KGI Securities analyst Leon Chen has elevated NXP Semiconductors (NXPI, Financial) from a Neutral to an Outperform rating. The analyst set a price target of $250 for the stock, reflecting a positive outlook on its future performance.

Wall Street Analysts Forecast

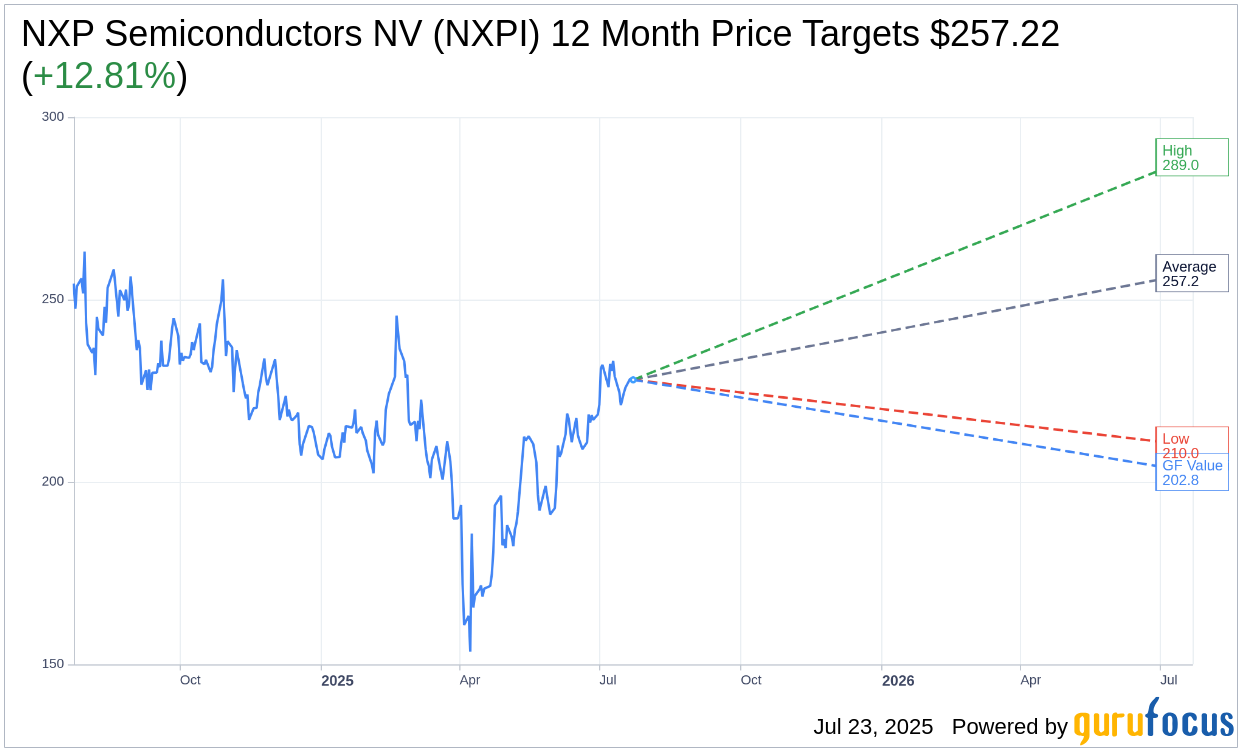

Based on the one-year price targets offered by 29 analysts, the average target price for NXP Semiconductors NV (NXPI, Financial) is $257.22 with a high estimate of $289.00 and a low estimate of $210.00. The average target implies an upside of 12.81% from the current price of $228.00. More detailed estimate data can be found on the NXP Semiconductors NV (NXPI) Forecast page.

Based on the consensus recommendation from 32 brokerage firms, NXP Semiconductors NV's (NXPI, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for NXP Semiconductors NV (NXPI, Financial) in one year is $202.76, suggesting a downside of 11.07% from the current price of $228. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the NXP Semiconductors NV (NXPI) Summary page.

NXPI Key Business Developments

Release Date: July 22, 2025

- Revenue: $2.93 billion, down 6% year-on-year, $26 million above the midpoint of guidance.

- Non-GAAP Operating Margin: 32%, down 230 basis points year-on-year, 20 basis points above the midpoint of guidance.

- Non-GAAP Gross Margin: 56.5%, down 210 basis points year-on-year, 20 basis points above the midpoint of guidance.

- Non-GAAP Earnings Per Share: $2.72, $0.06 better than the midpoint of guidance.

- Cash Flow from Operations: $779 million.

- Non-GAAP Free Cash Flow: $696 million or 24% of revenue.

- Total Debt: $11.48 billion, down $247 million sequentially.

- Ending Cash Balance: $3.17 billion, down $818 million sequentially.

- Net Debt: $8.31 billion.

- Days of Inventory: 158 days, a decrease of 11 days versus the prior quarter.

- Q3 Revenue Guidance: $3.15 billion, down 3% year-on-year, up 8% sequentially.

- Q3 Non-GAAP Gross Margin Guidance: 57%, plus or minus 50 basis points.

- Q3 Non-GAAP Operating Margin Guidance: 33.7% at the midpoint.

- Q3 Non-GAAP Earnings Per Share Guidance: $3.10 at the midpoint.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- NXP Semiconductors NV (NXPI, Financial) reported Q2 revenue of $2.93 billion, which was $26 million above the midpoint of their guidance.

- The company expects Q3 revenue to be $3.15 billion, reflecting an 8% sequential increase, indicating a return to better than historic seasonal trends.

- NXP's automotive segment is showing signs of recovery, with expectations of mid-single-digit growth in Q3 compared to Q2 2025.

- The company is experiencing a broad-based recovery in the Industrial & IoT segment, with anticipated high single-digit growth in Q3 versus Q2 2025.

- NXP's strategic acquisitions, such as TTTech Auto, are expected to strengthen their competitive portfolio and drive future growth.

Negative Points

- Q2 revenue decreased by 6% year-on-year, reflecting challenges in the market.

- Non-GAAP operating margin in Q2 was 32%, down 230 basis points year-on-year, indicating pressure on profitability.

- Distribution inventory remains below the long-term target of 11 weeks, which could impact supply chain efficiency.

- The Communication Infrastructure & Other segment is expected to decline by the upper 20% range in Q3 compared to Q3 2024.

- The tariff environment continues to create uncertainty in long-term planning for customers, posing a risk to future performance.