represents GuruFocus' assessment of the fair value at which the stock should trade, derived from historical trading multiples, past business growth, and future performance estimates. Detailed data is available on the Capital One Financial Corp (COF) Summary page.