A Citi analyst has adjusted the price target for Sherwin-Williams (SHW, Financial), lowering it to $375 from a previous $385 while maintaining a Neutral rating. This revision follows the company's earnings report, with the analyst noting that broader economic conditions are affecting Sherwin-Williams' market performance.

Wall Street Analysts Forecast

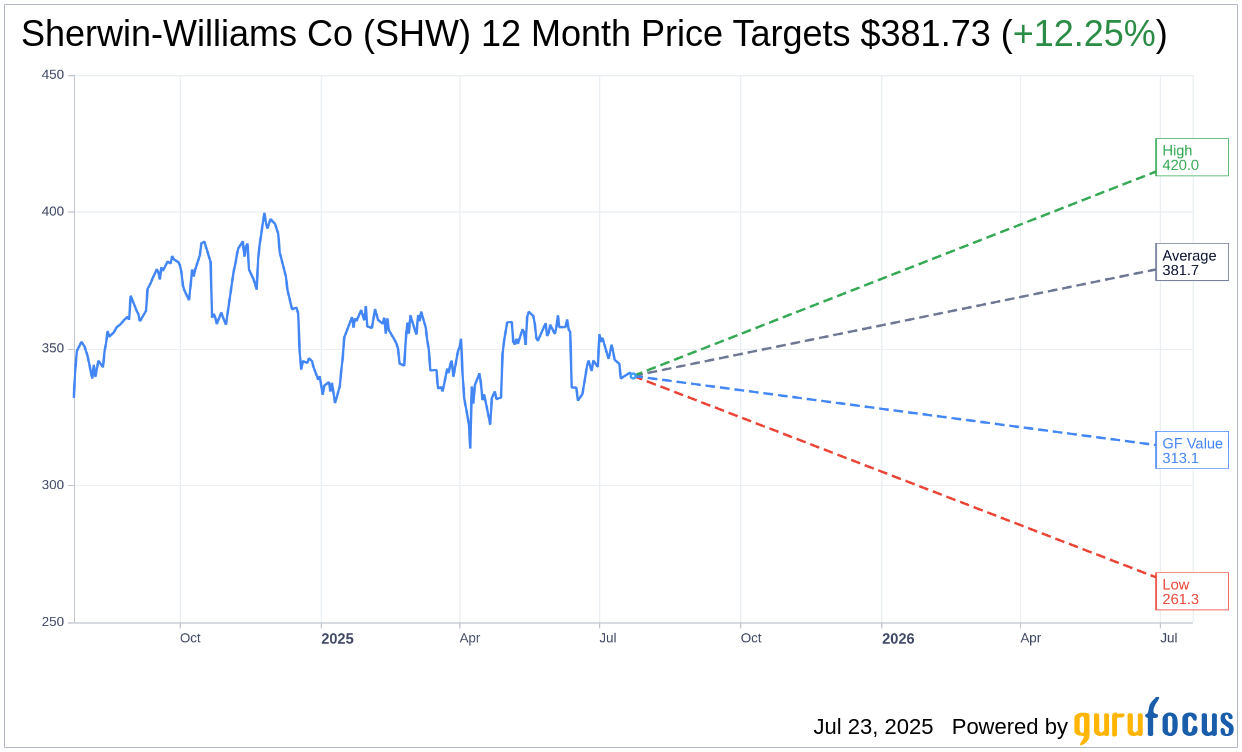

Based on the one-year price targets offered by 21 analysts, the average target price for Sherwin-Williams Co (SHW, Financial) is $381.73 with a high estimate of $420.00 and a low estimate of $261.34. The average target implies an upside of 12.25% from the current price of $340.07. More detailed estimate data can be found on the Sherwin-Williams Co (SHW) Forecast page.

Based on the consensus recommendation from 29 brokerage firms, Sherwin-Williams Co's (SHW, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Sherwin-Williams Co (SHW, Financial) in one year is $313.05, suggesting a downside of 7.95% from the current price of $340.07. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Sherwin-Williams Co (SHW) Summary page.

SHW Key Business Developments

Release Date: July 22, 2025

- Consolidated Sales: Within guided range; growth in Paint Stores Group offset by softness in other segments.

- Gross Margin: Expanded for the 12th consecutive quarter year-over-year.

- SG&A Expenses: Increased in the quarter; on track for low single-digit percentage increase for the full year.

- Adjusted Earnings Per Share: Decreased due to higher non-operating costs, new building expenses, and growth investments.

- Shareholder Returns: $716 million returned through share repurchases and dividends.

- Restructuring Initiatives: Target increased to $105 million or $0.32 per share, with expected annual savings of $80 million.

- Paint Stores Group Sales: Increased by low single digits; price mix up mid-single digits, volume down low single digits.

- Net New Stores: 20 opened in the quarter, 38 year-to-date.

- Consumer Brands Group Sales: Below expectations; volume, price mix, and FX down by low single digits.

- Performance Coatings Group Sales: In line with expectations; volume, acquisitions, and FX up by low single digits.

- Capital Expenditures: Reduced by $170 million to $730 million for the year.

- New Building Costs: Estimated total investment of $115 million for the year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Sherwin-Williams Co (SHW, Financial) reported its 12th consecutive quarter of year-over-year gross margin expansion.

- The company returned $716 million to shareholders through share repurchases and dividends.

- Sherwin-Williams Co (SHW) is aggressively investing in growth initiatives, particularly in the Paint Stores Group, to capitalize on competitive opportunities.

- The company has opened 38 new stores year-to-date, ahead of last year's pace, indicating expansion efforts.

- Sherwin-Williams Co (SHW) is seeing significant market share gains in residential repaint and new residential segments, outpacing the market despite challenging conditions.

Negative Points

- Sherwin-Williams Co (SHW) reduced its full-year adjusted earnings guidance due to softer-than-expected architectural sales volumes and supply chain inefficiencies.

- The company is experiencing a challenging demand environment, particularly in new residential, DIY, and coil coatings end markets.

- SG&A expenses increased in the quarter, impacting adjusted earnings per share.

- Sherwin-Williams Co (SHW) is facing pressure from lower production volumes in its supply chain, affecting bottom-line results.

- The Consumer Brands Group sales were below expectations, with volume, price mix, and FX all down by similar low single-digit percentages.