Key Takeaways:

- Cyberattacks on Microsoft's SharePoint software surge, affecting nearly 400 organizations.

- Wall Street projects a modest upside for Microsoft shares, with a consensus "Outperform" rating.

- GuruFocus estimates a slight increase in Microsoft's fair value over the next year.

Recent research by Eye Security has revealed a concerning trend: nearly 400 organizations have fallen victim to cyberattacks exploiting vulnerabilities within Microsoft's (MSFT, Financial) SharePoint software. This marks a dramatic rise from the previously noted 100 entities. The involvement of Chinese hackers has been prominently highlighted, though Microsoft has yet to provide public commentary on these developments.

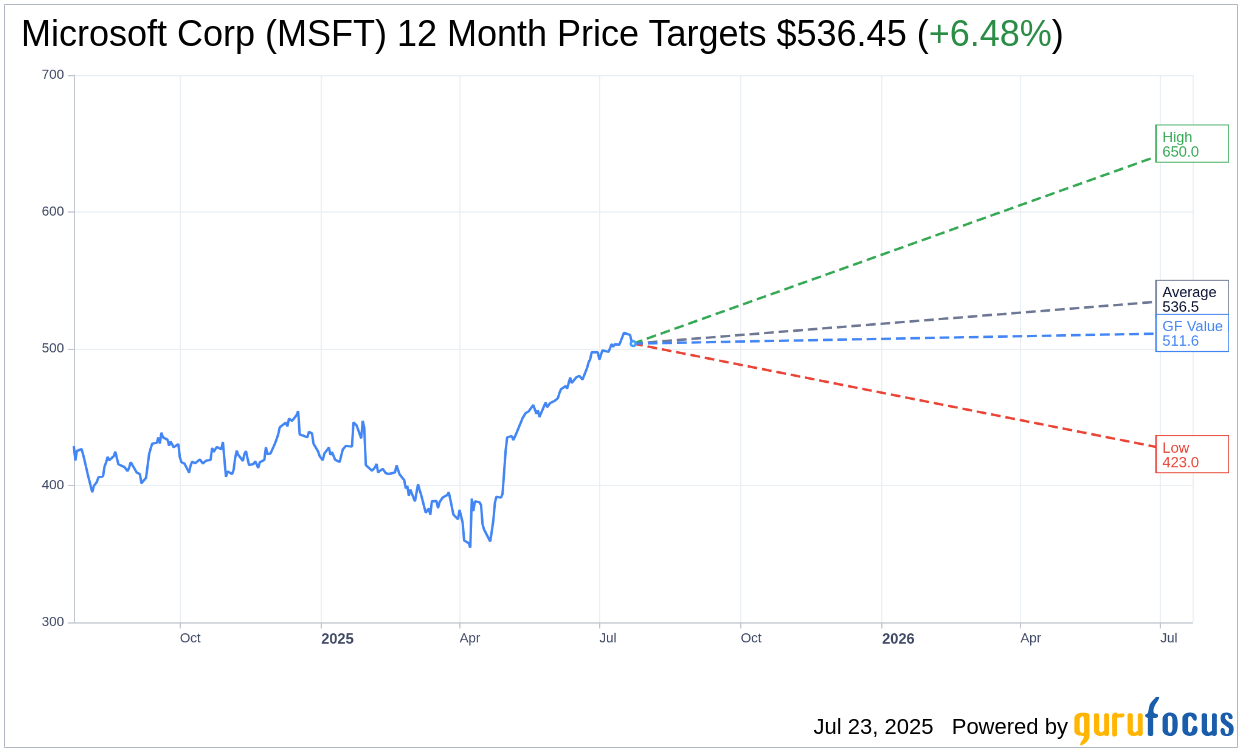

Wall Street Analysts Forecast

Analyzing data from 50 analysts, the average one-year price target for Microsoft Corp (MSFT, Financial) stands at $536.45. This figure is bracketed by a high estimate of $650.00 and a low estimate of $423.00, indicating a forecasted upside of 6.48% compared to the current price of $503.80. Investors looking for more in-depth analysis can explore the Microsoft Corp (MSFT) Forecast page.

Moreover, the consensus recommendation from 62 brokerage firms pegs Microsoft Corp (MSFT, Financial) with an average brokerage recommendation of 1.7, signaling an "Outperform" status. This rating employs a scale where 1 indicates a Strong Buy and 5 a Sell, underscoring a generally positive outlook among analysts.

In terms of valuation, GuruFocus' GF Value places Microsoft's one-year estimated fair value at $511.57. This suggests a potential upside of 1.54% from its current trading price of $503.80. The GF Value metric is meticulously calculated based on the historical multiples at which the stock has been traded, combined with past business growth patterns and projected future performance. For further details, the Microsoft Corp (MSFT, Financial) Summary page offers comprehensive insights.