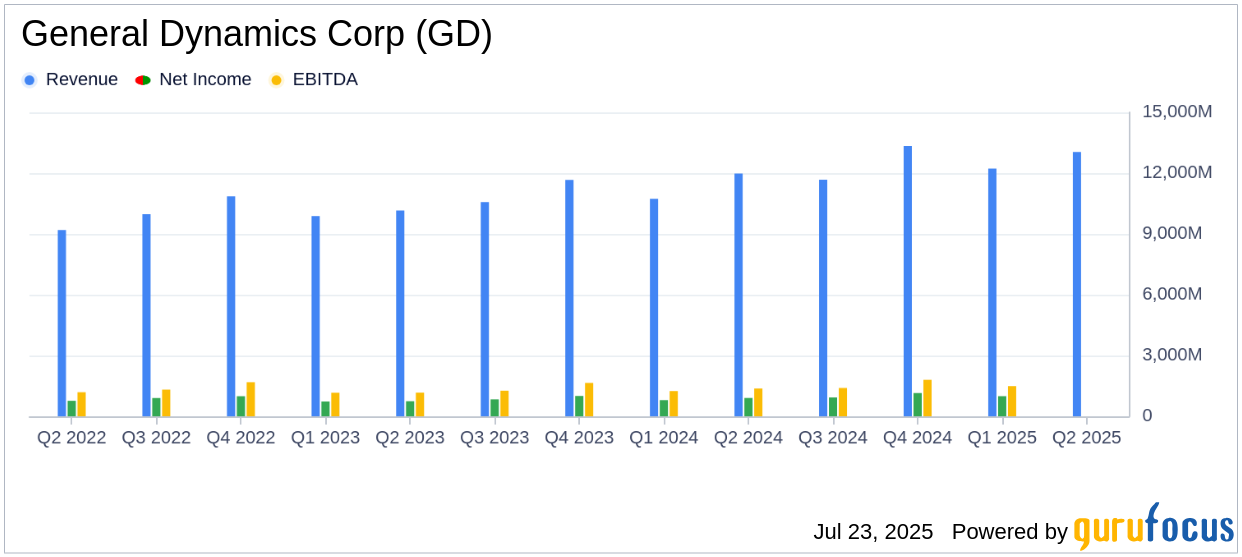

On July 23, 2025, General Dynamics Corp (GD, Financial) released its 8-K filing for the second quarter of 2025, showcasing a solid financial performance that exceeded analyst expectations. The company reported a revenue of $13 billion, surpassing the estimated $12,185.84 million. The diluted earnings per share (EPS) of $3.74 exceeded the estimated EPS of $3.44.

Company Overview

General Dynamics Corp (GD, Financial) is a prominent defense contractor and business jet manufacturer, operating through four main segments: Aerospace, Marine Systems, Combat Systems, and Technologies. The company is renowned for its Gulfstream business jets, land combat vehicles like the M1 Abrams tank, and nuclear-powered submarines. Its technologies segment provides critical IT and mission systems solutions to the government and military sectors.

Financial Performance and Challenges

General Dynamics Corp (GD, Financial) reported a notable 8.9% increase in revenue compared to the same quarter last year, driven by strong order activity in the Marine and Aerospace segments. The operating earnings rose by 12.9%, and the diluted EPS saw a 14.7% increase, reflecting the company's robust operational efficiency. However, the company faces challenges such as maintaining its growth trajectory amidst potential fluctuations in defense spending and geopolitical uncertainties.

Key Financial Achievements

The company's financial achievements are significant in the Aerospace & Defense industry, where consistent revenue growth and strong cash flow are crucial. General Dynamics Corp (GD, Financial) generated $1.6 billion in cash from operating activities, representing 158% of net earnings, highlighting its strong cash generation capability. The company also reduced its total debt by $897 million, ending the quarter with $8.7 billion in total debt and $1.5 billion in cash and equivalents.

Income Statement Highlights

General Dynamics Corp (GD, Financial) reported operating earnings of $1.3 billion for the quarter, with an operating margin of 10.0%, a 30-basis-point improvement from the previous year. The net earnings for the quarter were $1.014 billion, a 12.0% increase from the prior year. The company's book-to-bill ratio was an impressive 2.2-to-1, indicating strong demand for its products and services.

Segment Performance

| Segment | Revenue (Q2 2025) | Revenue Growth | Operating Margin |

|---|---|---|---|

| Aerospace | $3,062 million | 4.1% | 13.2% |

| Marine Systems | $4,220 million | 22.2% | 6.9% |

| Combat Systems | $2,283 million | -0.2% | 14.2% |

| Technologies | $3,476 million | 5.5% | 9.6% |

Analysis and Outlook

General Dynamics Corp (GD, Financial) has demonstrated strong financial health and operational efficiency, positioning itself well for future growth. The company's ability to generate substantial cash flow and maintain a healthy backlog of $103.7 billion underscores its resilience in the competitive Aerospace & Defense industry. However, the company must navigate potential challenges such as defense budget constraints and geopolitical risks to sustain its growth momentum.

Phebe Novakovic, chairman and chief executive officer, stated, "During the first half of the year, each of our four segments achieved growth in revenue and earnings, with margins on a companywide basis expanding 50 basis points over the same period last year."

General Dynamics Corp (GD, Financial) continues to be a key player in the defense and aerospace sectors, with its strong financial performance and strategic initiatives paving the way for sustained success.

Explore the complete 8-K earnings release (here) from General Dynamics Corp for further details.