Cyient Ltd (NSE:CYIENT, Financial) is set to release its Q1 2026 earnings on July 24, 2025. The consensus estimate for Q1 2026 revenue is $15.28 billion, and the earnings are expected to come in at $13.67 per share. The full year 2026's revenue is expected to be $75.81 billion and the earnings are expected to be $64.18 per share. More detailed estimate data can be found on the Forecast page.

Cyient Ltd (NSE:CYIENT, Financial) Estimates Trends

Revenue estimates for Cyient Ltd have declined over the past 90 days. For the full year 2026, estimates have decreased from $82.04 billion to $75.81 billion. Similarly, for 2027, revenue estimates have decreased from $91.76 billion to $85.66 billion. Earnings estimates have also seen a decline, with the full year 2026 estimates decreasing from $71.59 per share to $64.18 per share, and for 2027, from $83.58 per share to $77.12 per share.

Cyient Ltd (NSE:CYIENT, Financial) Reported History

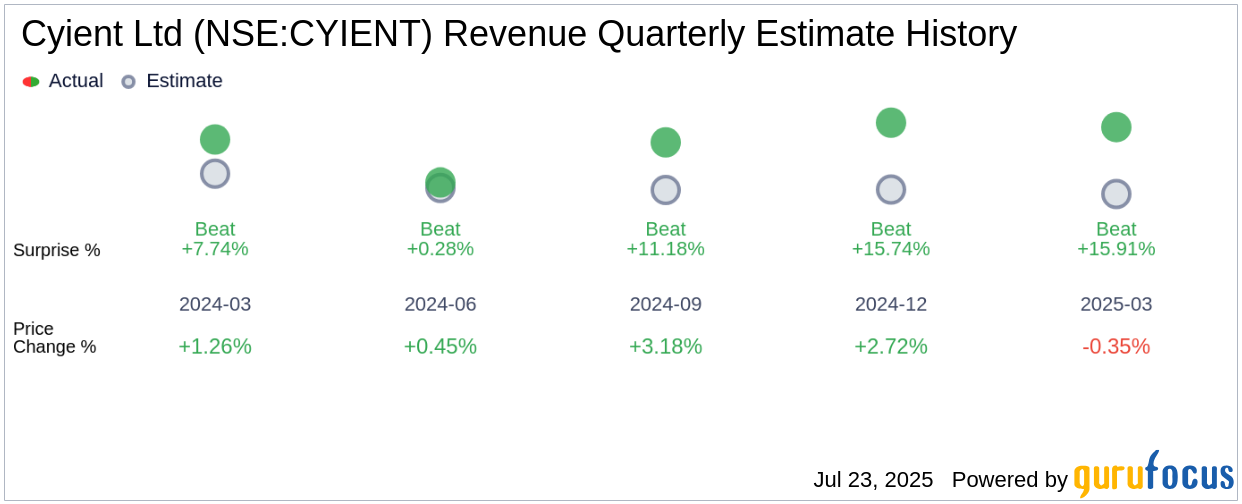

In the previous quarter ending March 31, 2025, Cyient Ltd's actual revenue was $19.09 billion, which beat analysts' revenue expectations of $16.47 billion by 15.91%. Cyient Ltd's actual earnings were $15.35 per share, which beat analysts' earnings expectations of $14.60 per share by 5.17%. After releasing the results, Cyient Ltd was down by 0.35% in one day.

Cyient Ltd (NSE:CYIENT, Financial) 12 Month Price Targets

Based on the one-year price targets offered by 18 analysts, the average target price for Cyient Ltd is $1,370.50 with a high estimate of $2,230.00 and a low estimate of $1,050.00. The average target implies an upside of 7.81% from the current price of $1,271.20.

Based on GuruFocus estimates, the estimated GF Value for Cyient Ltd in one year is $1,913.70, suggesting an upside of 50.54% from the current price of $1,271.20.

Based on the consensus recommendation from 19 brokerage firms, Cyient Ltd's average brokerage recommendation is currently 3.1, indicating a "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.