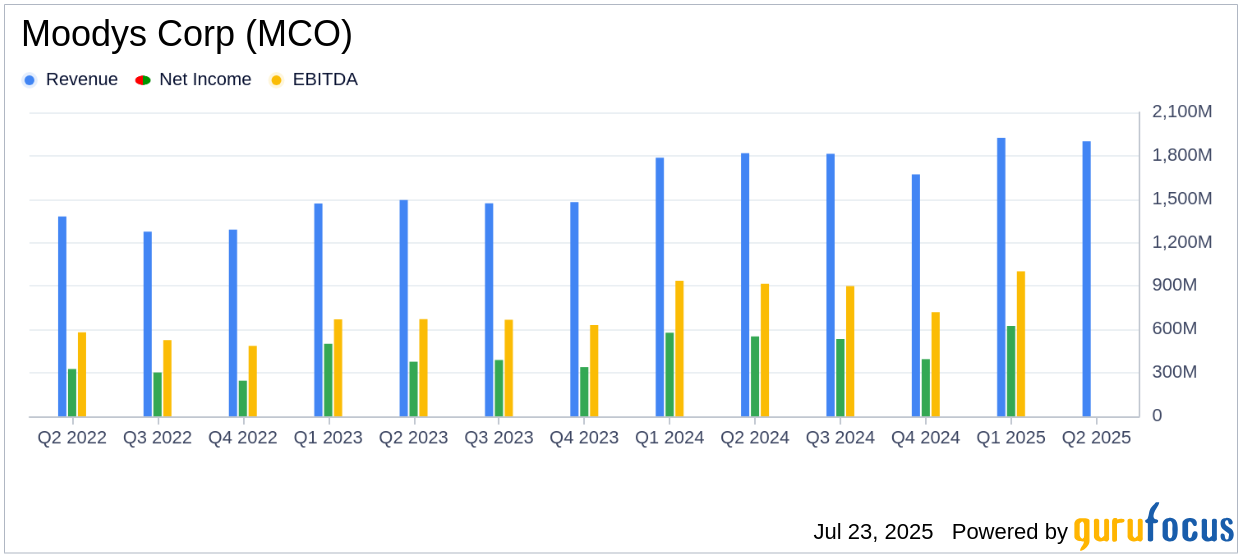

On July 23, 2025, Moody's Corp (MCO, Financial) released its 8-K filing detailing the financial results for the second quarter of 2025. Moody's, a leading provider of credit ratings and analytics, reported a robust performance, exceeding analyst expectations with a diluted EPS of $3.21, surpassing the estimated $2.99. The company's revenue for the quarter reached $1.9 billion, slightly above the estimated $1,819.47 million.

Company Overview

Moody's operates through two main segments: Moody's Investors Service (MIS) and Moody's Analytics (MA). MIS, which includes corporate, structured finance, financial institutions, and public finance ratings, contributes significantly to the firm's profits and about half of its revenue. MA focuses on decision solutions, research and insights, and data and information.

Performance Highlights and Challenges

Moody's reported a 4% increase in revenue for the second quarter of 2025, driven by strong performances across both business segments. The MIS segment's revenue remained flat at $1.0 billion, while the MA segment saw an 11% increase, reaching $888 million. This growth is crucial as it underscores the company's ability to adapt and thrive in a complex global market.

Despite the positive results, Moody's faces challenges such as geopolitical tensions and economic uncertainties that could impact future performance. These factors necessitate strategic planning and adaptability to maintain growth momentum.

Financial Achievements and Industry Importance

Moody's achievements in revenue growth and earnings are significant for the capital markets industry, where accurate credit ratings and analytics are vital for informed decision-making. The company's ability to deliver strong recurring revenue growth while maintaining cost discipline highlights its strategic efficiency.

Key Financial Metrics

Moody's reported a year-to-date revenue of $3.8 billion, a 6% increase from the previous year. The company's adjusted diluted EPS for the quarter was $3.56, reflecting a 9% increase. These metrics are essential as they provide insights into the company's profitability and operational efficiency.

"We are pleased to report a 4% increase in MCO's second quarter revenues, driven by strong performance across both our business segments. This, combined with the significant expansion in our segments' adjusted operating margins, highlights the success of our strategy and efficiency initiatives." - Nomie Heuland, Chief Financial Officer

Analysis and Outlook

Moody's strategic initiatives and focus on innovation have positioned the company well for continued growth. The updated full-year guidance for 2025 projects a diluted EPS range of $12.25 to $12.75, with adjusted diluted EPS expected to be between $13.50 and $14.00. This outlook reflects the company's confidence in its ability to navigate market challenges and capitalize on opportunities.

Overall, Moody's Corp (MCO, Financial) has demonstrated resilience and strategic foresight in its Q2 2025 performance, setting a positive trajectory for the remainder of the year. Investors and stakeholders will be keenly watching how the company continues to leverage its strengths in the evolving economic landscape.

Explore the complete 8-K earnings release (here) from Moodys Corp for further details.